Nevada Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

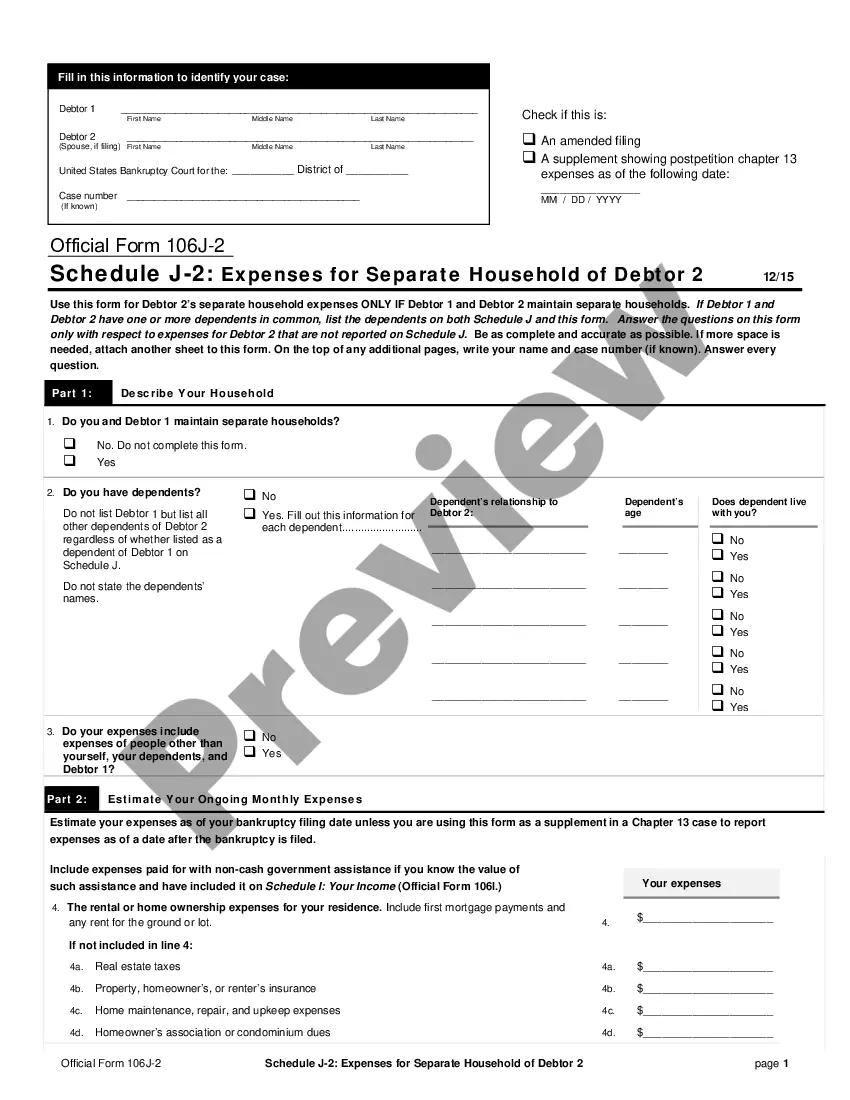

How to fill out Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

US Legal Forms - among the most significant libraries of authorized forms in America - delivers a wide range of authorized papers layouts you are able to obtain or printing. Utilizing the web site, you can get a huge number of forms for business and specific purposes, sorted by classes, says, or search phrases.You can get the newest types of forms like the Nevada Challenge to Credit Report of Experian, TransUnion, and/or Equifax within minutes.

If you currently have a monthly subscription, log in and obtain Nevada Challenge to Credit Report of Experian, TransUnion, and/or Equifax from your US Legal Forms collection. The Obtain button will show up on every develop you view. You have accessibility to all earlier acquired forms in the My Forms tab of the account.

If you wish to use US Legal Forms initially, here are straightforward directions to get you started out:

- Ensure you have picked the proper develop to your city/state. Go through the Review button to analyze the form`s articles. See the develop explanation to actually have chosen the appropriate develop.

- In the event the develop does not satisfy your specifications, take advantage of the Look for industry at the top of the screen to discover the the one that does.

- When you are pleased with the form, confirm your decision by simply clicking the Purchase now button. Then, pick the rates strategy you like and supply your credentials to sign up on an account.

- Approach the transaction. Make use of your charge card or PayPal account to accomplish the transaction.

- Choose the structure and obtain the form on your device.

- Make modifications. Load, edit and printing and indication the acquired Nevada Challenge to Credit Report of Experian, TransUnion, and/or Equifax.

Every single template you put into your bank account lacks an expiration day and it is the one you have eternally. So, if you would like obtain or printing an additional copy, just visit the My Forms area and click on around the develop you will need.

Gain access to the Nevada Challenge to Credit Report of Experian, TransUnion, and/or Equifax with US Legal Forms, probably the most extensive collection of authorized papers layouts. Use a huge number of specialist and express-certain layouts that fulfill your business or specific requires and specifications.

Form popularity

FAQ

FICO scores are generally known to be the most widely used by lenders. But the credit-scoring model used may vary by lender. While FICO Score 8 is the most common, mortgage lenders might use FICO Score 2, 4 or 5. Auto lenders often use one of the FICO Auto Scores.

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.

Neither your TransUnion or Equifax score is more or less accurate than the other. They're just calculated from slightly differing sources. Your Equifax credit score is likely lower due to reporting differences. Nonetheless, a ?fair? score from TransUnion is typically ?fair? across the board.

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus ? Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

It's important to note that all three bureaus are used widely in the U.S. None of them are more ?important? than the others. There is no ?best? credit bureau?all three bureaus can offer helpful information and tools to help you make financial decisions.

The primary credit scoring models are FICO® and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are looking at your FICO score when you apply for a loan.

More companies use Experian for credit reporting than use Equifax. This alone does not make Experian better, but it does indicate that any particular debt is more likely to appear on an Experian reports.

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.