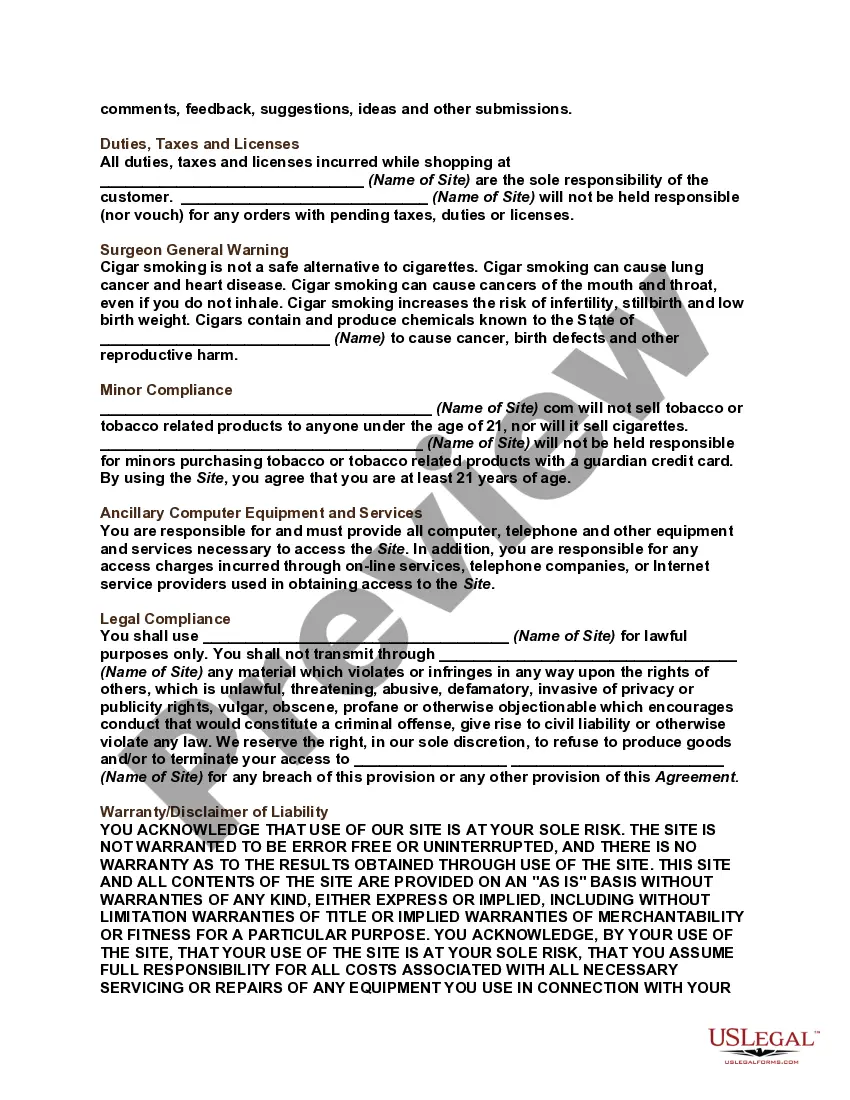

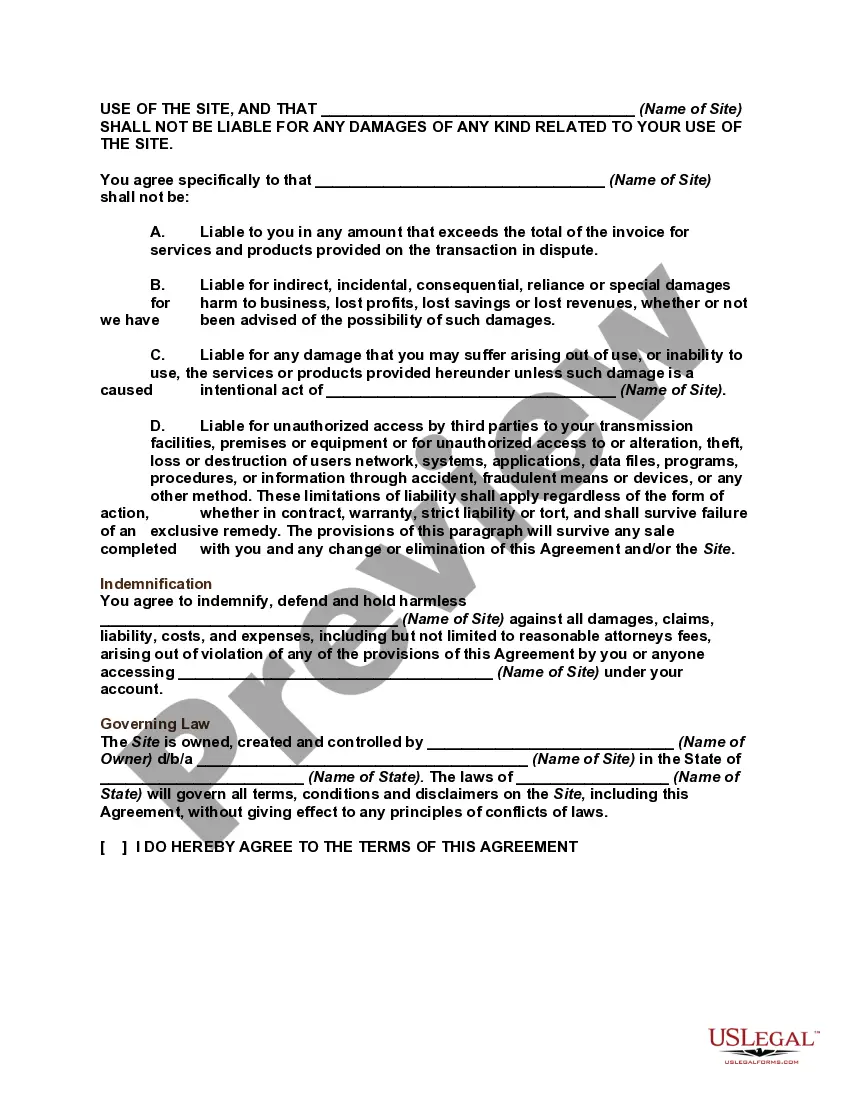

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kentucky Terms of Use Form for an Online Cigar Store

Description

How to fill out Terms Of Use Form For An Online Cigar Store?

Locating the appropriate legal document design can be challenging.

Clearly, there is an assortment of templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Kentucky Terms of Use Form for an Online Cigar Shop, that you can utilize for business and personal purposes.

You can browse the document using the Review button and examine the form description to ensure it is the appropriate one for you.

- All of the forms are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Kentucky Terms of Use Form for an Online Cigar Shop.

- Use your account to review the legal documents you have purchased previously.

- Navigate to the My documents tab in your account and acquire another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions you should follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Kentucky imposes a specific tax rate on tobacco products, including cigars. As of now, the tax stands at $3.00 per pack of cigarettes and varies for other tobacco products. Understanding the financial impact of this tax is crucial for any online store, especially when drafting the Kentucky Terms of Use Form for an Online Cigar Store. This way, you ensure compliance while being transparent in your business dealings.

Cigars in Kentucky are subject to a different tax structure compared to cigarettes. While both types of tobacco face taxation, the rates differ significantly. Generally, cigars encounter a lower tax rate, making them more appealing to some consumers. This aspect is important to consider when setting up your Kentucky Terms of Use Form for an Online Cigar Store.

To run an online cigar store in Kentucky, you must obtain the proper business licenses and permits. Specifically, the Kentucky Department of Revenue requires a sales tax permit. Additionally, you may need a tobacco retailer's license, ensuring compliance with state laws. Using the Kentucky Terms of Use Form for an Online Cigar Store can help streamline the legal requirements.

Mailing cigars as a gift is permissible in Kentucky, but you must ensure that the recipient is of legal age. Always check the packaging to comply with any labeling requirements. Utilizing the Kentucky Terms of Use Form for an Online Cigar Store can provide clarity on applicable laws and promote responsible gifting practices.

Yes, you can have cigars shipped to your home in Kentucky, as long as the retailer follows state and federal regulations. It is important to choose a reputable online cigar store that understands the legal requirements involved. Reviewing the Kentucky Terms of Use Form for an Online Cigar Store is advisable to confirm that they comply with applicable rules.

Kentucky has specific policies that govern the sale and distribution of tobacco products, including cigars. These laws aim to control access to tobacco, primarily ensuring that purchases are made by individuals who are at least 21 years old. For any online transactions, adhering to the Kentucky Terms of Use Form for an Online Cigar Store will ensure compliance with local regulations.

Mailing cigars to a family member is generally allowed in Kentucky, provided that both parties comply with federal and state laws regarding tobacco. However, it's crucial to ensure the recipient is of legal age to receive tobacco products. To help you navigate these laws, consider reviewing the Kentucky Terms of Use Form for an Online Cigar Store.

Certain businesses may not need to register for state taxes in Kentucky, including those with no taxable sales or activities. If your online cigar store operates under specific thresholds, exemptions, or categorical conditions, you might find yourself eligible. However, always verify these details when drafting your Kentucky Terms of Use Form for an Online Cigar Store to ensure accuracy. It’s wise to consult the appropriate regulatory bodies for clarity.

To obtain a sales and use tax permit in Kentucky, you must apply through the Kentucky Department of Revenue. This process can be completed online or via a physical application. When you fill out your Kentucky Terms of Use Form for an Online Cigar Store, having this permit shows your commitment to legal compliance and responsible sales practices. Acquiring this permit is a crucial step for online businesses selling tangible products.

The Kentucky 740 form is commonly used for individual income tax returns in Kentucky. However, if you operate an online cigar store, knowing how this relates to your business activities and tax responsibilities is vital. When filing, ensure that any income from sales reflected in your Kentucky Terms of Use Form for an Online Cigar Store is accurately reported. This form is essential for demonstrating compliance with state tax regulations.