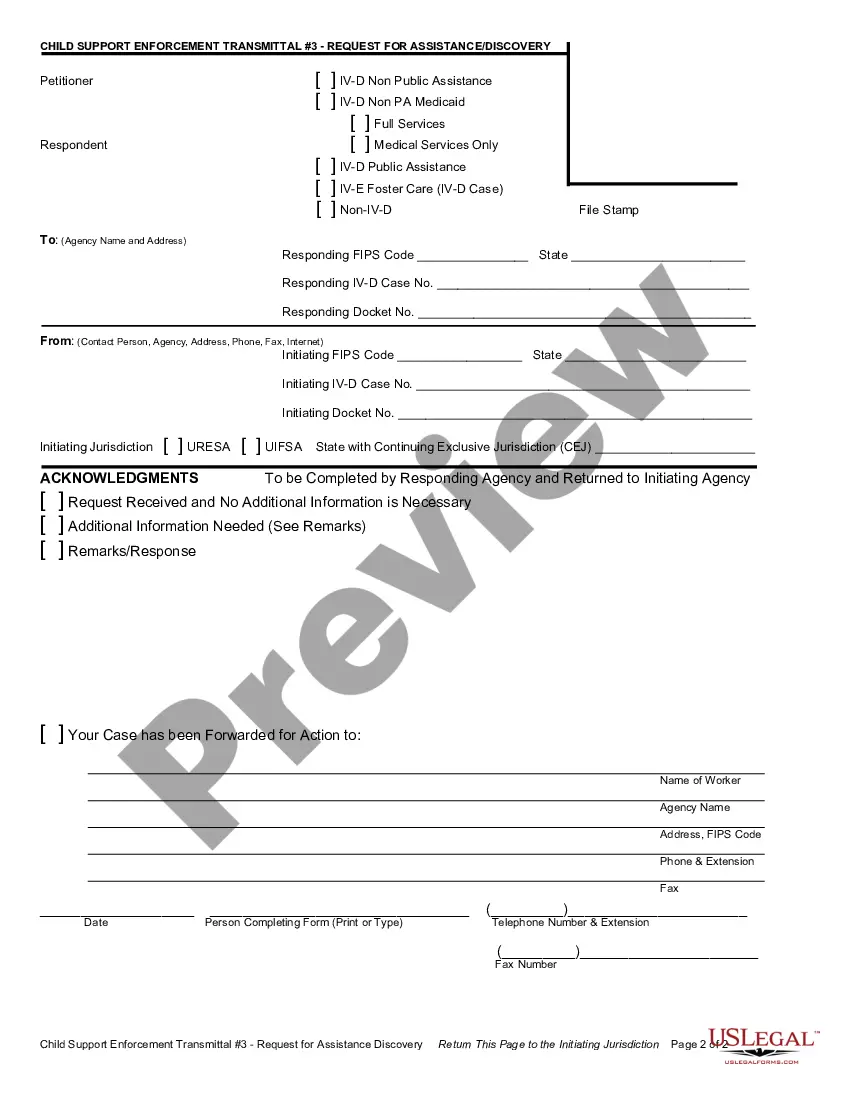

Kentucky Child Support Enforcement Transmittal #3 - Request for Assistance - Discovery and Instructions

Description

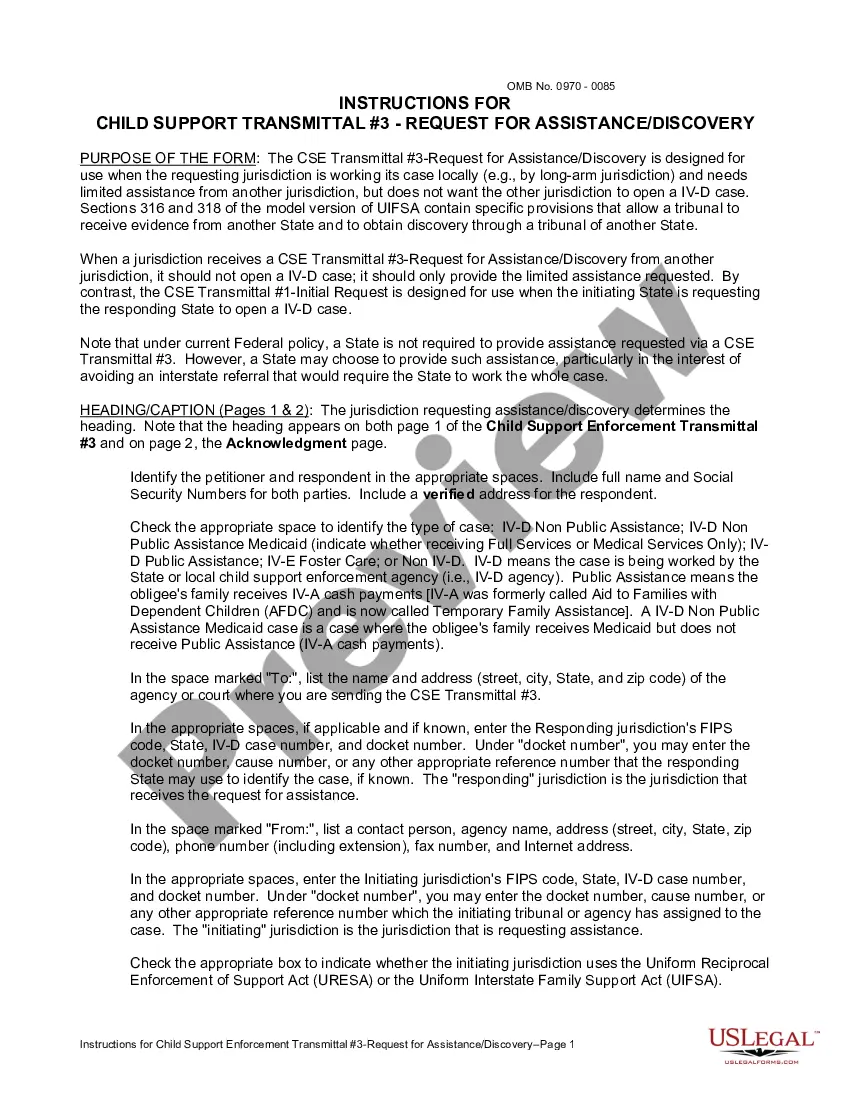

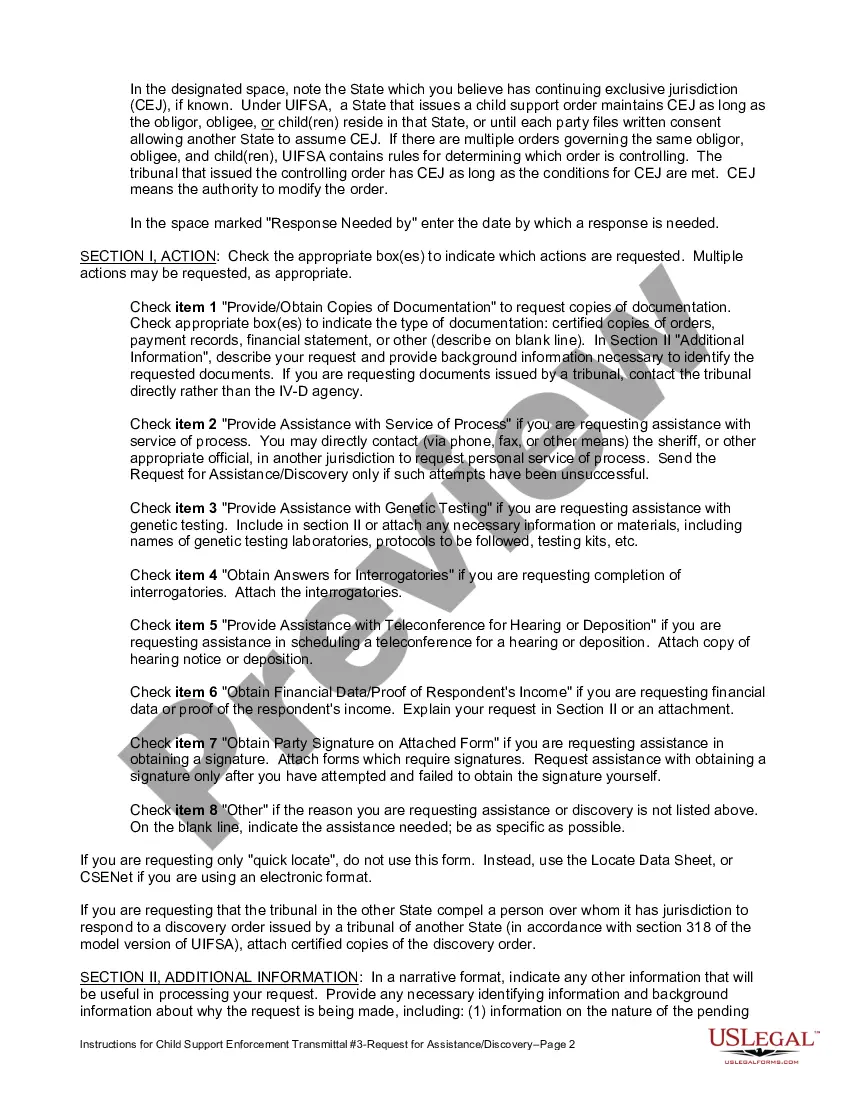

How to fill out Child Support Enforcement Transmittal #3 - Request For Assistance - Discovery And Instructions?

If you need to acquire comprehensive, download, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the website's simple and convenient search feature to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Buy now option. Choose the payment plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to locate the Kentucky Child Support Enforcement Transmittal #3 - Request for Assistance - Discovery and Instructions in just a few clicks.

- If you are currently a US Legal Forms member, Log In to your account and click the Download button to obtain the Kentucky Child Support Enforcement Transmittal #3 - Request for Assistance - Discovery and Instructions.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Preview option to review the form's content. Don't forget to check the summary.

- Step 3. If you are unsatisfied with the form, utilize the Search area at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

The minimum amount of child support is $60 per month. The court can use its judicial discretion to determine child support obligations if the parents' gross income exceed the uppermost levels of the guideline table.

New Income Maximums The new changes to child support law increase the maximum combined monthly adjusted parental gross income utilized for calculating child support. Previously the chart stopped at $15,000 monthly, which is $180,000 per year. The new chart goes up to $30,000 monthly, or $360,000 per year.

Child support back pay cannot be totally forgiven or waived, but there are a few situations that can help you handle it. Double-check the amount the court states you are in arrears.

In fact, once a party owes $2,000 or more they may be charged with felony nonsupport, resulting in prison sentences and a permanent felony record that will limit employment opportunities in the future.

For Kentucky child support orders, the child support order ends when the child turns 18, unless he or she is still enrolled in high school, in which case child support would continue through the school year in which the child turns 19.

Kentucky's Statute of Limitations on Back Child Support Payments (Arrears) The statute of limitations for enforcement of child support arrears in Kentucky 15 years after the last child on the order emancipates.

It is possible that even though you share custody one parent may still have to pay child support. Child support is intended to make both households as equal as possible. So even if it is joint custody, if one parent makes significantly more income than the other, they may have to pay child support.

In Kentucky, the child support calculations are based on the income of both parties and take into consideration if the receiving part has sole or joint physical custody. A percentage of the parents' joint income is used in the child support formula.