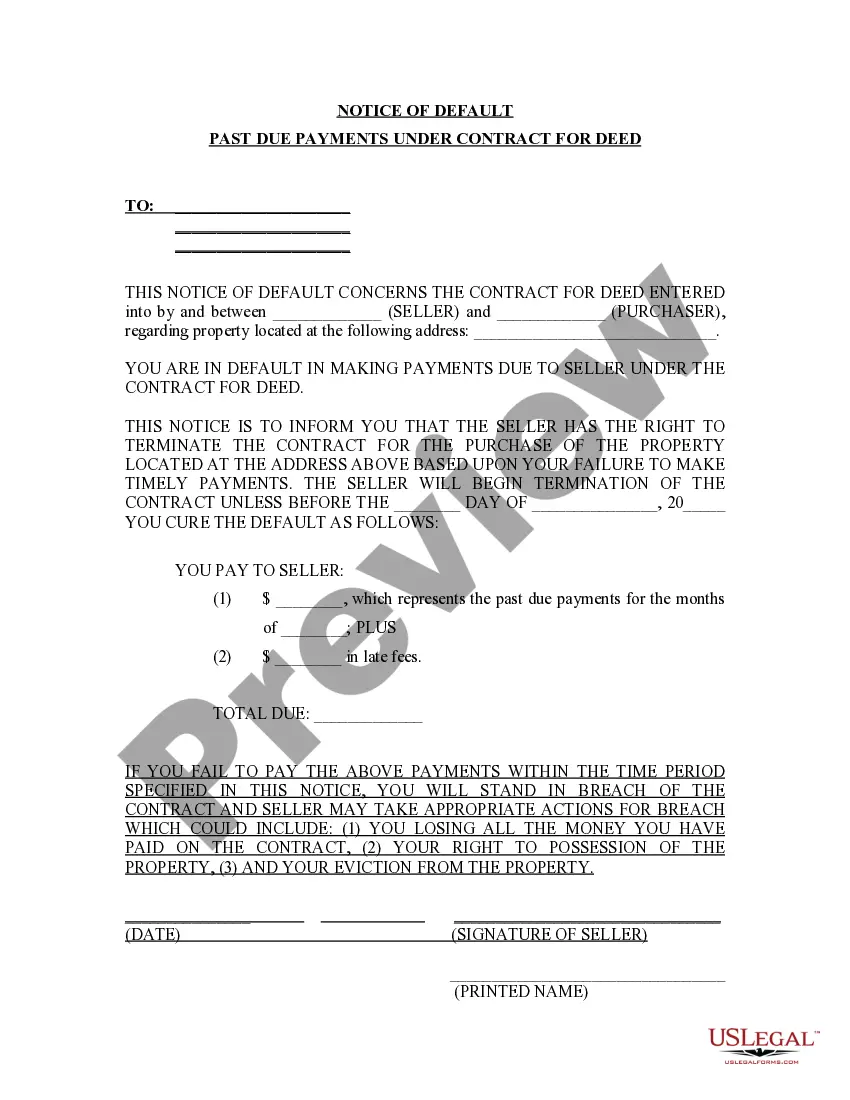

Under the Fair Credit Reporting Act, whenever credit or insurance for personal, family, or household purposes, or employment involving a consumer is denied, or the charge for such credit or insurance is increased, either wholly or partly because of information contained in a consumer report from a consumer reporting agency, the user of the consumer report must:

notify the consumer of the adverse action,

identify the consumer reporting agency making the report, and

notify the consumer of the consumer's right to obtain a free copy of a consumer report on the consumer from the consumer reporting agency and to dispute with the reporting agency the accuracy or completeness of any information in the consumer report furnished by the agency.

Kentucky Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency

Description

How to fill out Notice Of Increase In Charge For Credit Or Insurance Based On Information Received From Consumer Reporting Agency?

If you want to total, download, or print authorized file web templates, use US Legal Forms, the most important collection of authorized varieties, which can be found on the web. Use the site`s easy and hassle-free research to find the files you need. A variety of web templates for business and individual functions are sorted by categories and says, or key phrases. Use US Legal Forms to find the Kentucky Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency within a handful of mouse clicks.

In case you are previously a US Legal Forms client, log in for your accounts and click on the Obtain button to have the Kentucky Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency. You can also entry varieties you previously saved in the My Forms tab of your respective accounts.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for the correct city/country.

- Step 2. Use the Preview choice to look over the form`s articles. Don`t forget to read through the description.

- Step 3. In case you are not happy with the kind, use the Lookup discipline near the top of the monitor to discover other types of your authorized kind design.

- Step 4. Once you have discovered the shape you need, select the Purchase now button. Opt for the pricing program you like and add your references to register for the accounts.

- Step 5. Process the transaction. You can utilize your credit card or PayPal accounts to accomplish the transaction.

- Step 6. Choose the structure of your authorized kind and download it on the device.

- Step 7. Comprehensive, edit and print or sign the Kentucky Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency.

Every single authorized file design you get is yours eternally. You may have acces to every kind you saved within your acccount. Go through the My Forms segment and pick a kind to print or download again.

Contend and download, and print the Kentucky Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency with US Legal Forms. There are thousands of skilled and express-distinct varieties you can use for the business or individual requirements.

Form popularity

FAQ

* You may request a complaint form be sent to you by calling our toll free number at 888-432-9257 and selecting option #3. Please leave your name and address and indicate whether your complaint is against a telemarketer, automobile dealer, or other type of business.

KRS 413.190. The Kentucky criminal statutes of limitations are found in KRS 500.050 ? General Provisions: Time Limitations. A prosecutor may bring charges for felonies at any time: there is no statute of limitations for a felony. However, a misdemeanor may only be prosecuted within one year after it was committed.

Kentucky Consumer Protection Act, Section 367.110 et seq was broadly designed to curtail unfair, false, misleading or deceptive practices in the conduct of commerce in the state of Kansas.

(e) The term ?investigative consumer report? means a consumer report or portion thereof in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or associates of the consumer reported on or with ...

The KCPA protects Kentucky's citizens from "unfair, false, misleading, or deceptive acts or practices in trade or commerce." The Office of Consumer Protection enforces the Act by bringing lawsuits in the public interest to obtain civil penalties and consumer redress, including restitution and injunctive relief aimed at ...

A consumer reporting agency is any person that (1) for monetary fees, dues, or on a cooperative nonprofit basis regularly engages in whole or in part in the practice of assembling or evaluating consumer credit information, or other information on consumers, for the purpose of furnishing consumer reports to third ...