Kentucky Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report

Description

How to fill out Notice Of Adverse Action - Non-Employment - Due To Consumer Investigative Report?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or create.

By utilizing the site, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Kentucky Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report in just a few minutes.

If you already have a subscription, Log In to download the Kentucky Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form onto your device. Edit. Fill out, modify, and print and sign the downloaded Kentucky Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report.

- If you want to use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have chosen the correct form for the location/county.

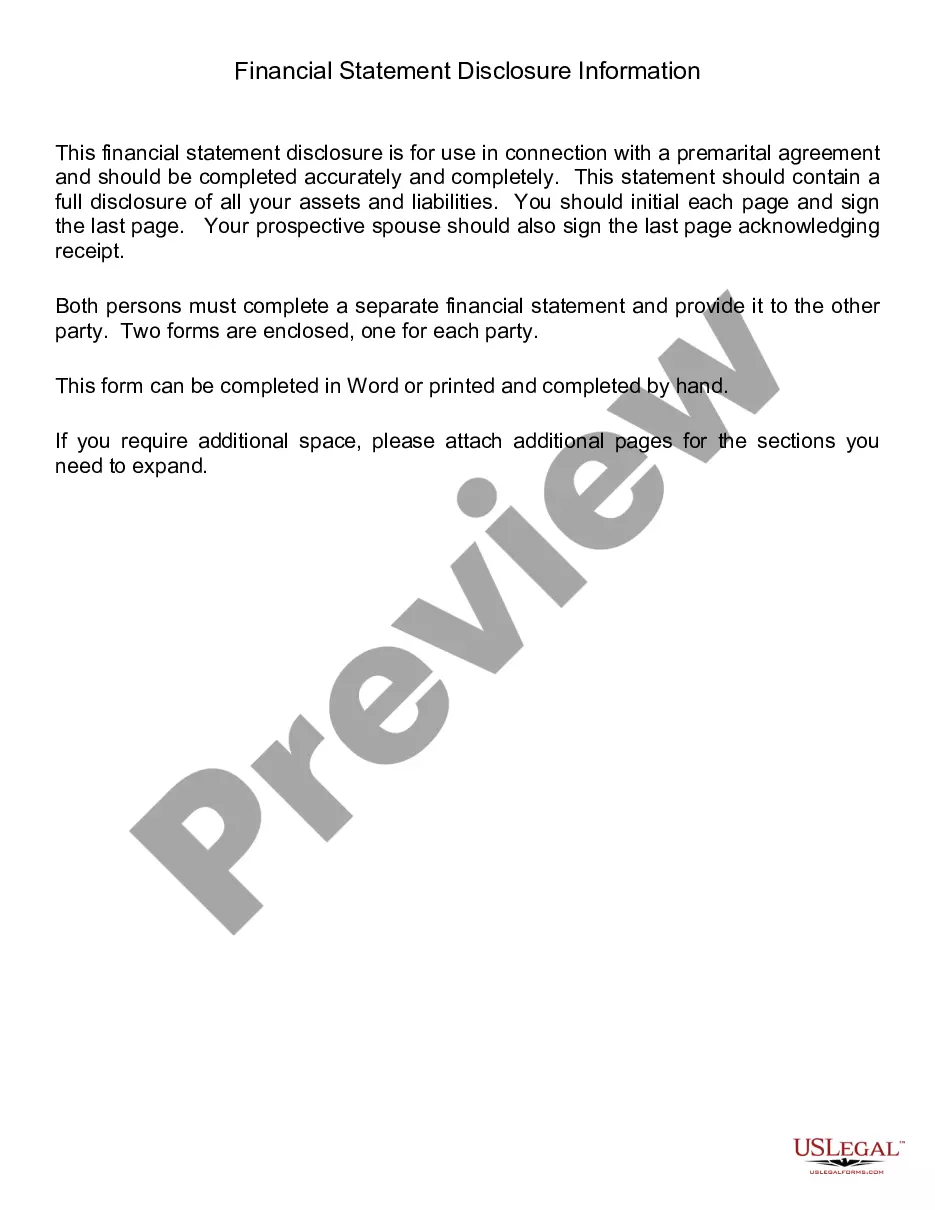

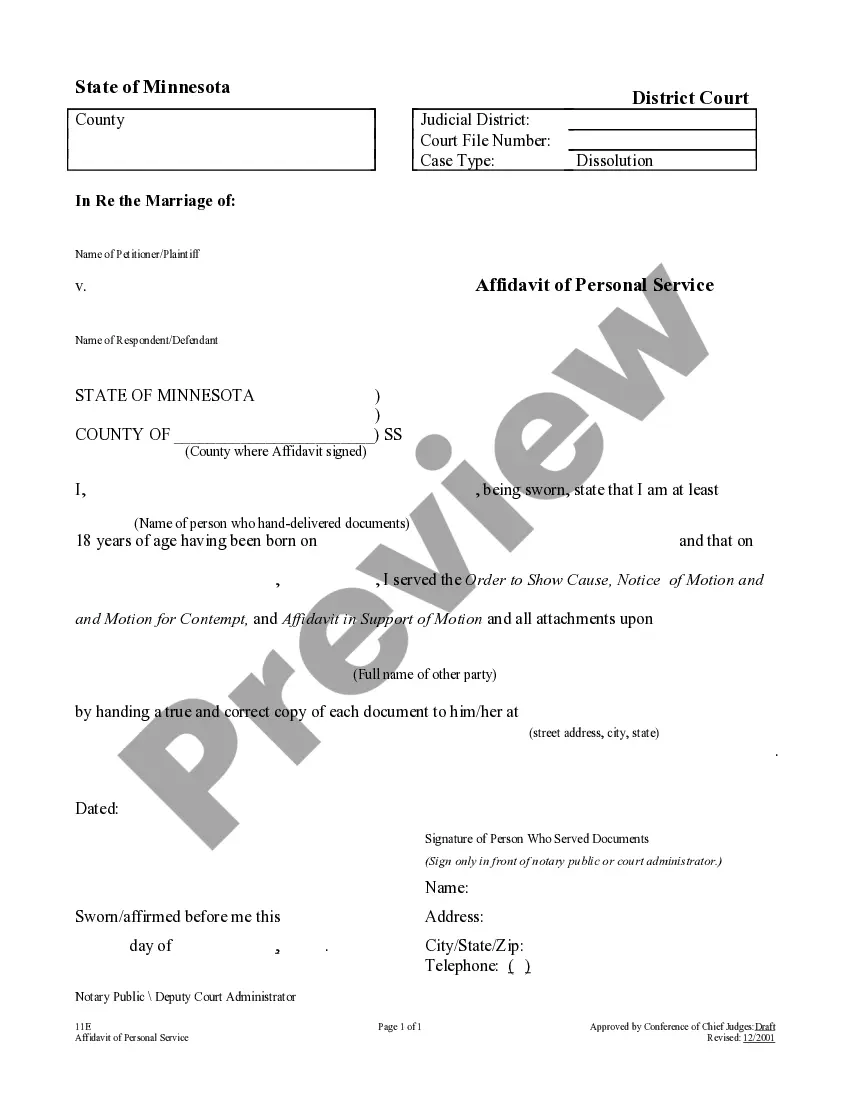

- Click the Preview button to review the content of the form.

- Read the form description to confirm that you have selected the right form.

- If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase Now button.

- Then, select the pricing plan you prefer and provide your information to register for the account.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) authorization is a requirement that allows entities to access a consumer's report only with the individual’s consent. This authorization helps protect consumers from unauthorized access to their sensitive information. When dealing with a Kentucky Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report, understanding your rights regarding this authorization is essential to ensure proper disclosure practices are followed.

If you need to file a complaint against a company in Kentucky, you should first gather all relevant information and documentation regarding your issue. You can then submit your complaint to the Better Business Bureau or the Kentucky Attorney General's office. Utilizing online platforms like USLegalForms can simplify this process by providing guides and forms needed for an effective response.

A consumer report typically includes various details such as credit history, public records, and inquiries from creditors. It can also show negative information, such as collections or late payments, impacting creditworthiness. Understanding what appears on your report is crucial, especially if you receive a Kentucky Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report, since it may affect your financial opportunities.

A financial institution must notify the affected individual of the adverse action within a reasonable time frame, typically within 30 days. This notification period aligns with the requirements of the Kentucky Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report, helping ensure that individuals are informed promptly. Timely communication can help individuals address any discrepancies in the information leading to the adverse decision.

Yes, there are specific disclosure requirements mandated under the Fair Credit Reporting Act (FCRA) when an institution takes adverse action based on third-party information. Institutions must provide affected individuals with a written notice, detailing the adverse action alongside the name and contact information of the credit reporting agency used. This practice ensures transparency and compliance with the Kentucky Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report guidelines.

Employers routinely obtain consumer reports that include the verification of the applicant/employee's Social Security number; current and previous residences; employment history, including all personnel files; education; references; credit history and reports; criminal history, including records from any criminal

As a rule of thumb, the distinction between the two types of investigations can be thought of as simply verifying the specific facts about education, employment or other information the applicant has provided to the employer ("consumer report") versus obtaining more general character or personal information through

Essentially, personal or professional reference verification, and employment verification that stray beyond the realm of facts and into personal character assessments and opinions are considered Investigative Consumer Reports.

An investigative consumer report is more like a detailed background check. Facts that create a picture of who you are as a person are included in this kind of report, and the gathering of that information might even include interviews with your neighbors, friends and associates.

Employers should be aware that California law generally limits an investigative consumer report inquiry regarding public records to the past seven years (10 years for bankruptcy filings).