Kentucky Option to Purchase Stock - Long Form

Description

How to fill out Option To Purchase Stock - Long Form?

Locating the appropriate legitimate document template can be quite a challenge. Clearly, there are numerous templates available online, but how do you find the valid one you need.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Kentucky Option to Purchase Stock - Long Form, which you can use for business and personal purposes.

All documents are verified by experts and meet state and federal requirements.

If the template does not meet your needs, use the Search field to find the suitable document. Once you are confident that the template is appropriate, click the Buy now button to obtain the document. Choose the payment plan you want and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, revise, print, and sign the obtained Kentucky Option to Purchase Stock - Long Form. US Legal Forms is indeed the largest collection of legal templates where you can find various document formats. Utilize this service to acquire professionally crafted paperwork that adheres to state standards.

- If you are currently registered, Log In to your account and click on the Download button to obtain the Kentucky Option to Purchase Stock - Long Form.

- Use your account to search for the legal templates you have purchased previously.

- Visit the My documents tab of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure that you have selected the appropriate template for your area/region.

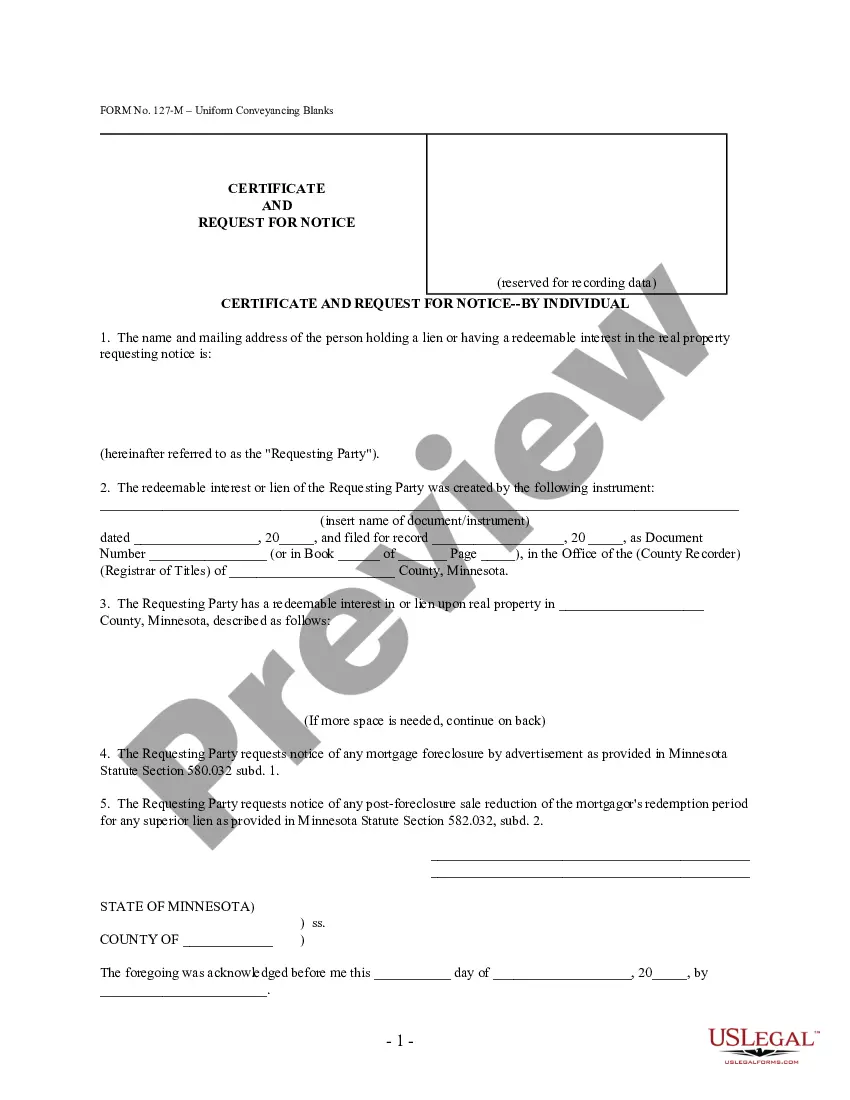

- You can browse the document using the Preview button and review the template details to confirm that it is the right fit for you.

Form popularity

FAQ

The Llet, or limited liability entity tax, in Kentucky varies based on factors like entity type and revenue. For specifics related to your business structure, it’s best to consult a professional or use a reliable service like uslegalforms. They provide the resources you need to navigate Kentucky’s tax regulations effectively. Being informed will help you avoid surprises during tax season.

You can write off stocks on taxes by declaring capital losses on your tax return. This allows you to offset any gains you have from other investments. You will report the loss using Form 8949 and summarize it on Schedule D for your overall capital gains and losses. Using resources like USLegalForms can help you navigate this process effectively.

When filing taxes on stock trades, you need to report your gains and losses on your tax return. This is done using Form 8949, where you'll list each trade in detail. Following this, you will transfer the summary to Schedule D for your overall capital gains and losses. Consider using USLegalForms for accessing the appropriate forms and ensuring a smooth filing process.

To report stocks on your taxes, you need to document any capital gains or losses from selling your shares. This requires you to use IRS Form 8949 to list your transactions. After that, you will summarize the total amounts on Schedule D of your tax return. Utilizing tools from platforms like USLegalForms can simplify this reporting process.