Kentucky Option to Purchase Real Estate - Short Form

Description

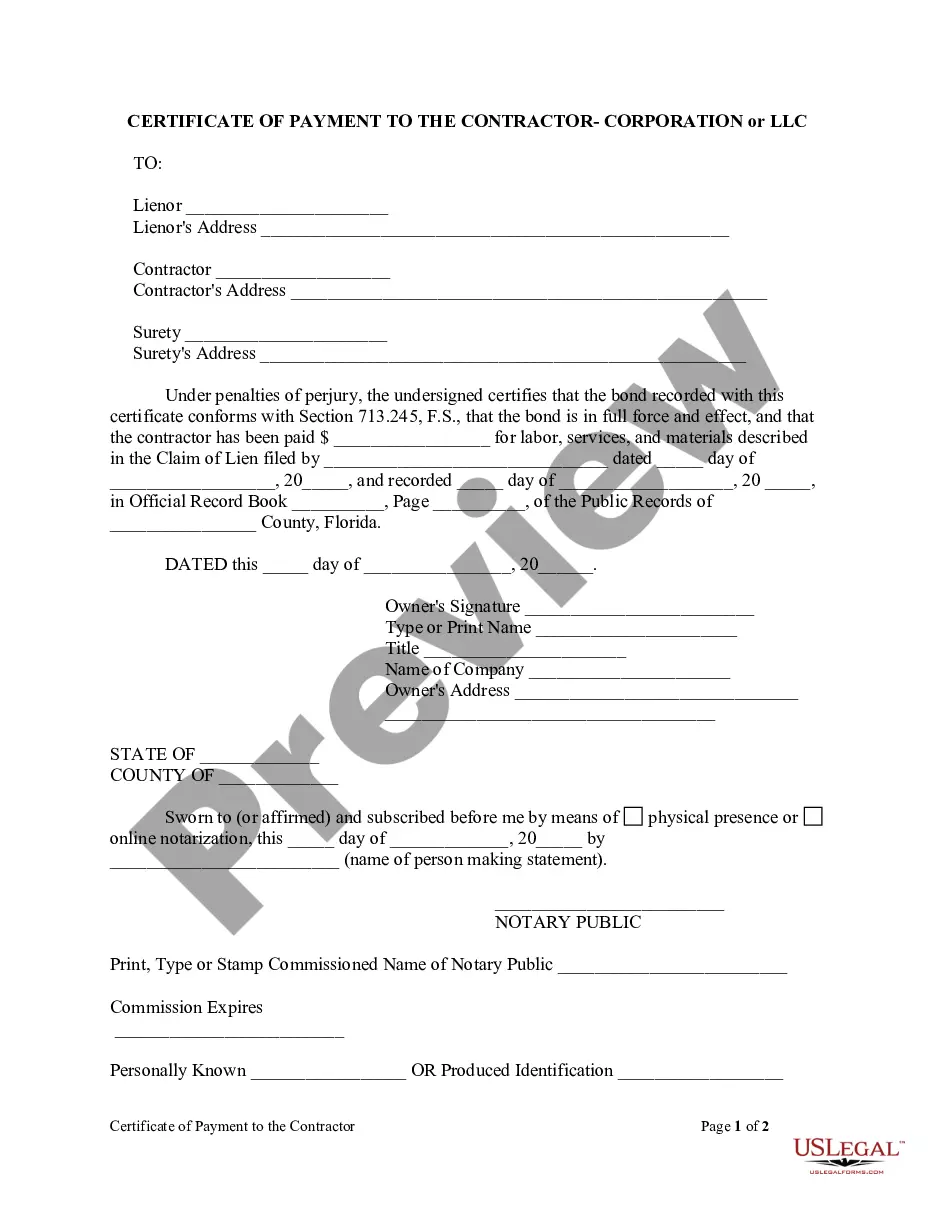

How to fill out Option To Purchase Real Estate - Short Form?

It is feasible to spend time online attempting to locate the legal documentation template that meets the federal and state criteria you require.

US Legal Forms offers an extensive selection of legal documents that can be reviewed by experts.

You can actually download or print the Kentucky Option to Purchase Real Estate - Short Form from my service.

If available, make use of the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- After that, you may complete, edit, print, or sign the Kentucky Option to Purchase Real Estate - Short Form.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the area/city of your choice.

- Check the form details to confirm you have selected the right form.

Form popularity

FAQ

For a valid and enforceable contract regarding the Kentucky Option to Purchase Real Estate - Short Form, the agreement must involve competent parties, an identifiable subject matter, and mutual consent. It should also address lawful consideration and be in writing, especially when dealing with real estate. Additionally, using resources from uslegalforms can help ensure that your contract meets all necessary legal standards.

An option gives the buyer the right, but not the obligation, to purchase the property under specified terms, while a contract obligates both the buyer and seller to complete the transaction. In the context of Kentucky Option to Purchase Real Estate - Short Form, the option provides flexibility and allows you to decide at a later date if you want to proceed with the purchase. This is particularly beneficial if you need time to arrange financing or assess the property before making a commitment.

Kentucky law requires real estate contracts to be in writing to be enforceable. This includes agreements related to the Kentucky Option to Purchase Real Estate - Short Form, which ensures clarity and protection for both buyers and sellers. The law emphasizes that all significant terms must be included in the contract, affording parties a clear framework for their transactions. For those seeking guidance, US Legal Forms offers resources to help navigate Kentucky’s real estate laws effectively.

A short form agreement is a simplified legal document that outlines the fundamental terms of a contract between two parties. It contains only the essential elements, making it easier to understand and execute compared to longer, more complex agreements. This format is conducive for parties looking for a straightforward approach to legal commitments. You can utilize the Kentucky Option to Purchase Real Estate - Short Form to efficiently formalize your real estate intentions.

The primary point of an option agreement is to give one party the exclusive right to purchase or lease a property under specified terms. This agreement allows potential buyers or tenants to secure a future deal without immediate financial commitment. It benefits sellers or landlords by providing them with a guaranteed prospect, making it a popular choice in real estate transactions. Consider exploring the Kentucky Option to Purchase Real Estate - Short Form for a concise option agreement.

A short form lease agreement is a simplified rental contract that outlines the basic terms of a lease between a landlord and a tenant. It typically includes essential details such as the rental period, payment terms, and responsibilities of both parties. This type of agreement is especially beneficial in situations where a detailed lease is not necessary. If you are interested in a Kentucky Option to Purchase Real Estate - Short Form, you can find specific templates that cater to your needs.

For a contract to be legally binding in Kentucky, it must contain an offer, acceptance, and consideration, indicating the intentions of the parties involved. Additionally, the agreement must comply with state laws and regulations to be enforceable. If you're using the Kentucky Option to Purchase Real Estate - Short Form, ensuring these elements are present is crucial to protect your interests. Using templates from platforms like uslegalforms can help ensure your contract meets all legal requirements.

In real estate, the four main types of legal contracts include purchase agreements, lease agreements, options to purchase, and listing agreements. Each of these contracts serves a unique purpose in the real estate transaction process. For those interested in Kentucky Option to Purchase Real Estate - Short Form, understanding these contracts helps in making informed decisions. Knowing the differences can greatly assist you in navigating your real estate journey.

Breaking a real estate contract is possible, but it often involves legal consequences. In Kentucky, if you wish to explore your options for breaking a contract, you should first check if the contract includes any exit clauses. Consulting an expert in Kentucky Option to Purchase Real Estate - Short Form can provide guidance tailored to your situation. Remember, it's vital to understand your obligations before taking action.