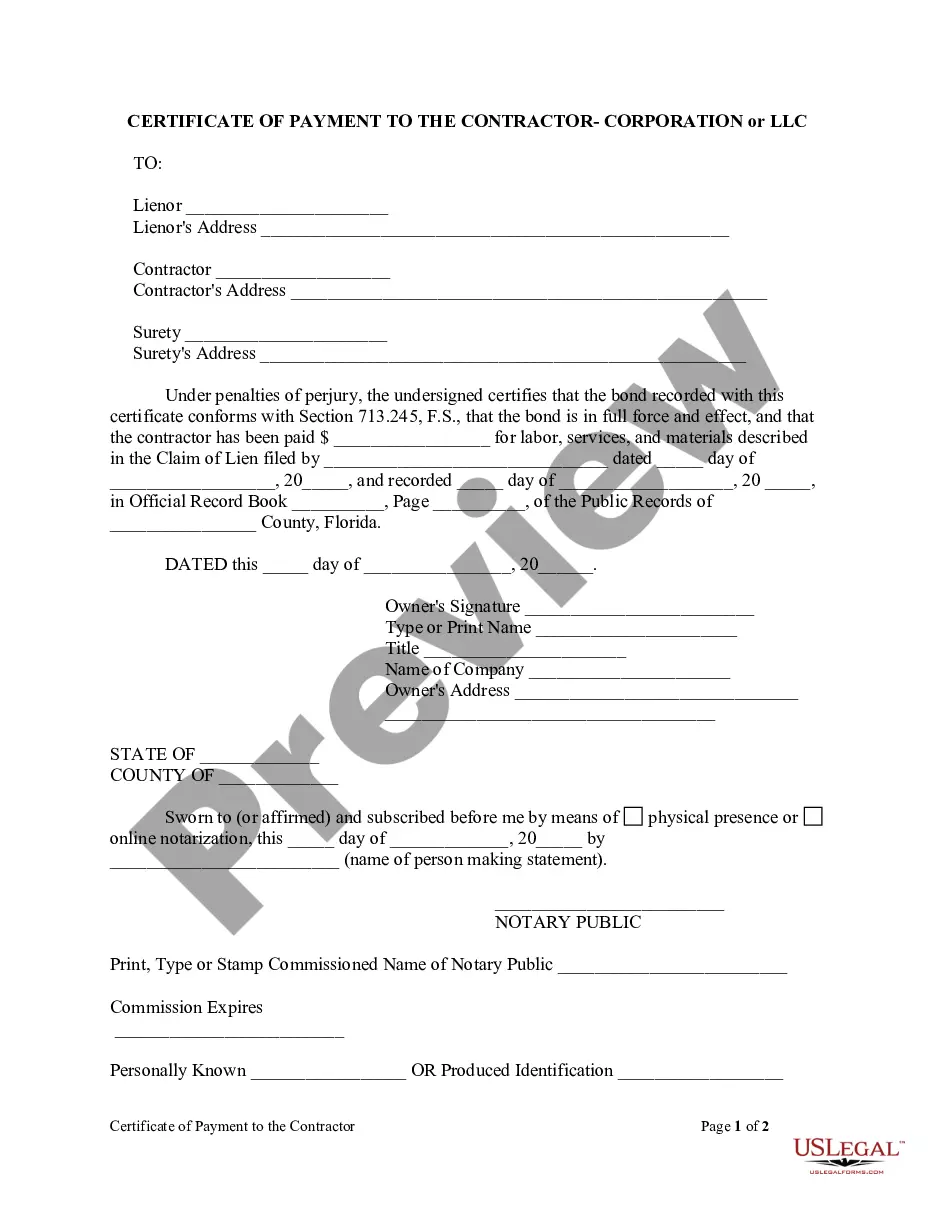

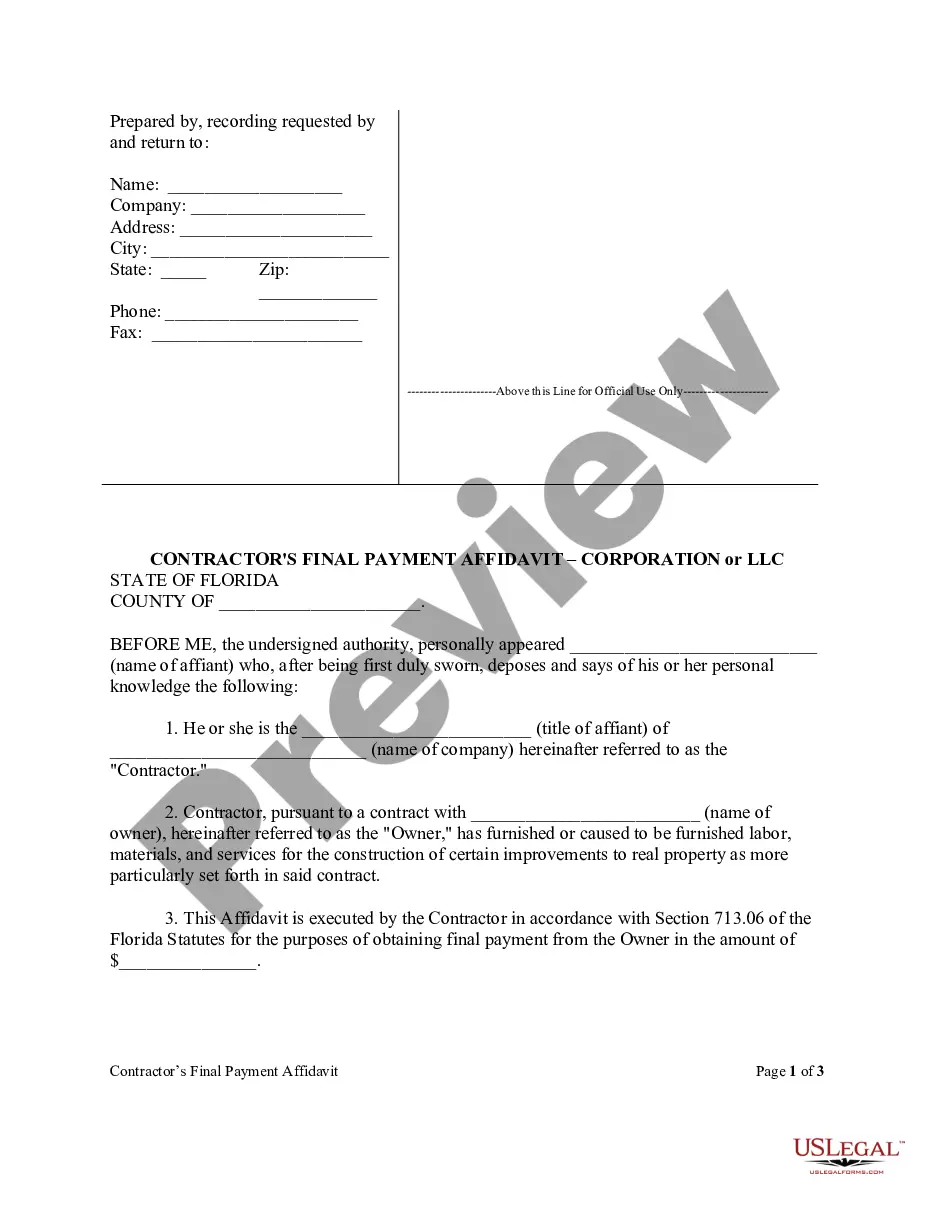

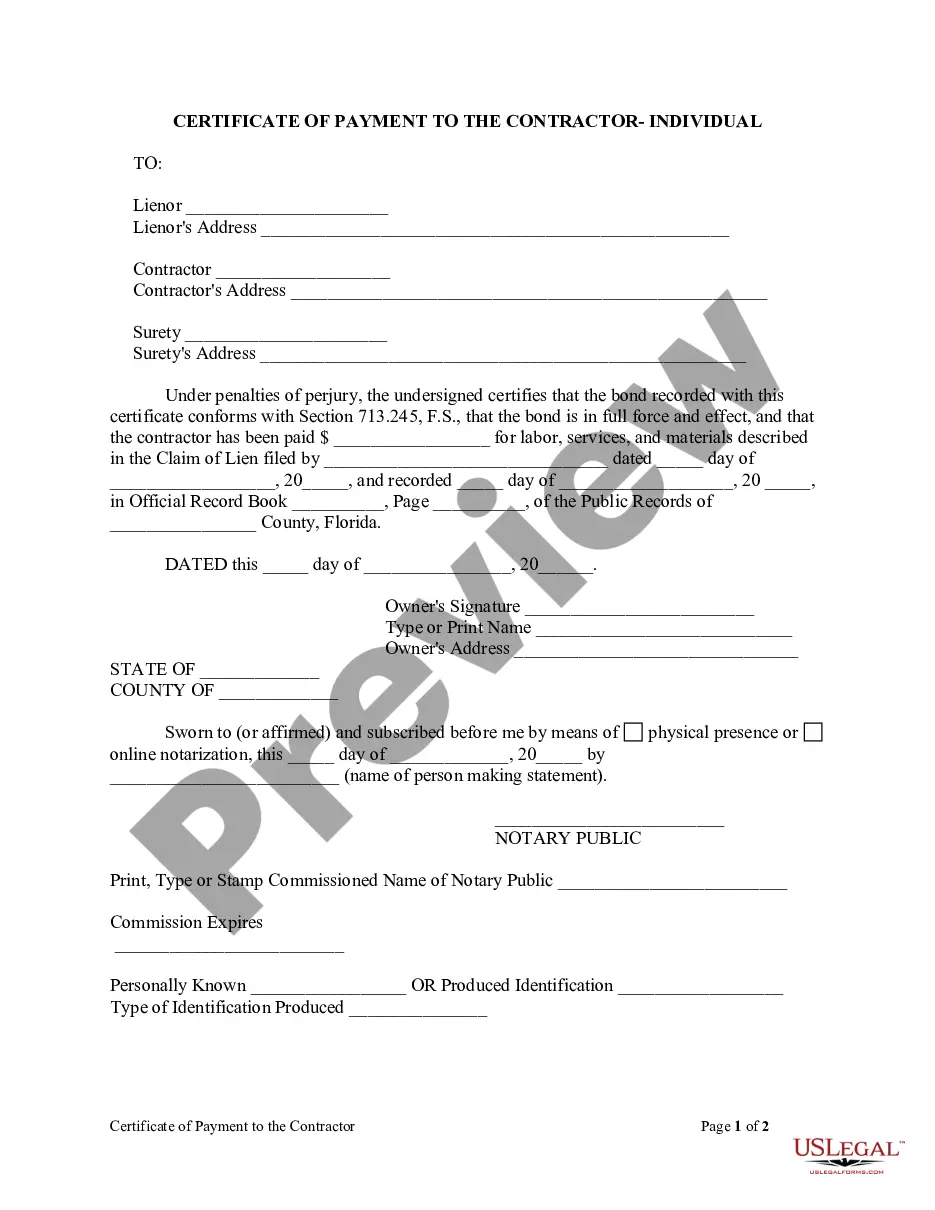

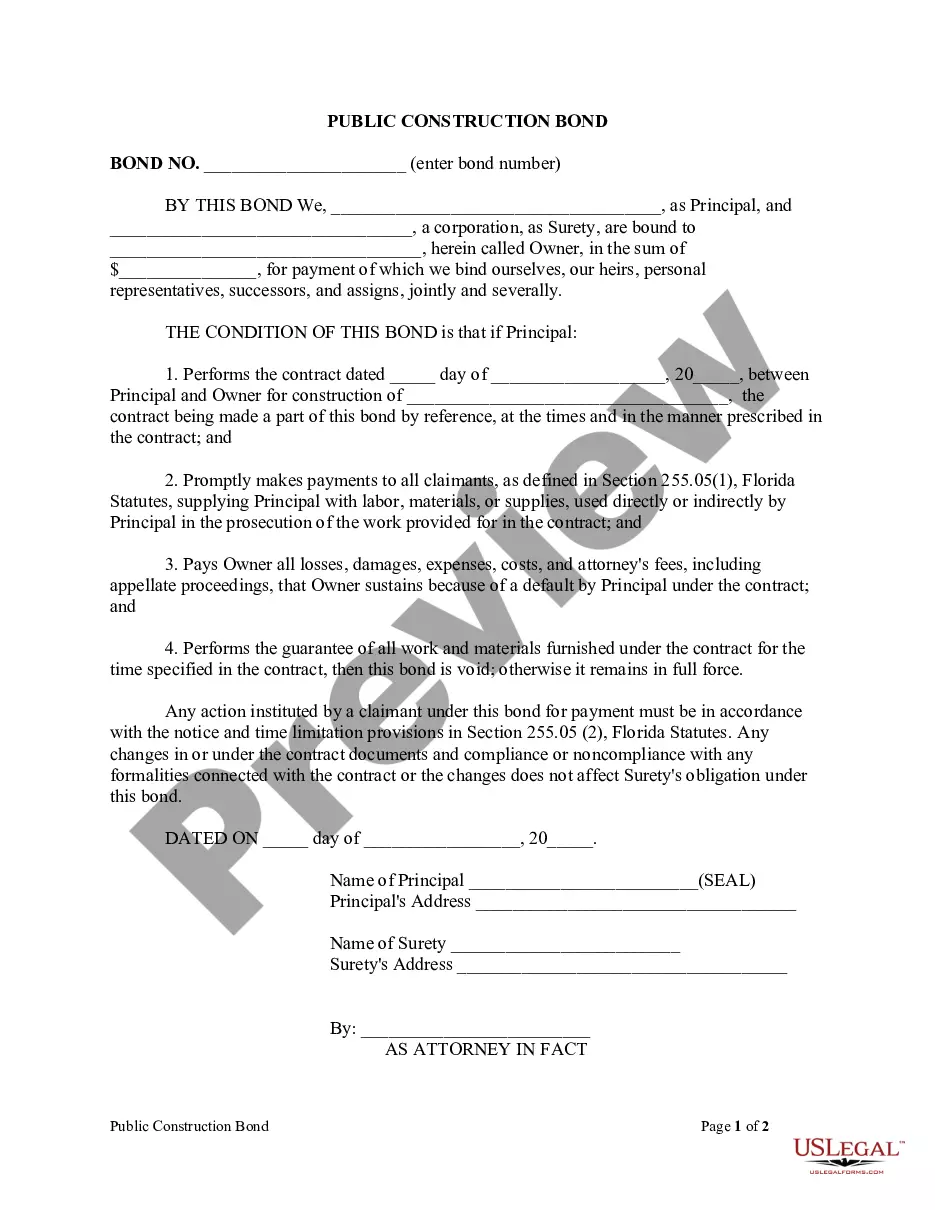

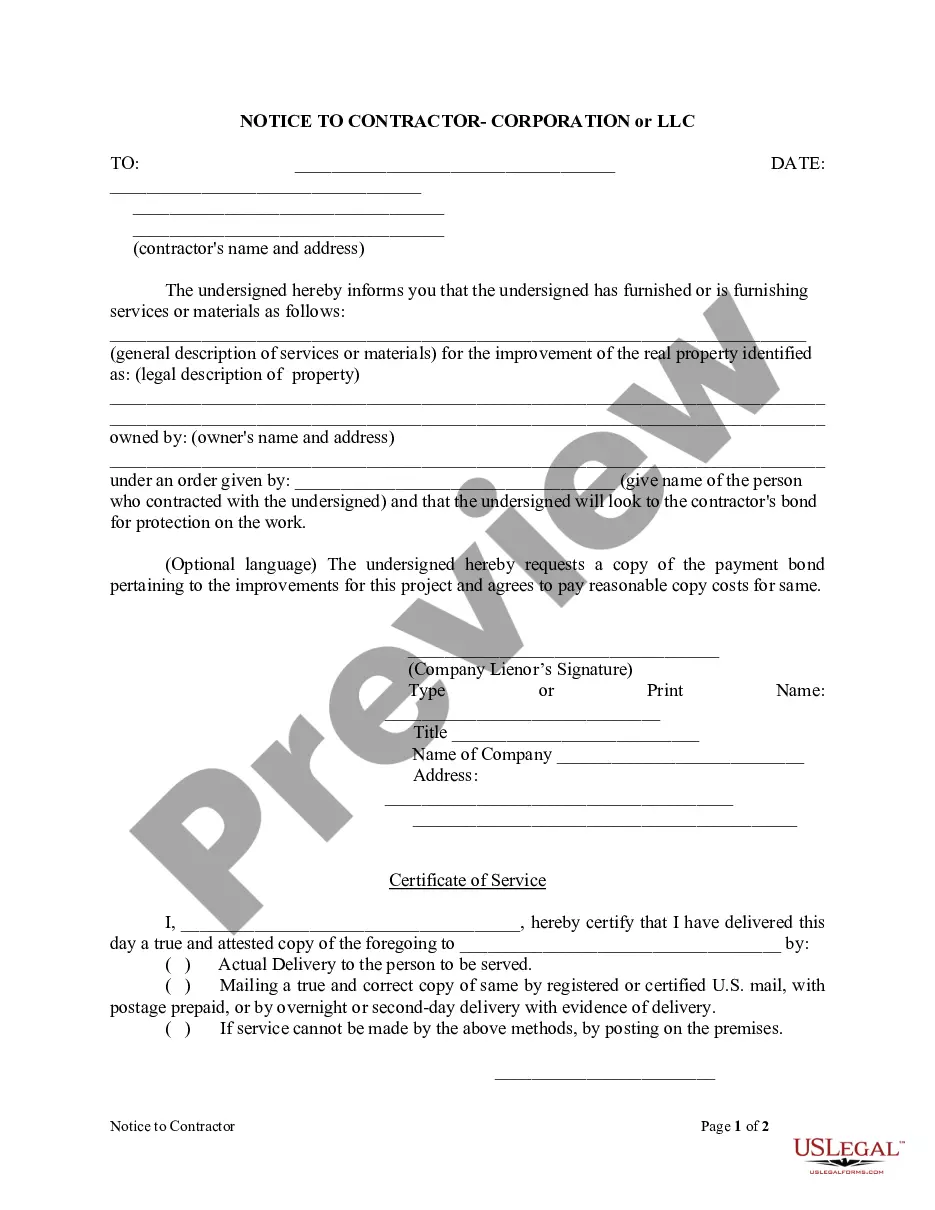

Within 90 days after a claim of lien is recorded for labor, services, or materials for which the contractor has been paid, the corporate or LLC owner or contractor may record a notice of bond as specified in s. 713.23(2), together with a copy of the bond and a sworn statement of Certificate Of Payment To Contractor Form. 713.245 Conditional payment bond.

Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC

Description

How to fill out Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation Or LLC?

The larger amount of documentation you are required to assemble - the more stressed you feel.

You can find a vast array of Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC templates online, yet you are unsure which ones to trust.

Eliminate the inconvenience of obtaining samples more simply with US Legal Forms. Acquire professionally crafted forms that are designed to fulfill state requirements.

Enter the required details to set up your account and complete the purchase with your PayPal or credit card. Choose a convenient file format and download your copy. Locate each document you receive in the My documents section. Simply navigate there to complete a new version of the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC. Even when working with professionally prepared templates, it remains essential to consider consulting your local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- If you hold a subscription with US Legal Forms, Log In to your account, and you will see the Download button on the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC’s page.

- If you've not utilized our site before, finalize the registration process using these guidelines.

- Ensure the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC is recognized in your state.

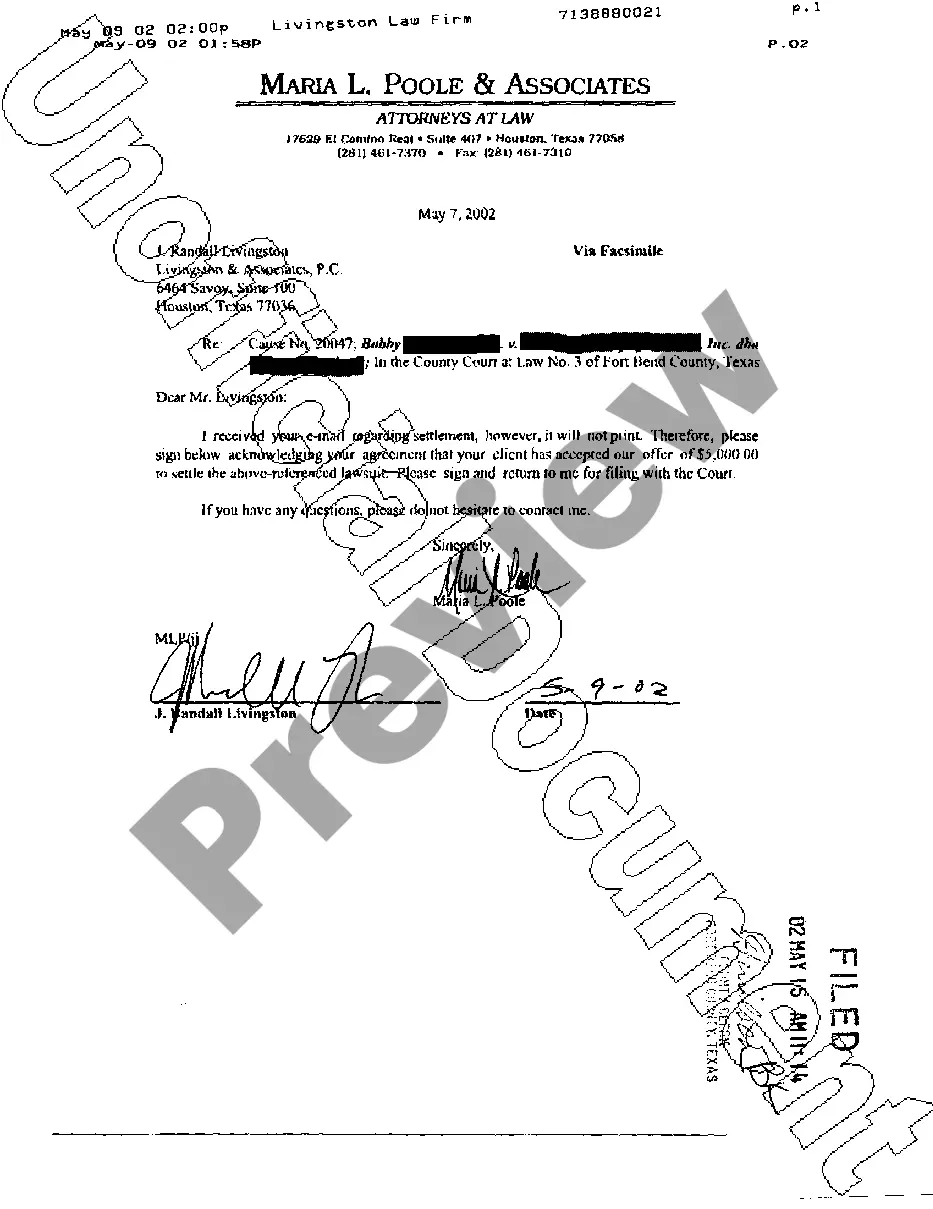

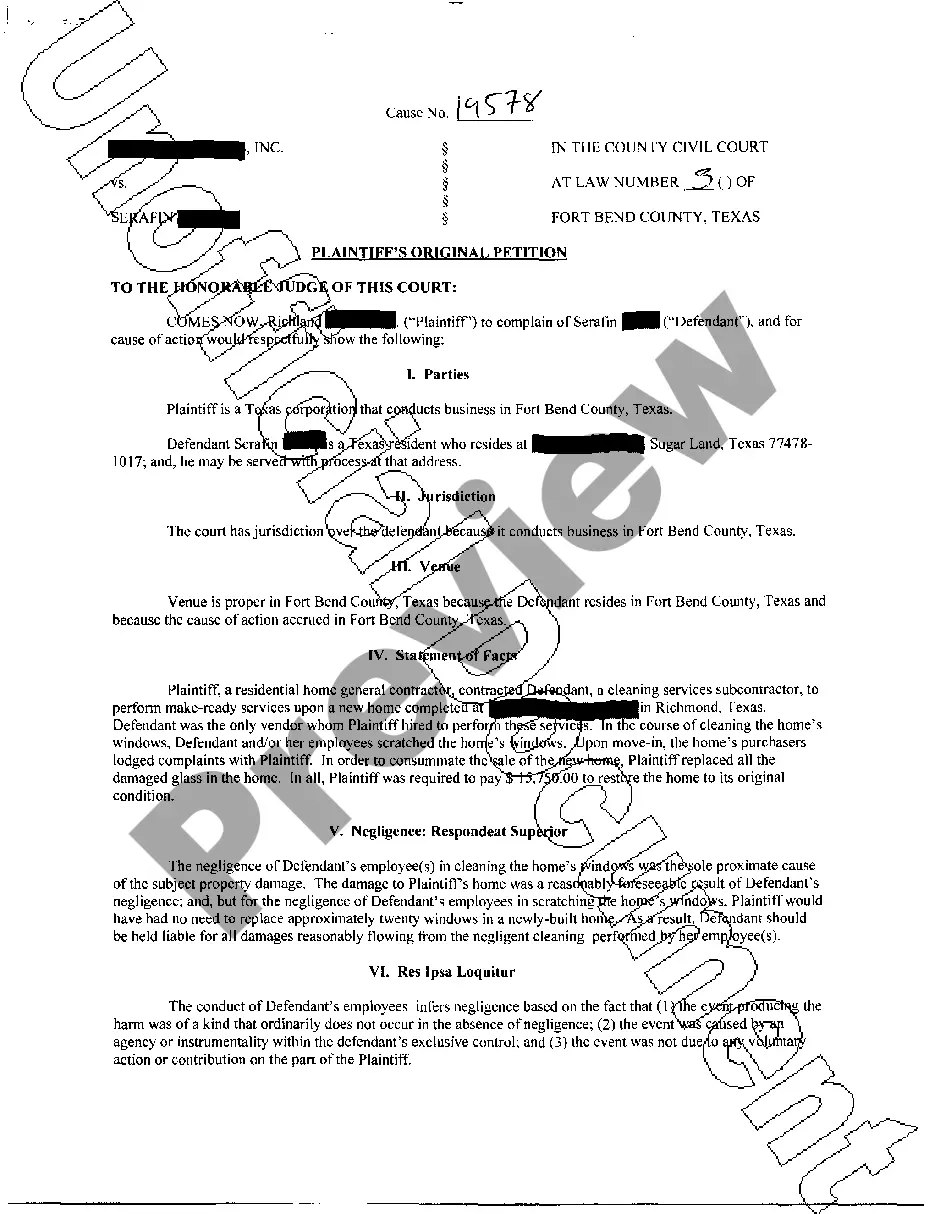

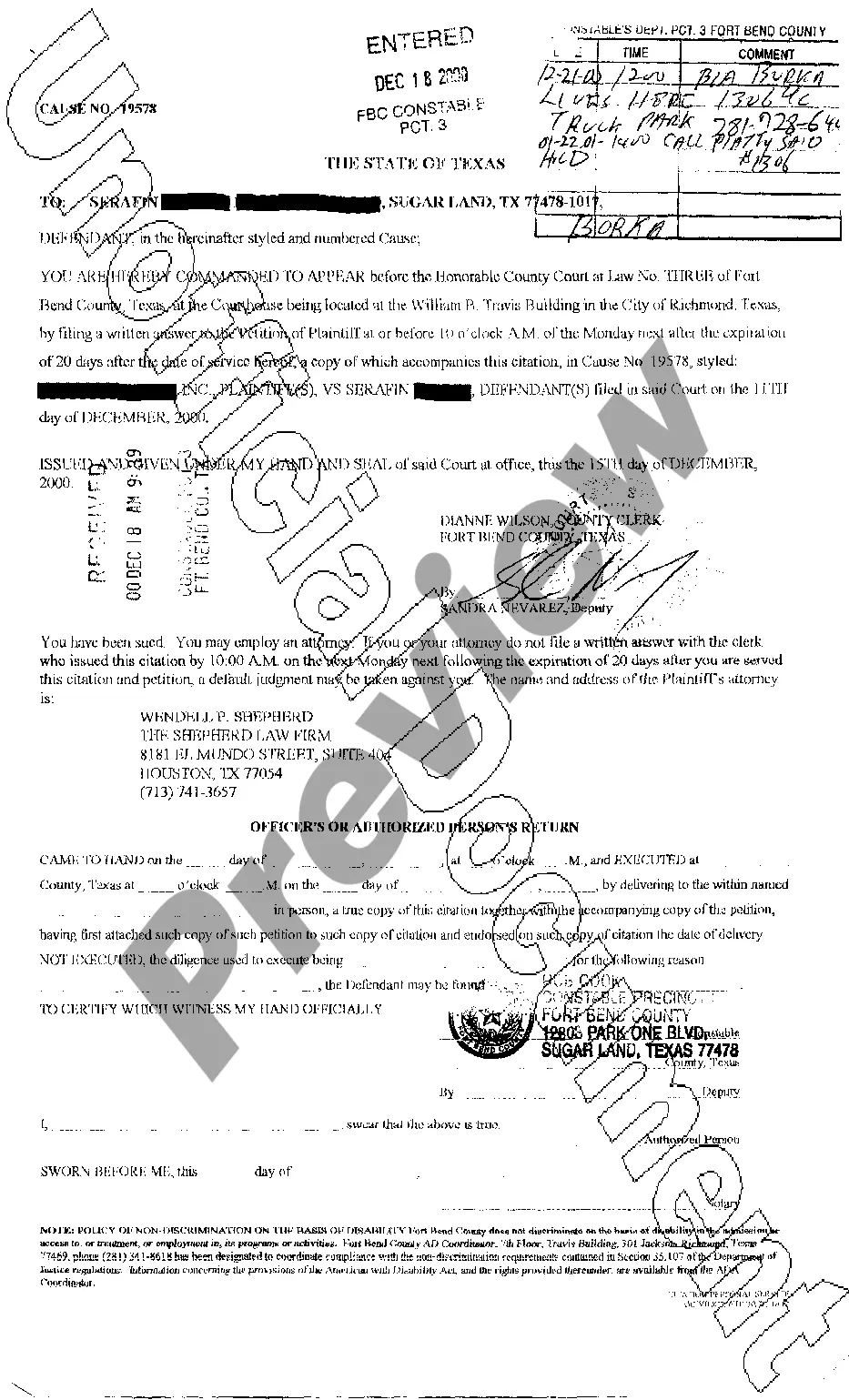

- Verify your selection by reviewing the description or by utilizing the Preview mode if available for the selected document.

- Just click Buy Now to initiate the registration process and choose a pricing plan that meets your requirements.

Form popularity

FAQ

Yes, you can file a lien without a contract in Florida, but it involves proving that services were provided. The Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC can aid this process by documenting your claim clearly. It becomes crucial to gather as much evidence as possible to substantiate your position.

In Florida, a contractor can place a lien on your property even without a signed contract if they can prove the work was performed and compensation is owed. The burden of proof rests with the contractor, who must demonstrate the services rendered. Using the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC can formalize the process and clarify their rights.

The three primary types of liens are mechanic's liens, mortgage liens, and tax liens. Mechanic's liens relate specifically to unpaid construction work, while mortgage liens pertain to loans taken out for real property. Understanding these types can clarify your options and obligations; consider the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC for guidance on mechanic's liens.

To file a contractor lien in Florida, start by completing the necessary forms, including the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC. Next, you must record the lien with the county clerk’s office where the project is located. Make sure to adhere to the timeframes required, ensuring your claim is enforceable.

Filing a lien in Missouri requires a written lien statement that details the amount owed and the property in question. Additionally, you must file this statement with the appropriate county clerk's office in a timely manner. Look into the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC for a similar approach when dealing with liens in Florida.

Yes, in Florida, you can file a lien without a signed contract, but proving your entitlement may be more challenging. Courts typically assess the circumstances surrounding the project and any agreements implied by the parties involved. Utilizing the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC can help clarify your position.

To file a lien in Florida, you need a few key elements, including a valid contract or work agreement and a notice of intent. You must complete the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC to document your claim accurately. This form provides a clear path to enforcing your rights in case of non-payment.

In Nebraska, construction liens generally last for three years from the date of filing. This timeframe ensures that contractors and suppliers have a limited window to enforce their rights. If you're navigating mechanic liens, consider using the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC for similar processes in Florida.

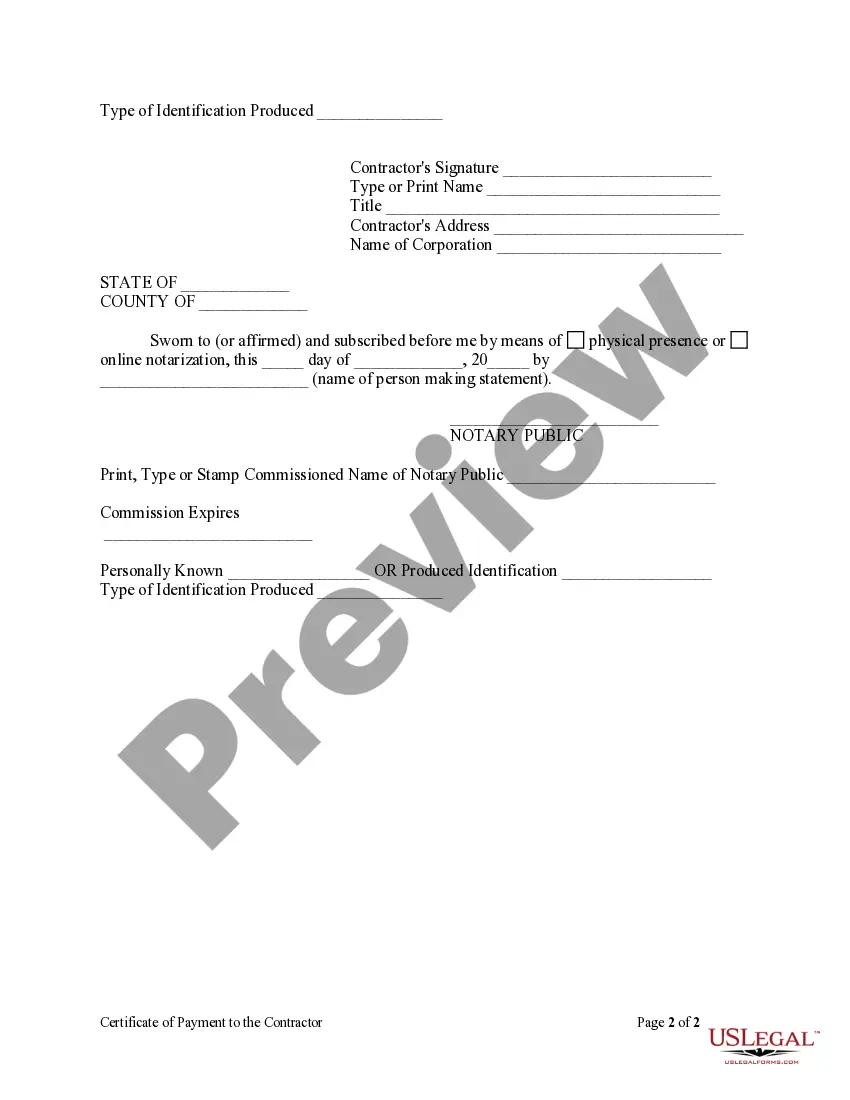

To notarize a lien release, you first need to have the document signed in front of a notary public. The notary will verify the identity of the signer and may require a valid photo ID. Once the notary is present, she will complete the notarization by affixing her signature and seal to the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC. If you're unsure about the process, consider consulting uslegalforms for guidance.

In Florida, lien releases typically do need to be notarized. This requirement enhances the legality of the document. If you are completing the Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation or LLC, ensuring notarization can protect your interest against any future claims. Always confirm current regulations to stay compliant.