Kentucky Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

It is possible to commit hrs on the Internet looking for the lawful record web template which fits the state and federal needs you require. US Legal Forms supplies a huge number of lawful forms which are reviewed by professionals. It is possible to down load or print out the Kentucky Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan from my support.

If you already have a US Legal Forms profile, you are able to log in and click the Obtain button. Following that, you are able to comprehensive, modify, print out, or indication the Kentucky Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. Every single lawful record web template you buy is your own for a long time. To have yet another version of any bought develop, go to the My Forms tab and click the corresponding button.

If you work with the US Legal Forms internet site the first time, stick to the simple instructions listed below:

- Very first, be sure that you have chosen the proper record web template for your state/town that you pick. Look at the develop outline to ensure you have picked out the right develop. If offered, utilize the Review button to check throughout the record web template at the same time.

- If you want to get yet another version of the develop, utilize the Look for area to get the web template that suits you and needs.

- When you have found the web template you need, just click Purchase now to proceed.

- Select the costs program you need, enter your credentials, and register for your account on US Legal Forms.

- Comprehensive the deal. You can use your credit card or PayPal profile to fund the lawful develop.

- Select the structure of the record and down load it to your gadget.

- Make alterations to your record if needed. It is possible to comprehensive, modify and indication and print out Kentucky Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan.

Obtain and print out a huge number of record themes using the US Legal Forms website, which offers the biggest selection of lawful forms. Use skilled and state-particular themes to deal with your company or individual demands.

Form popularity

FAQ

However, borrowers who allow another buyer to assume their mortgage ?remain liable to the VA for any loss that may occur as a result of a future default and subsequent claim payment,? ing to VA Pamphlet 26-7, ?Unless the property is sold to a creditworthy purchaser who agrees to assume the payment obligation.?

Find a home seller who will allow you to assume their VA loan. Verify that you meet the VA's minimum credit score and income requirements. Agree to assume all obligations of the existing loan. Pay the funding fee, down payment (if required) and closing costs.

An FHA/VA financing addendum is attached to a purchase contract to state that a buyer with FHA/VA financing can back out of the sale if the appraised property value is less than the asking price.

To receive VA home loan benefits and services, the Veteran's character of discharge or service must be under other than dishonorable conditions (e.g., honorable, under honorable conditions, general). Generally, there is no character of discharge bar to benefits to Veterans' Group Life Insurance.

If the purchaser(s) is creditworthy and assumes the liability to the lender and VA to the same extent that you did when you obtained the loan, you will be released from liability on the loan. To obtain a release from liability, you should check with the company to whom you make your payments before you sell your home.

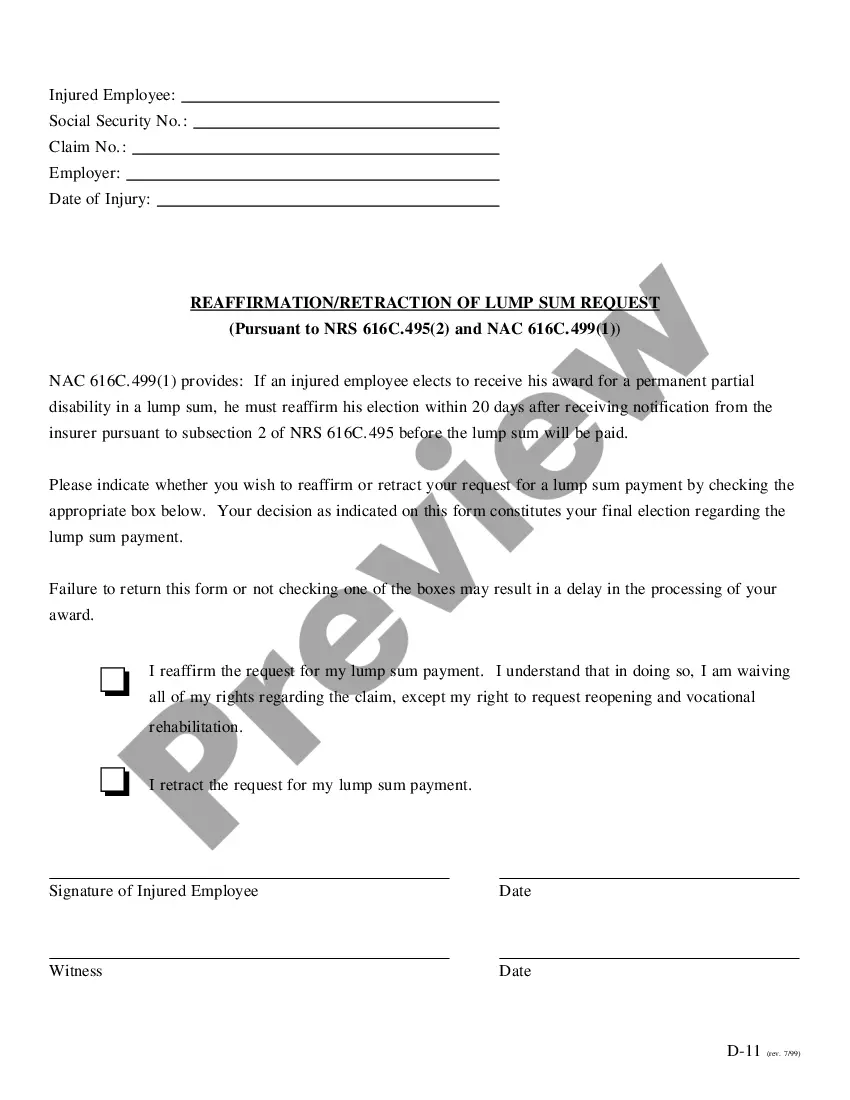

Addendum for Release of Liability on Assumed Loan and/or Restoration of Seller's VA Entitlement. Description: This Addendum is used in conjunction with the Loan Assumption Addendum if the Seller wants to be released from future liability of the loan.

Funding fee: A VA loan assumption will come with a funding fee equal to 0.5% of the loan balance.

For VA loan assumptions, the only way to safeguard your entitlement is to have a Veteran assume your loan and substitute their entitlement for yours. Unless that happens, Veterans will not regain their entitlement with a loan assumption ? it will remain tied to the property until the loan is repaid in full.