This form is a Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums

Description

How to fill out Complaint For Declaratory Judgment For Return Of Improperly Waived Insurance Premiums?

Are you presently in a position where you require documents for various organizational or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding versions you can trust is not simple.

US Legal Forms offers thousands of form templates, such as the Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums, which are designed to meet federal and state requirements.

If you find the correct form, click Purchase now.

Select the pricing plan you prefer, complete the necessary information to create your account, and purchase the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Choose the form you need and ensure it is for the correct jurisdiction/area.

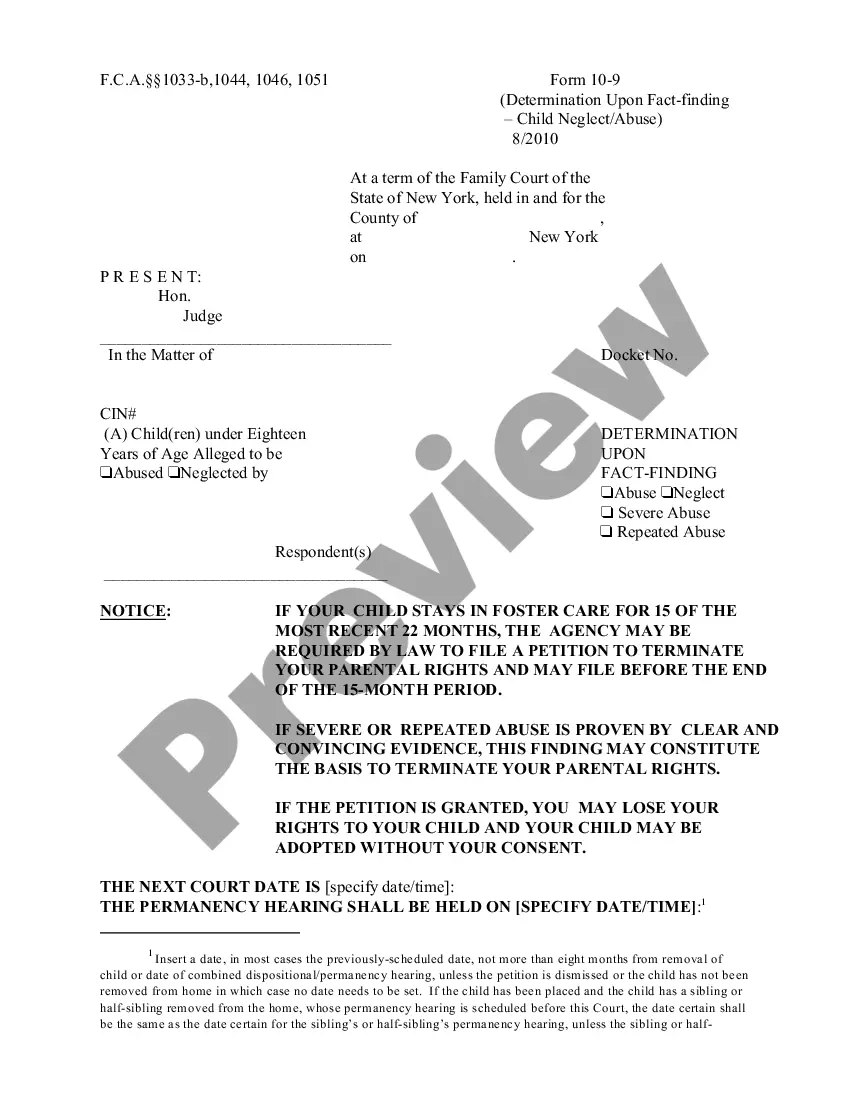

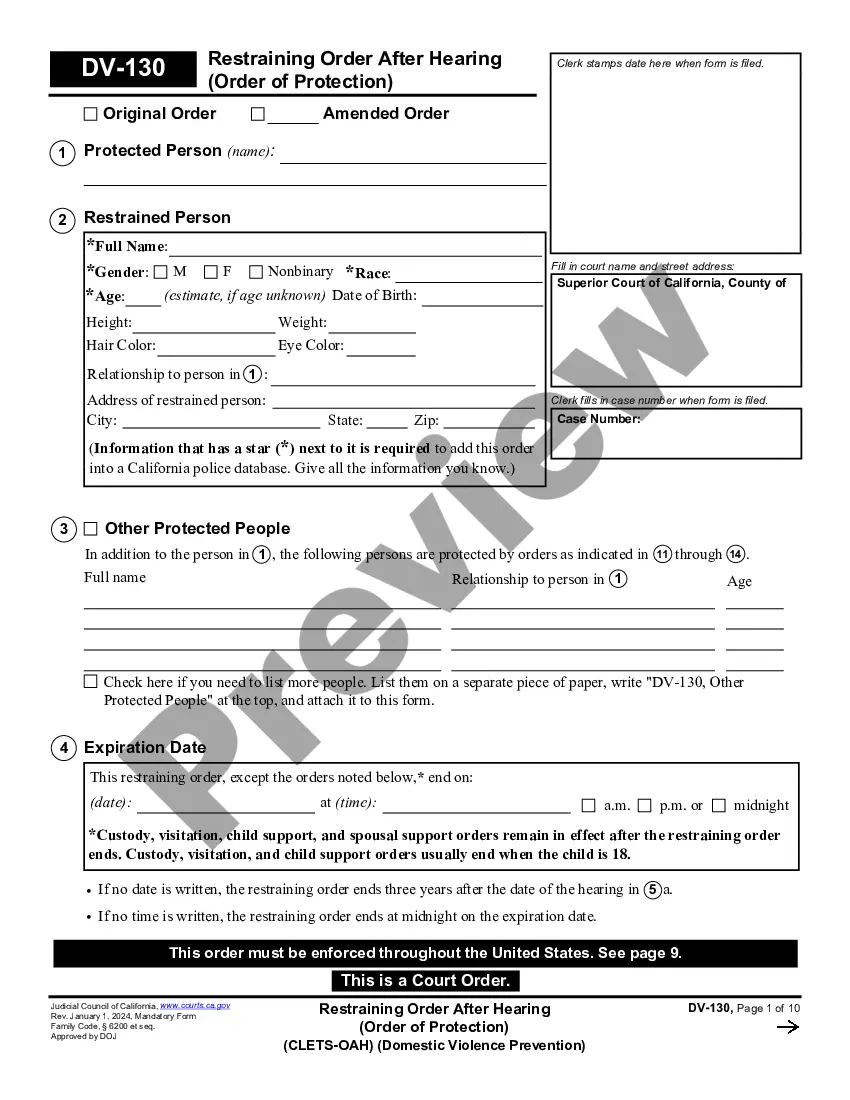

- Utilize the Preview option to examine the document.

- Read the description to ensure you have selected the right form.

- If the form isn’t what you are searching for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

The Supreme Court has ruled on various matters regarding insurance claims, emphasizing the importance of fair treatment and adherence to policy terms. These judgments often reinforce the rights of policyholders while also clarifying the obligations of insurers. If you believe your insurance claim has been improperly handled, consider pursuing a Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums. Platforms like uslegalforms can provide the necessary forms and guidance to support your case.

Proving that an insurance company acted in bad faith requires you to demonstrate that they failed to honor their obligations under the policy. Collect evidence such as emails, recorded phone calls, and any documentation that shows unreasonable delays or denials of claims. A Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums can be a vital tool in this process, helping you assert your rights effectively. Utilizing resources from uslegalforms can help you structure your case properly.

To file a complaint against an insurance company in Kentucky, you should first gather all relevant documents, including your policy details and any communication with the insurer. Next, contact the Kentucky Department of Insurance to understand the complaint process. You can also consider filing a Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums through a legal platform like uslegalforms, which can guide you through the necessary steps.

To file a complaint with the Kentucky Attorney General, you can start by visiting their official website, where you will find a dedicated section for consumer complaints. Follow the prompts to fill out the required information, detailing your situation clearly. If your issue involves improperly waived insurance premiums, consider mentioning your intent to pursue a Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums. This approach can ensure that your complaint is taken seriously and addressed effectively.

In Kentucky, driving without insurance can result in significant fines and penalties. Specifically, you may face a fine ranging from $500 to $1,000 for a first offense. Additionally, you could incur further costs, such as reinstatement fees and increased insurance premiums. For those affected by improperly waived insurance premiums, utilizing a Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums can help address your situation.

It may be appropriate to bring a declaratory judgment action when there is uncertainty regarding legal rights or obligations that could lead to future litigation. For example, if a policyholder believes they have been wrongfully denied coverage, they can file a Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums to seek clarification. This proactive approach can help resolve issues before they escalate into more significant disputes.

The actual controversy in a declaratory judgment refers to a real and substantial dispute between parties that requires resolution. In the context of a Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums, the controversy might involve whether the insurer wrongfully waived premiums and what the implications are for both the insurer and the insured. Courts look for genuine disputes to ensure that they provide useful and actionable decisions.

A declaratory judgment in insurance is a legal determination made by a court regarding the rights and obligations of parties under an insurance policy. It provides clarity on whether certain claims are covered or denied. This type of judgment is particularly useful in cases like a Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums, where the parties need a clear resolution to proceed.

Insurance companies may request a declaratory judgment when there is uncertainty about their obligations under a policy. For instance, if they believe that coverage for a claim is not warranted, they might seek a declaration to clarify their position. This can help prevent disputes and provide a definitive answer regarding the policy terms, especially in cases of improperly waived insurance premiums.

In a Kentucky Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums, the burden of proof lies with the party seeking the judgment. This means they must present sufficient evidence to demonstrate their claim is valid and justified. Typically, the plaintiff needs to show that there exists a legal basis for the court to issue a declaration, clarifying the rights and obligations of the parties involved.