Kentucky Complaint regarding Insurer's Failure to Pay Claim

Description

How to fill out Complaint Regarding Insurer's Failure To Pay Claim?

Are you presently within a place that you need to have papers for possibly company or personal uses just about every working day? There are plenty of legal file layouts available online, but discovering ones you can rely on is not easy. US Legal Forms provides 1000s of kind layouts, just like the Kentucky Complaint regarding Insurer's Failure to Pay Claim, that happen to be created to fulfill state and federal requirements.

If you are previously familiar with US Legal Forms site and also have your account, simply log in. After that, you are able to download the Kentucky Complaint regarding Insurer's Failure to Pay Claim design.

Should you not offer an bank account and need to start using US Legal Forms, abide by these steps:

- Find the kind you need and ensure it is for your proper metropolis/state.

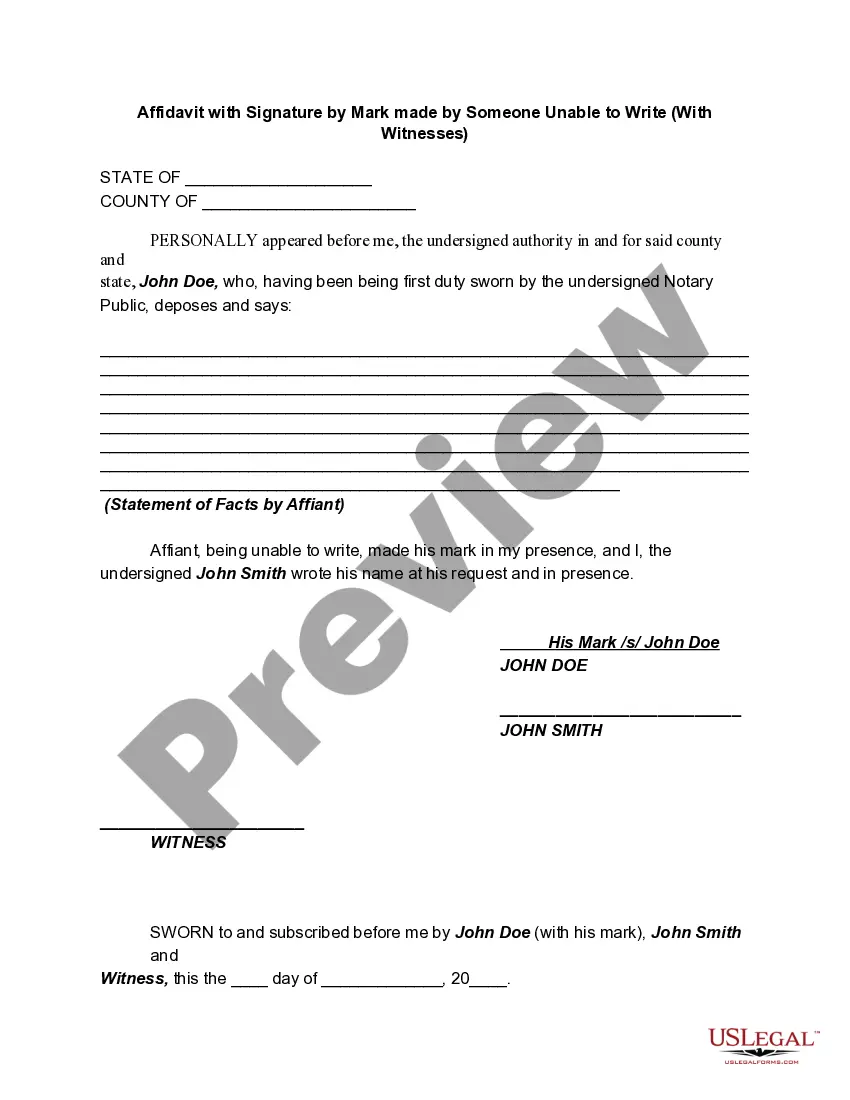

- Use the Preview button to review the form.

- See the description to ensure that you have selected the appropriate kind.

- When the kind is not what you are searching for, use the Look for discipline to discover the kind that meets your requirements and requirements.

- When you get the proper kind, simply click Buy now.

- Select the rates prepare you need, submit the required information and facts to create your money, and purchase the transaction using your PayPal or bank card.

- Choose a practical paper structure and download your copy.

Get every one of the file layouts you might have purchased in the My Forms menus. You can obtain a more copy of Kentucky Complaint regarding Insurer's Failure to Pay Claim any time, if possible. Just go through the essential kind to download or printing the file design.

Use US Legal Forms, by far the most considerable variety of legal forms, to save some time and stay away from errors. The services provides appropriately manufactured legal file layouts that you can use for a range of uses. Produce your account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

The Kentucky Department of Insurance regulates the Commonwealth's insurance market, licenses agents and other insurance professionals, monitors the financial condition of companies, educates consumers to make wise choices, and ensures Kentuckians are treated fairly in the marketplace.

Kentucky Insurance Bad Faith Laws It is one of the few states that allow first and third-party bad faith claims. Simply put, this means that you can bring a bad faith claim against your insurance company as well as against the insurance company of a defendant who may be responsible for your losses/injury.

Kentucky Commissioner of InsuranceSelection Method:Appointed by the governor with the consent of the Kentucky State SenateCurrent OfficeholderSharon ClarkOther Kentucky Executive Offices11 more rows

Insurance companies in Kentucky have at least 45 days to settle a claim and make the final payment after the claim is filed. Kentucky insurance companies have 15 days to acknowledge a claim and send paperwork and further instructions to the claimant.

If a loss requires replacement of items and the replaced items do not reasonably match in quality, color, and size, the insurer shall replace all items in the area so as to conform to a reasonably uniform appearance.

CDI enforces the insurance laws of California and has authority over how insurers and licensees conduct business in California.

State legislatures are the public policymakers that establish set broad policy for the regulation of insurance by enacting legislation providing the regulatory framework under which insurance regulators operate.

You may submit your complaint to us by mail or fax, or by using the online complaint form at our website ( ) under File a Complaint or Consumer Protection.