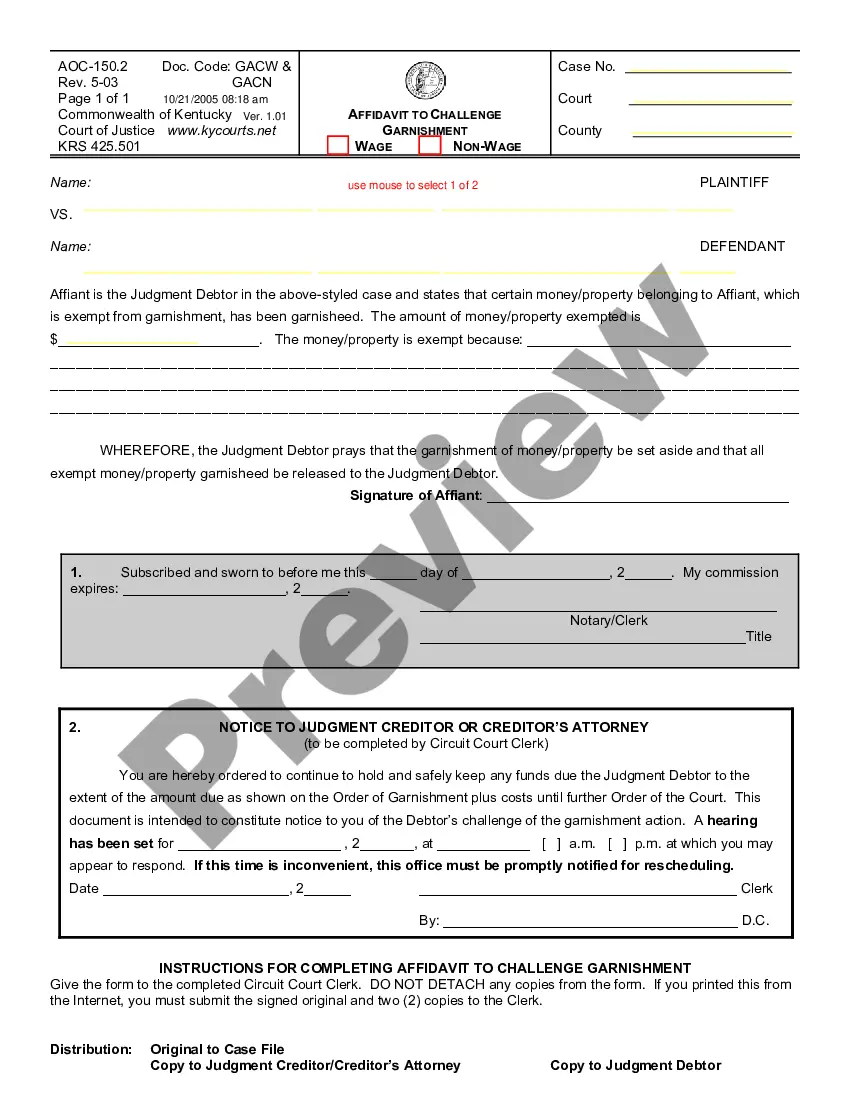

The Kentucky Affidavit to Challenge Garnishment [ ] Wage [ ] Non-Wage is a legal document used to contest the garnishment of wages or non-wage funds from a debtor’s account. The affidavit must be completed and filed with the court to successfully challenge a garnishment in Kentucky. There are two types of Kentucky Affidavit to Challenge Garnishment: Wage and Non-Wage. The Wage Affidavit is used to contest the garnishment of wages from a debtor’s employer. The Non-Wage Affidavit is used to contest the garnishment of non-wage funds, such as tax refunds, bank accounts, or other assets. The affidavit must be completed and filed with the court in order to successfully challenge the garnishment. In addition, the debtor must provide evidence to prove that the garnishment should not be enforced.

Kentucky Affidavit to Challenge Garnishment [ ] Wage [ ] Non-Wage

Description

How to fill out Kentucky Affidavit To Challenge Garnishment [ ] Wage [ ] Non-Wage?

How much time and resources do you typically allocate for creating official documentation.

There’s a larger chance to obtain such forms than to hire legal professionals or invest countless hours searching online for an appropriate template.

Download your Kentucky Affidavit to Challenge Garnishment [ ] Wage [ ] Non-Wage to your device and complete it on a printed hard copy or electronically.

Another benefit of our library is that you can access previously downloaded documents securely stored in your profile under the My documents section. Retrieve them anytime and redo your paperwork as often as necessary. Save time and energy preparing formal documents with US Legal Forms, one of the most reliable online services. Sign up with us today!

- Browse through the form details to ensure it complies with your state laws. To achieve this, review the form description or utilize the Preview option.

- If your legal template does not satisfy your requirements, find an alternative using the search bar located at the top of the page.

- If you already possess an account with us, Log In and retrieve the Kentucky Affidavit to Challenge Garnishment [ ] Wage [ ] Non-Wage.

- If not, follow the next steps.

- Click Buy now once you identify the correct template. Choose the subscription plan that best fits your needs to gain access to our library’s full features.

- Create an account and complete your subscription payment. Payments can be made via credit card or PayPal - our service ensures complete security for transactions.

Form popularity

FAQ

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673).

If you wish to stop wage garnishment in Kentucky there are several options available to you. Pay the Debt and Avoid the Suit. The best way to stop the garnishment you're experiencing in Kentucky is to pay the debt off.Appeal to the Court in Kentucky.Bankruptcy in Kentucky.Seek Legal Assistance.

A Kentucky non-wage garnishment gives your creditor permission to directly tap into your bank account, which means that they can take some or all of the money in your account.

A Kentucky non-wage garnishment gives your creditor permission to directly tap into your bank account, which means that they can take some or all of the money in your account.

While states are free to impose stricter limits, Kentucky's law is the same as federal law. On a weekly basis, the garnishment can't exceed the lesser of: 25% of your disposable earnings for that week, or. the amount by which your disposable earnings for that week surpasses 30 times the federal minimum hourly wage.