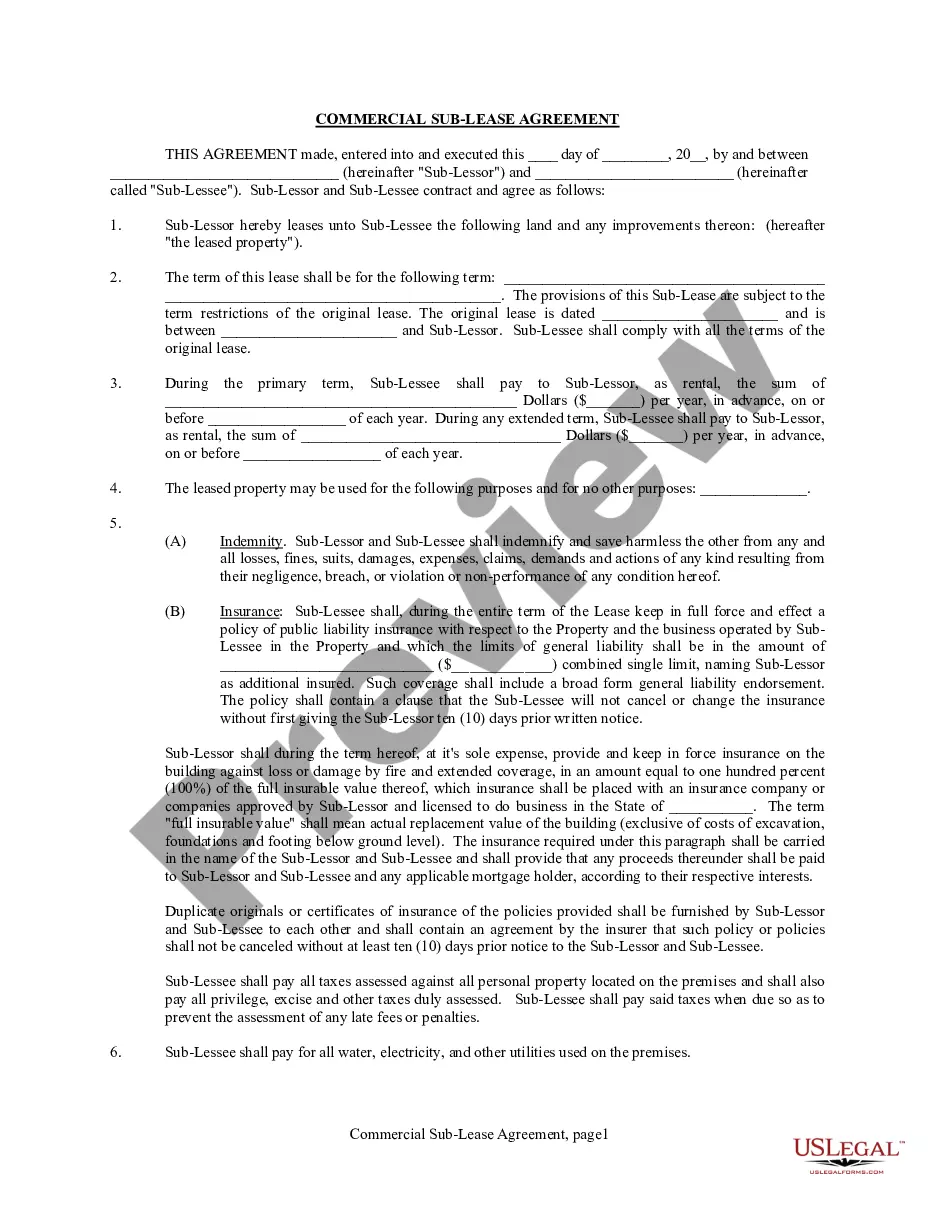

This is a commercial lease form for the State of Kentucky. It is for leasing a building for any use, such as an office. This lease is very detailed and includes provisions addressing the areas of lease term, payment of rent, later charges, utilities, condition of premises, security deposits, default, termination, right of re-entry, holdover, and many other legal clauses. Make changes to suit your needs and agreement with your lessee.

Kentucky Commercial Building or Space Lease

Description

How to fill out Kentucky Commercial Building Or Space Lease?

Searching for Kentucky Commercial Property or Space Rental documents and filling them out could be difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your region with just a few clicks.

Our attorneys prepare every document, so you only need to complete them. It truly is that easy.

You can print the Kentucky Commercial Property or Space Rental document or complete it using any online editor. Don’t stress about errors because your document can be used and sent multiple times, and printed as frequently as you desire. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's page to download the template.

- All downloaded templates are stored in My documents and are always available for future use.

- If you haven't registered yet, it’s advisable to sign up.

- To obtain an approved form, verify its relevance for your region.

- Preview the template if the option is available.

- If there's a description, review it to understand the specifics.

- Click the Buy Now button if you've found what you need.

Form popularity

FAQ

The Gross Lease. The gross lease tends to favor the tenant. The Net Lease. The net lease, however, tends to favor the landlord. The Modified Gross Lease.

Single net lease. A single net lease, or net lease, is an arrangement where the tenant pay for utilities and property taxes. Double net or NN lease. A double net or NN lease is similar. Triple net or NNN lease. Full-service gross or modified lease.

Commercial leases generally fall into one of three major categories based on how the building's operating expenses are passed on to tenants: Gross or full-service lease. You pay a flat monthly rate from which the landlord pays all operating expenses, including utilities, property taxes and maintenance.

Triple Net Lease Arguably the favorite among commercial landlords, the triple net lease, or NNN lease makes the tenant responsible for the majority of costs, including the base rent, property taxes, insurance, utilities and maintenance.

Summary. There are different types of leases, but the most common types are absolute net lease, triple net lease, modified gross lease, and full-service lease. Tenants and proprietors need to understand them fully before signing a lease agreement.

A typical commercial lease is a 5 and 5, meaning a 5 year lease, with an option to renew for another 5 years. Options usually must be exercised by writing a letter to the landlord some months before the initial lease term expires, expressly exercising the option.

The Parties & Personal Guarantees. Lease Term & Renewals. Rent Payments and Expenses. Business Protection Clauses.

The Introduction. The beginning of the lease agreement should contain the name of the landlord and tenant, as well as a statement of the agreement into which they are entering. Rent. Deposit. Taxes. Property Insurance. Utilities and Amenities. Remodeling and Improvements. Repairs and Maintenance.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.