Kansas Tax Release Authorization

Description

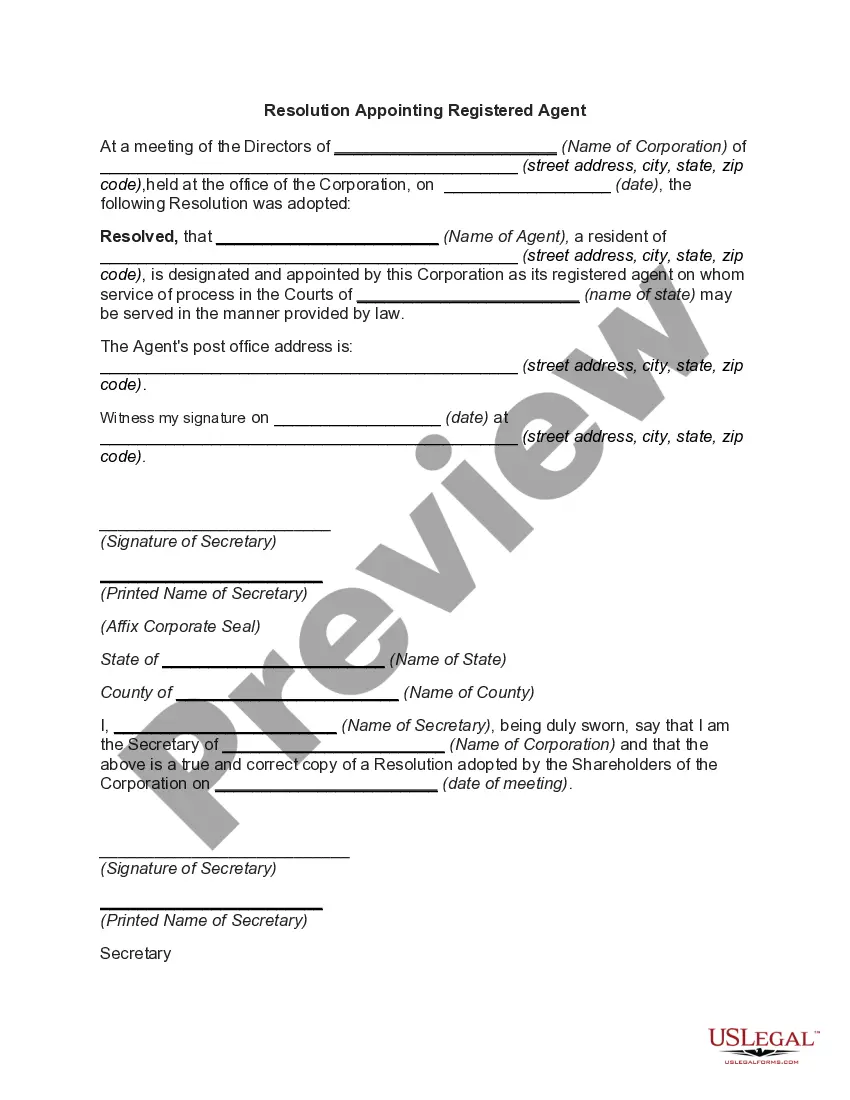

How to fill out Tax Release Authorization?

If you want to total, acquire, or print authorized file web templates, use US Legal Forms, the largest selection of authorized forms, that can be found on the web. Use the site`s simple and practical lookup to obtain the documents you will need. Different web templates for business and specific reasons are categorized by classes and states, or keywords. Use US Legal Forms to obtain the Kansas Tax Release Authorization in a couple of clicks.

In case you are currently a US Legal Forms buyer, log in for your bank account and then click the Obtain switch to have the Kansas Tax Release Authorization. You can also gain access to forms you formerly downloaded from the My Forms tab of the bank account.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form to the appropriate metropolis/land.

- Step 2. Use the Preview solution to examine the form`s information. Do not forget to learn the description.

- Step 3. In case you are unsatisfied with all the type, take advantage of the Look for industry towards the top of the display to discover other types from the authorized type template.

- Step 4. After you have found the form you will need, click the Acquire now switch. Pick the costs plan you favor and add your references to register for an bank account.

- Step 5. Approach the deal. You can utilize your charge card or PayPal bank account to complete the deal.

- Step 6. Find the structure from the authorized type and acquire it on your own gadget.

- Step 7. Total, edit and print or indicator the Kansas Tax Release Authorization.

Every authorized file template you purchase is yours forever. You have acces to every type you downloaded with your acccount. Go through the My Forms section and select a type to print or acquire once more.

Be competitive and acquire, and print the Kansas Tax Release Authorization with US Legal Forms. There are thousands of professional and state-distinct forms you can utilize for your personal business or specific needs.

Form popularity

FAQ

If you have already mailed your return, or you filed electronically, mail your payment and the voucher to: KANSAS INCOME TAX KANSAS DEPARTMENT OF REVENUE 915 SW HARRISON ST. TOPEKA, KS 66699-1000 Print your name(s), address, Social Security number(s), and the first four letters of your last name in the space provided.

If you need to change or amend an accepted Kansas State Income Tax Return for the current or previous Tax Year you need to complete Form K-40. Form K-40 is a Form used for the Tax Return and Tax Amendment. You can prepare a current Kansas Tax Amendment Form on eFile.com, however you can not submit it electronically.

(a) Any partnership or S corporation required to file a return under the Kansas income tax act may file a composite income tax return for all nonresident partners or nonresident shareholders that derive income from the partnership or S corporation.

When the IRS approves you for electronic filing of tax returns, Kansas automatically accepts you. Signature requirements for Kansas are fulfilled through IRS efile procedures. Kansas does not have a signature form.

Obtain a State of Kansas Tax Clearance Request Online - Click here to complete an application through our secure website. Return to the website the following day to retrieve your "Certificate of Tax Clearance". Applications must be submitted by 5pm Monday ? Friday in order to be available the following business day.

Kansas uses Form K-40C to file a composite return on behalf of non-resident shareholders. Open the federal tab Shareholders > Shareholder Information. Enter the code for the shareholder's resident state in the column titled State or Resident State Code.

Kansas uses Form K-40C to file a composite return on behalf of non-resident partners. There are alternative methods to achieve this. Select Composite > Select Section 1 - General - (K-40C). In line 1 - All qualifying nonresidents, input a checkmark.

Generally, if the return was completed correctly. taxpayers expecting refunds that filed electronically can expect a deposit within 10 to 14 business days. Taxpayers expecting a refund that filed using a paper form should allow at least 16 to 20 weeks to receive a refund back by mail.