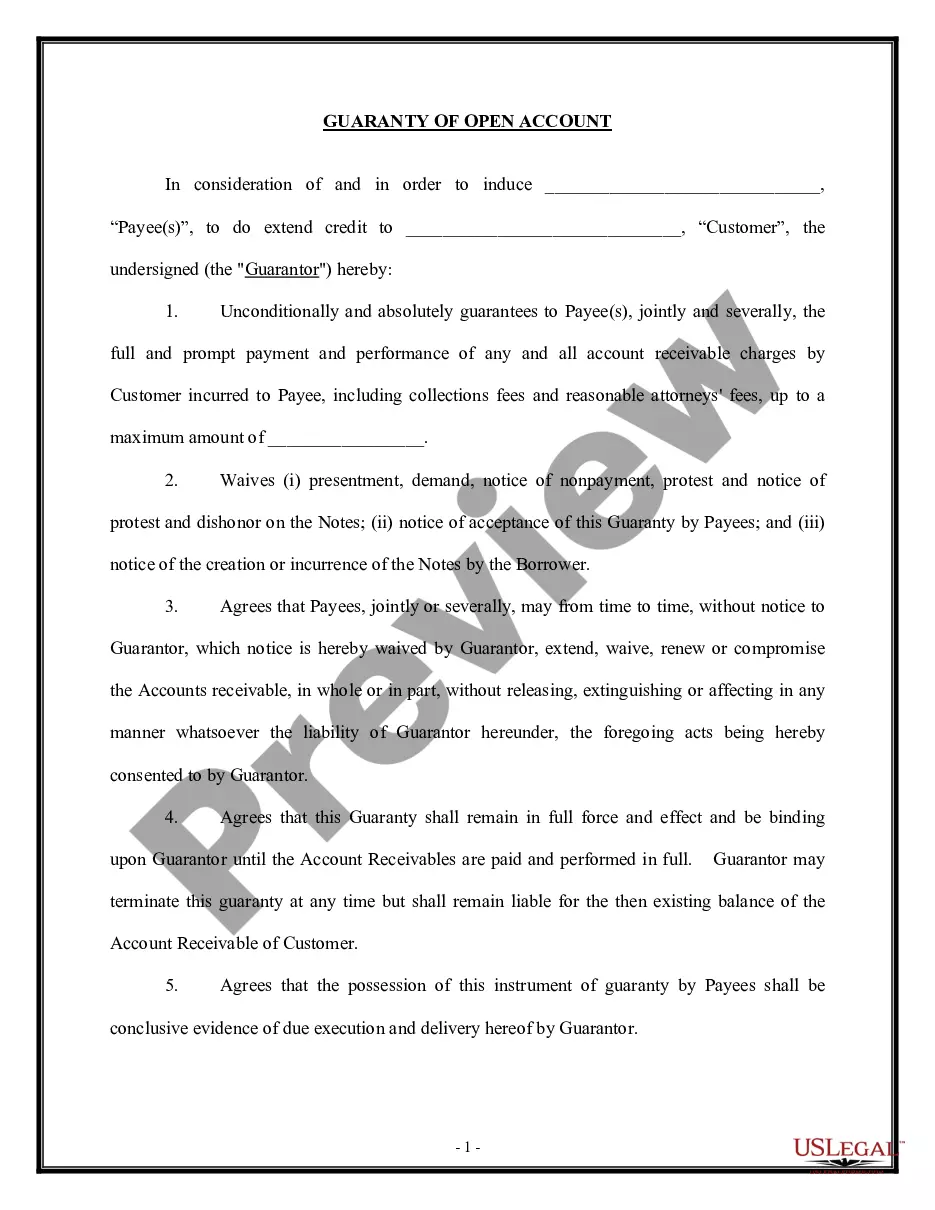

Kansas Guaranty of Payment of Open Account

Description

How to fill out Guaranty Of Payment Of Open Account?

If you are looking to finalize, obtain, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the website's simple and user-friendly search functionality to locate the documents you require.

Various forms for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you want, click the Purchase now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the purchase.Step 6. Choose the format of the legal form and download it to your device.Step 7. Complete, modify, and print or sign the Kansas Guaranty of Payment of Open Account.

Every legal document template you purchase is yours permanently. You can access every form you downloaded in your account. Visit the My documents section and select a form to print or download again. Be proactive and download, and print the Kansas Guaranty of Payment of Open Account with US Legal Forms. There are countless professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to locate the Kansas Guaranty of Payment of Open Account with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and press the Download button to access the Kansas Guaranty of Payment of Open Account.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Use the Preview feature to review the form's details. Do not forget to read the summary.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Guaranty funds are funded through multiple channels, including assessments on member insurers and fees collected from insurance premiums. These funds accumulate to create a reserve that can be tapped into when necessary—such as during insolvency cases. The Kansas Guaranty of Payment of Open Account relies on this robust structure to ensure the financial security of policyholders.

In Kansas, the insurance premium tax is 2% of the total premiums collected by insurance companies. This tax revenue contributes to state funding, which can support various financial safety nets, including the Kansas Guaranty of Payment of Open Account. By understanding this tax, consumers can appreciate the system that protects them.

The primary source of funding for guaranty funds comes from insurance premiums collected from policyholders. Insurance companies also contribute through assessments mandated by state regulations. This collaborative funding model helps ensure that the Kansas Guaranty of Payment of Open Account remains well-capitalized and capable of fulfilling its promises to consumers.

A guaranty fund is a financial mechanism designed to protect consumers from the insolvency of insurance companies. It serves as a backup system, ensuring that policyholders receive payments even if their insurer cannot meet its obligations. The Kansas Guaranty of Payment of Open Account represents this security, allowing policyholders to have peace of mind.

State guaranty associations, including those in Kansas, are regulated by state insurance departments. These departments oversee the operations and ensure that they meet established standards for consumer protection. By adhering to these regulations, the Kansas Guaranty of Payment of Open Account maintains its integrity and robustness.

The Guarantee Fund is financed primarily through assessments on member insurance companies. These companies contribute based on their market share and the amount of insurance they provide. This ensures a stable financial backing for the Kansas Guaranty of Payment of Open Account, helping to protect consumers in case of insurance company insolvency.

The Guaranty Association receives its funds through multiple channels, predominantly via member insurance company assessments and fees. These funds allow the association to support policyholders under the Kansas Guaranty of Payment of Open Account framework, especially in times of insurer insolvency. This structured funding model ensures that consumers and businesses remain protected, allowing for swift financial assistance when needed. For comprehensive information on managing guaranty associations, consider exploring resources on the uslegalforms platform.

In Kansas, insurance requirements vary based on the type of business and operations you conduct. For businesses utilizing the Kansas Guaranty of Payment of Open Account, it's essential to have general liability and possibly other specific types of coverage relevant to your industry. This coverage helps mitigate risks associated with financial transactions and ensures compliance with state regulations. You can rely on the uslegalforms platform to access tailored resources and legal forms to help meet these insurance requirements effectively.

The Kansas Health Care Prompt Payment Act is designed to ensure timely payment for health care services provided to patients. This act requires insurers to process claims quickly, aligning with the Kansas Guaranty of Payment of Open Account to support healthcare providers in maintaining their financial stability. By promoting prompt payments, the act helps prevent financial hardships for health care practitioners, allowing them to continue delivering quality care. For providers seeking reliable payment solutions, this law reinforces the importance of timely reimbursement.

The Kansas Insurance Guaranty Association (KIGA) protects policyholders and claimants in the event an insurance company becomes insolvent. By fulfilling the Kansas Guaranty of Payment of Open Account, KIGA ensures that you still receive your insurance benefits, even if your provider can no longer meet its obligations. This guarantees protection for consumers, helping to maintain trust in the insurance system. If you are concerned about insurance coverage, KIGA plays a critical role in safeguarding your financial interests.