Kansas Sample Letter for Short Sale Request to Lender

Description

How to fill out Sample Letter For Short Sale Request To Lender?

Are you currently in a situation where you require documentation for both business or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but locating reliable forms isn't easy.

US Legal Forms offers a wide array of form templates, such as the Kansas Sample Letter for Short Sale Request to Lender, which are designed to comply with state and federal regulations.

If you locate the correct form, click Get now.

Choose the pricing plan you want, enter the necessary information to create your account, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Kansas Sample Letter for Short Sale Request to Lender at any time if necessary. Just select the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legitimate forms, to save time and prevent errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kansas Sample Letter for Short Sale Request to Lender template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct state/region.

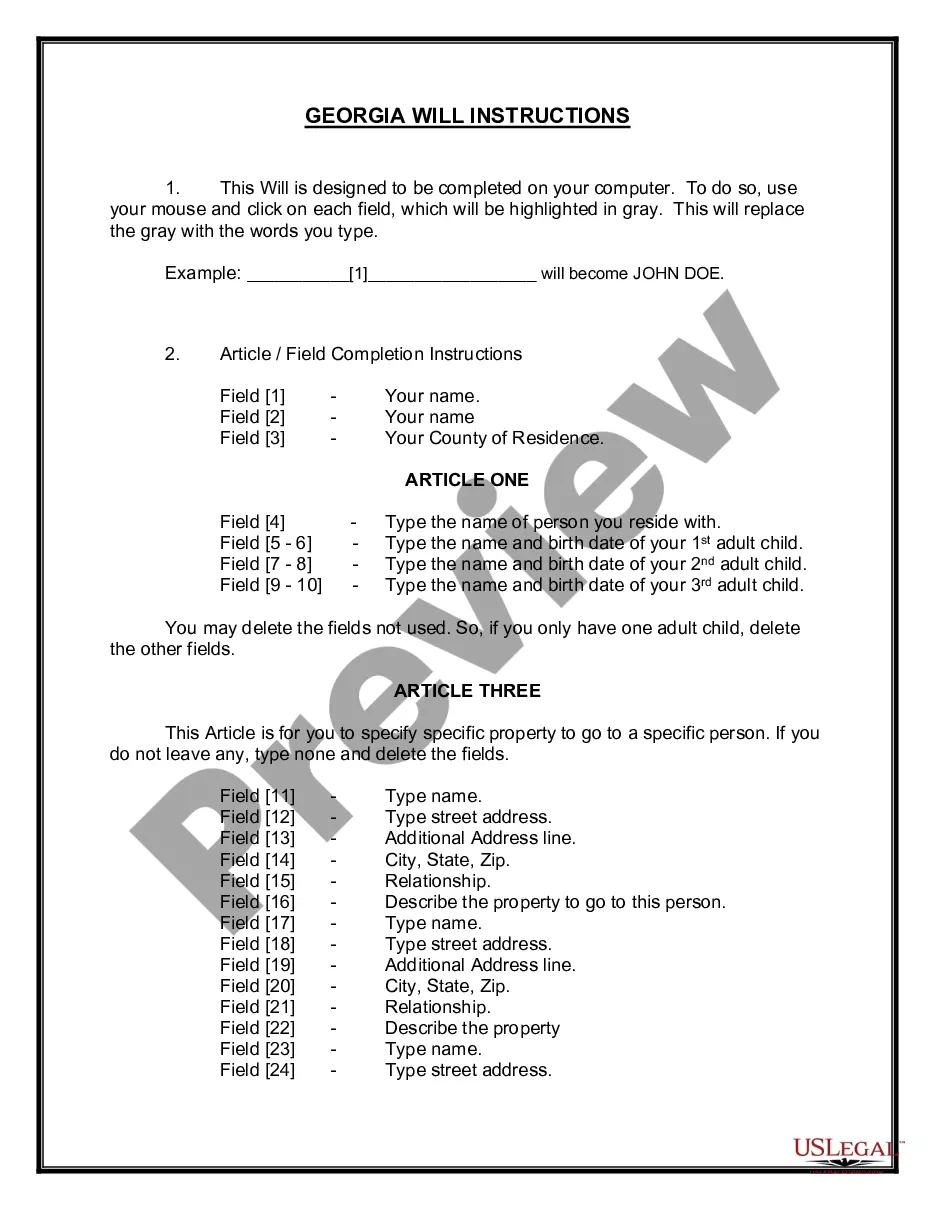

- Use the Review option to examine the form.

- Read the description to confirm you have selected the correct form.

- If the form isn't what you're looking for, utilize the Search field to find a form that meets your requirements.

Form popularity

FAQ

In your hardship letter for a short sale request, avoid including emotionally charged statements or overly personal details that do not directly relate to your financial situation. Additionally, steer clear of blaming others or presenting false information, as these can undermine your credibility. Instead, focus on honest explanations of your current circumstances, using the Kansas Sample Letter for Short Sale Request to Lender as a structured guide.

A short sale approval letter is a formal document from the lender that grants permission for a homeowner to sell their property for less than the remaining mortgage balance. This letter outlines the terms of the sale and any conditions that must be met. It is essential for buyers and sellers to have this document to finalize the transaction. Integrating a Kansas Sample Letter for Short Sale Request to Lender can help ease the process of working towards obtaining this crucial letter.

To write a letter to a mortgage company for hardship, start by outlining your financial situation clearly and honestly. Include relevant details about your income, expenses, and the reasons for your financial strain. Make sure to request specific assistance, such as consideration for a short sale. Using a Kansas Sample Letter for Short Sale Request to Lender can provide a useful template to help structure your letter effectively.

A short sale can be advantageous for buyers, as these properties often come with lower prices compared to market value. Buyers can negotiate better terms, and the lender may be more flexible, given the circumstances. However, buyers should be aware that the process can be lengthy and complex. It's beneficial to utilize tools like a Kansas Sample Letter for Short Sale Request to Lender to expedite communication with lenders.

Short sale approval is the lender's agreement to allow a homeowner to sell their property for less than the amount owed on the mortgage. This process involves the lender reviewing the homeowner's financial situation to determine eligibility. A successful negotiation can ease the burden on the homeowner while helping the lender recover some of the owed amount. Accessing a Kansas Sample Letter for Short Sale Request to Lender can streamline the communication needed for this process.

To ask for a short sale, you need to reach out to your lender and formally state your desire to pursue this option. Prepare your financial documents and craft a clear Kansas Sample Letter for Short Sale Request to Lender that explains your circumstances and motivations. This letter should include a request for consideration of your short sale and any supporting evidence that reinforces your case.

Short sales can have a negative impact on your credit score, but often less severe than a foreclosure. While the short sale will show on your credit report, it reflects your efforts to resolve your financial difficulties responsibly. Utilizing a Kansas Sample Letter for Short Sale Request to Lender can help present your situation transparently and positively to lenders, possibly minimizing the credit score impact.

When offering on a short sale, you may propose an amount lower than the outstanding mortgage balance. However, the offer must be reasonable and supported by comparable sales in the area. A well-crafted Kansas Sample Letter for Short Sale Request to Lender can articulate your offer effectively, explaining your reasons and justifying your proposed amount to enhance the lender's willingness to consider it.

To request a short sale, you should begin by contacting your lender to discuss your financial situation. It's essential to prepare a comprehensive financial statement that outlines your income, expenses, and reasons for the short sale. Additionally, using a Kansas Sample Letter for Short Sale Request to Lender can help streamline your request, clearly presenting your case and intentions to the lender.