Kansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

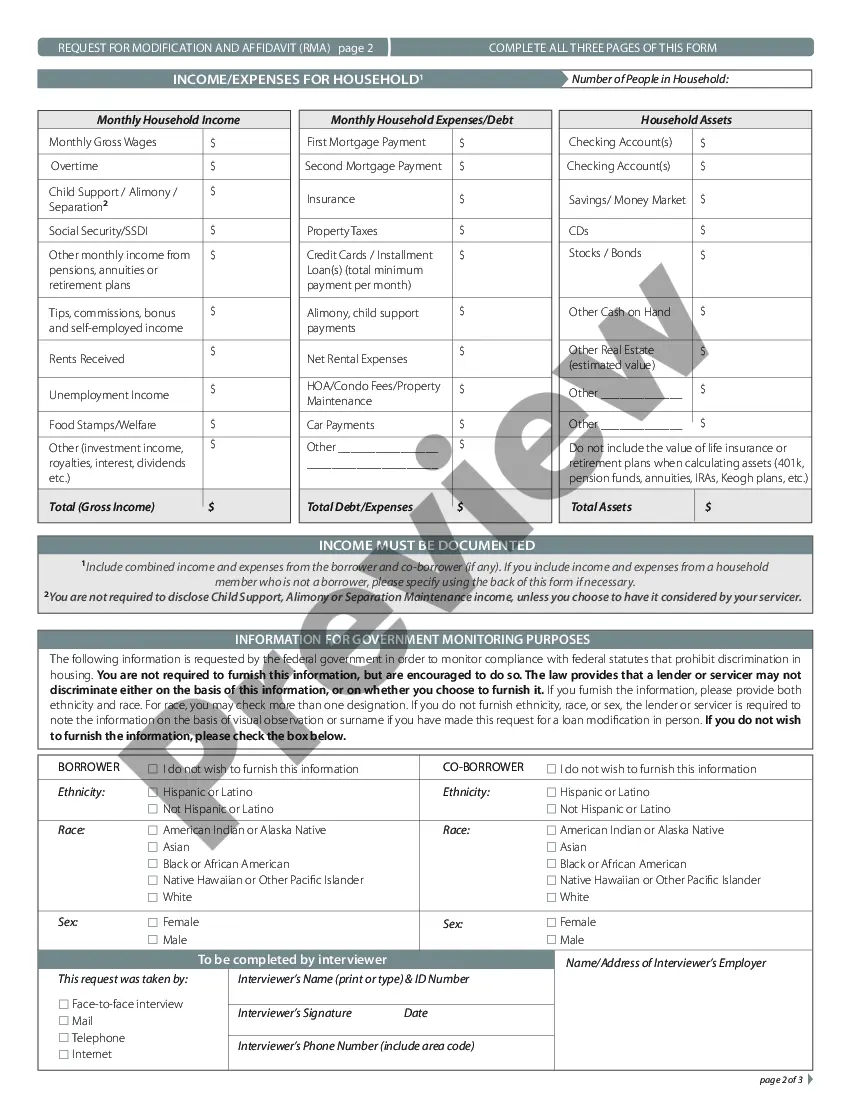

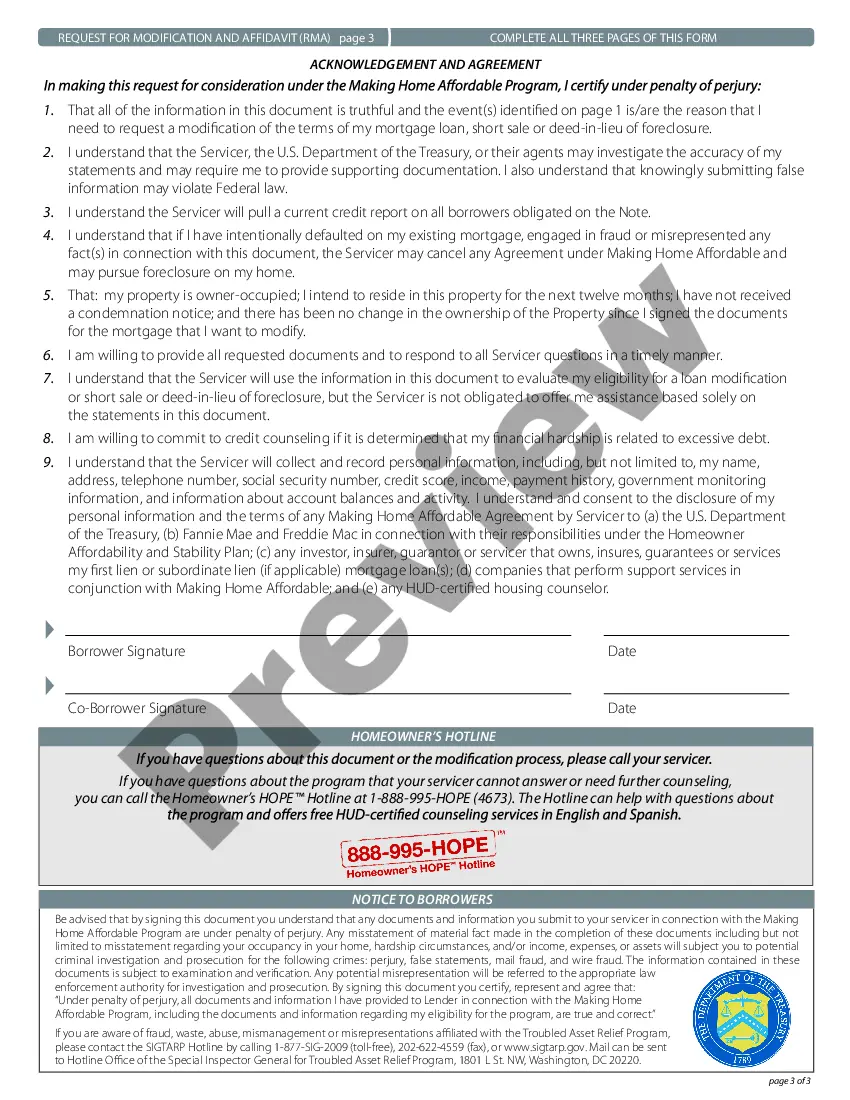

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or create.

Utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most current versions of forms such as the Kansas Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP in just seconds.

If you are already a member, Log In and obtain the Kansas Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP from the US Legal Forms library. The Download option will appear on every form you view. You will have access to all previously downloaded forms in the My documents tab of your account.

Make edits. Fill out, modify, and print and sign the downloaded Kansas Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP.

Every template you add to your account has no expiration date and is yours indefinitely. So, if you need to download or print another copy, simply go to the My documents section and click on the form you need. Access the Kansas Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP with US Legal Forms, one of the most substantial collections of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal requirements.

- If you want to use US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you’ve selected the correct form for your city/county. Click on the Review option to examine the form's content.

- Check the form description to confirm you have selected the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now option. Then, select the pricing plan you prefer and enter your information to register for an account.

- Complete the purchase. Use your credit card or PayPal account to finish the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

A loan modification request is a formal appeal made by a borrower to their lender to alter the terms of an existing mortgage agreement. This process, particularly under the Kansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, can help borrowers secure more manageable payment terms. By modifying their loan, borrowers may reduce their interest rate, extend the loan period, or switch from an adjustable-rate mortgage to a fixed-rate mortgage. Utilizing tools from platforms like USLegalForms can simplify this process, guiding you step by step through the necessary documentation.

Applying for a loan modification typically involves submitting an application along with documentation of your financial situation to your lender. It’s crucial to provide accurate and up-to-date information to facilitate the process. To enhance your experience, consider the Kansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP as a dedicated way to seek beneficial modifications.

HAMP modification is the process of altering the terms of your mortgage through the Home Affordable Modification Program. It focuses on making your loan more affordable by potentially lowering interest rates or extending the loan term. If you're in Kansas, utilizing the Kansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can facilitate this modification in a structured manner.

HAMP stands for Home Affordable Modification Program, designed to reduce mortgage payments for struggling homeowners. It offers a structured way to modify existing loans to make them more affordable. If you find yourself facing financial hardship, the Kansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is a meaningful resource to consider.

To request a mature modification on your loan, start by gathering necessary financial documents and then contacting your lender. Be clear about your needs, and inquire about the steps involved. Using the Kansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can streamline this process, making it easier for you to achieve a modification.

As of now, HAMP has officially concluded, which means new applications won't be accepted after its termination. However, some loan modification options may still exist. If you are looking for support, the Kansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP could uncover alternative solutions available to you in 2025.

A HAMP loan modification refers to adjustments made to a mortgage through the Home Affordable Modification Program. It specifically aims to lower monthly payments and enhance the borrower's ability to keep their home. If you're exploring your options, the Kansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can guide you toward a more manageable mortgage.

A mortgage loan modification can be a beneficial option if you are facing financial difficulties. It invites potential monthly payment adjustments that align better with your financial situation. If you are considering a Kansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, this could help you avoid foreclosure and maintain homeownership.

Qualifying for a loan modification requires meeting specific criteria outlined in the Kansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Generally, you must show proof of financial hardship, such as loss of income or increased expenses, and your mortgage must be eligible under the program's guidelines. Additionally, you should be current or just behind on your mortgage payments to be considered for assistance. By reviewing these criteria closely, you can better prepare your application and increase your chances of success.

To apply for a loan modification, start by gathering your financial documents and then complete the Kansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP application. You should provide your lender with information about your income, expenses, and any hardship you've experienced. Once submitted, your lender will review your application and notify you of their decision. Tools available on platforms like US Legal Forms can simplify this process and ensure all necessary paperwork is completed correctly.