Kansas Complex Will - Income Trust for Spouse

Description

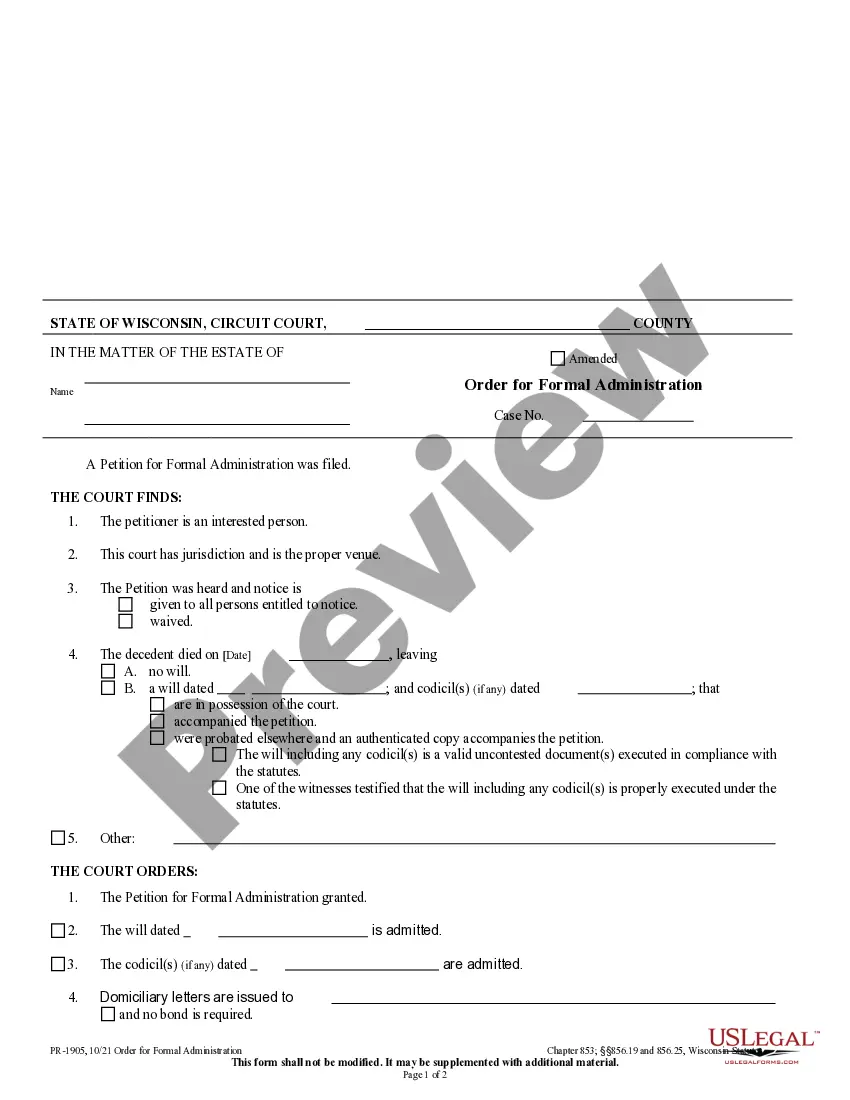

How to fill out Complex Will - Income Trust For Spouse?

If you need to complete, down load, or print legitimate file layouts, use US Legal Forms, the largest variety of legitimate varieties, which can be found on the Internet. Utilize the site`s basic and practical lookup to find the documents you require. A variety of layouts for enterprise and personal reasons are sorted by groups and says, or search phrases. Use US Legal Forms to find the Kansas Complex Will - Income Trust for Spouse in a handful of clicks.

If you are presently a US Legal Forms buyer, log in to your profile and click the Acquire button to find the Kansas Complex Will - Income Trust for Spouse. You can also access varieties you earlier downloaded from the My Forms tab of your respective profile.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for your appropriate area/land.

- Step 2. Take advantage of the Review option to look over the form`s articles. Never neglect to read through the description.

- Step 3. If you are not happy together with the type, use the Look for industry on top of the monitor to find other types of your legitimate type format.

- Step 4. Once you have located the form you require, click the Purchase now button. Opt for the rates program you favor and include your credentials to sign up for an profile.

- Step 5. Method the deal. You should use your charge card or PayPal profile to complete the deal.

- Step 6. Select the format of your legitimate type and down load it on your own gadget.

- Step 7. Total, modify and print or indicator the Kansas Complex Will - Income Trust for Spouse.

Each legitimate file format you purchase is your own permanently. You have acces to every single type you downloaded with your acccount. Go through the My Forms portion and decide on a type to print or down load once again.

Remain competitive and down load, and print the Kansas Complex Will - Income Trust for Spouse with US Legal Forms. There are millions of professional and state-certain varieties you can utilize for the enterprise or personal requirements.

Form popularity

FAQ

Disadvantages. Surviving Spouse's Decision: The effectiveness of a Disclaimer Trust relies on the surviving spouse's decision to disclaim their inheritance. If the surviving spouse chooses not to disclaim their inheritance, the potential tax and asset protection benefits of the Disclaimer Trust may not be realized.

If the trust was established during the marriage, then it is marital property, and you stand a strong chance of getting access to those funds. If the trust was established before the marriage, it is separate property, and you will find it much more difficult to access this asset.

The law considers inherited property to be a personal gift to the recipient and a spouse or domestic partner has no claim to it. When couples divorce, the inherited property generally stays with the person who inherited it. But inherited property must retain its character as separate throughout the marriage.

Many couples want to leave all trust property to the survivor. If you choose that option, we'll insert your spouse or partner's name (entered earlier) as beneficiary of all your trust property.

If the person who dies was married and has a surviving spouse, the entire estate generally passes over to this spouse if there are no children from the marriage. If a spouse and children survive the deceased, the estate's assets are divided in half equally between the spouse and the surviving children.

Each spouse's Will leaves their estate to the surviving spouse. In addition, it directs that if the surviving spouse were to disclaim any assets, then those assets found can be used to fund a Disclaimer Trust.

A marital disclaimer trust has provisions (usually contained in a will) that allow a surviving spouse to leave assets in a trust for the benefit of their spouse by disclaiming ownership of a portion of the estate that the survivor would have inherited after the death of the first spouse.

A disclaimer trust is a type of trust that contains embedded provisions, usually included in a will, allowing a surviving spouse to put specific assets under the trust by disclaiming ownership of a portion of the estate. Disclaimed property interests are then transferred to the trust, without being taxed.

Under Kansas law, property you inherit or receive as a gift, even if acquired during the marriage, is considered separate property not subject to division of assets with your spouse during a divorce.

Part of your trust may be marital property. Marital property is subject to equitable distribution or division in a divorce. This means that your spouse could be entitled to part of the trust's value. In contrast, all, or part, of your trust may be separate property.