Kansas Complex Will - Maximum Unified Credit to Spouse

Description

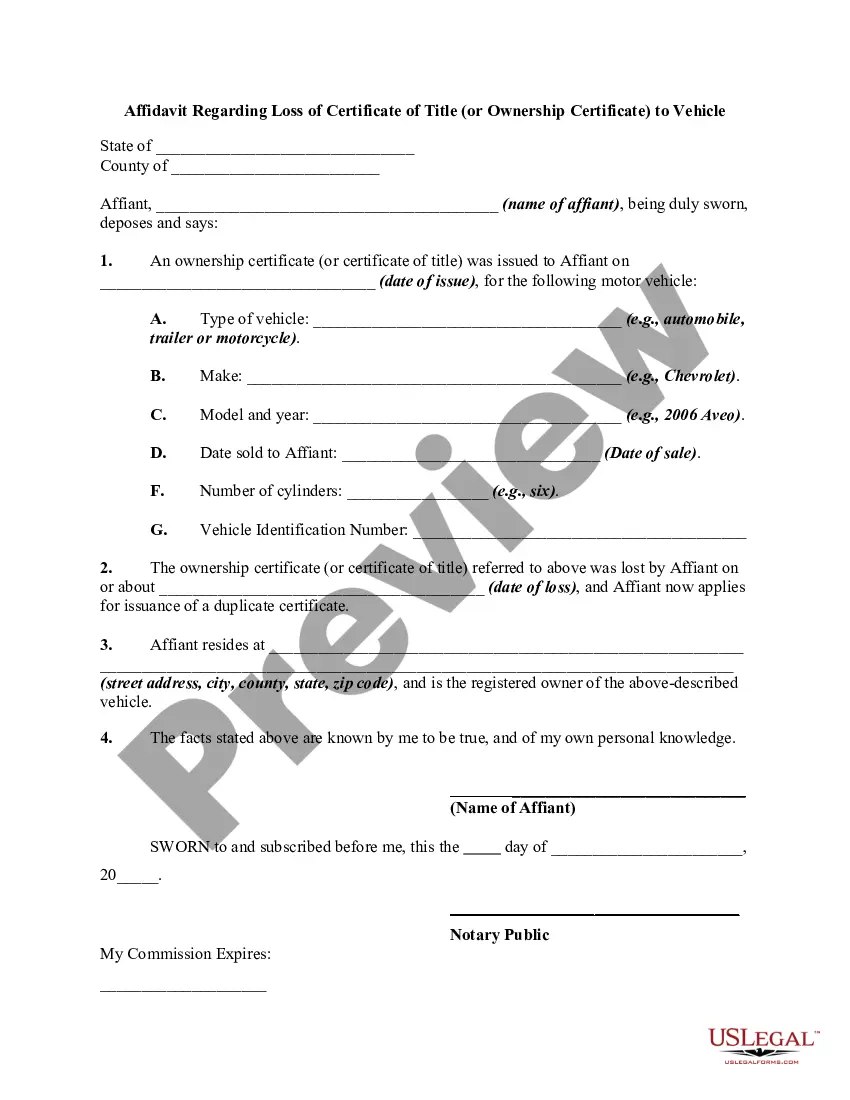

How to fill out Complex Will - Maximum Unified Credit To Spouse?

It is possible to devote time on-line trying to find the authorized file web template which fits the state and federal requirements you need. US Legal Forms supplies thousands of authorized forms that are examined by specialists. You can actually acquire or print out the Kansas Complex Will - Maximum Unified Credit to Spouse from my support.

If you already have a US Legal Forms bank account, you can log in and click on the Acquire button. After that, you can comprehensive, change, print out, or signal the Kansas Complex Will - Maximum Unified Credit to Spouse. Each authorized file web template you acquire is the one you have permanently. To have one more duplicate for any obtained type, proceed to the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms website the very first time, adhere to the simple recommendations beneath:

- First, ensure that you have selected the proper file web template for that area/metropolis of your choosing. Look at the type outline to ensure you have picked the right type. If accessible, utilize the Preview button to search from the file web template too.

- If you would like discover one more model of the type, utilize the Search field to find the web template that fits your needs and requirements.

- Upon having found the web template you want, click Purchase now to continue.

- Choose the prices plan you want, type your references, and register for a merchant account on US Legal Forms.

- Complete the deal. You can utilize your Visa or Mastercard or PayPal bank account to purchase the authorized type.

- Choose the formatting of the file and acquire it to the device.

- Make modifications to the file if possible. It is possible to comprehensive, change and signal and print out Kansas Complex Will - Maximum Unified Credit to Spouse.

Acquire and print out thousands of file web templates making use of the US Legal Forms web site, that provides the largest assortment of authorized forms. Use specialist and status-specific web templates to handle your business or personal demands.

Form popularity

FAQ

Spousal Planning As stated, each person has a unified credit. This means that each spouse in a marriage has a unified credit and that by using both of those credits a married couple may exempt from transfer taxes a marital estate worth up to $10.86 million.

The 2023 gift tax limit is $17,000. For married couples, the limit is $17,000 each, for a total of $34,000. This amount, formally called the annual gift tax exclusion, is the maximum amount you can give a single person without reporting it to the IRS.

The unified tax credit provides every American taxpayer with a set amount that they can gift during their lifetime or pass on as part of their estate. That amount will be exempt from gift and estate taxes.

The unified credit in 2023 will be $12,920,000, up from $12,060,000 in 2022. Since the credit can be shared between spouses, when used correctly, a married couple can transfer up to a combined $25,840,000 without incurring gift or estate tax.

What Is Maximum Unified Credit? The current maximum unified credit for 2022 is standing at $12.06 million. This is up from $11.7 million in 2021.

Conclusion. The unified estate and gift tax exclusions are at all-time high levels. The exclusions are set to go back to $5-7 Million depending on inflation in 2026, at which point your ability to save on estate taxes will be greatly reduced (ending December 31, 2025).

Spousal Planning As stated, each person has a unified credit. This means that each spouse in a marriage has a unified credit and that by using both of those credits a married couple may exempt from transfer taxes a marital estate worth up to $10.86 million.

The unified credit in 2023 will be $12,920,000, up from $12,060,000 in 2022. Since the credit can be shared between spouses, when used correctly, a married couple can transfer up to a combined $25,840,000 without incurring gift or estate tax. This represents an increase of $1,720,000 from 2022 to 2023.