Kansas Proposed amendment to the restated certificate of incorporation to authorize preferred stock

Description

How to fill out Proposed Amendment To The Restated Certificate Of Incorporation To Authorize Preferred Stock?

If you want to comprehensive, acquire, or print out lawful record themes, use US Legal Forms, the most important variety of lawful kinds, which can be found on the web. Use the site`s simple and easy convenient search to discover the papers you need. Different themes for enterprise and individual purposes are categorized by groups and says, or key phrases. Use US Legal Forms to discover the Kansas Proposed amendment to the restated certificate of incorporation to authorize preferred stock within a few clicks.

If you are presently a US Legal Forms client, log in to your accounts and click on the Obtain option to get the Kansas Proposed amendment to the restated certificate of incorporation to authorize preferred stock. Also you can entry kinds you earlier saved in the My Forms tab of the accounts.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have selected the shape for your right town/land.

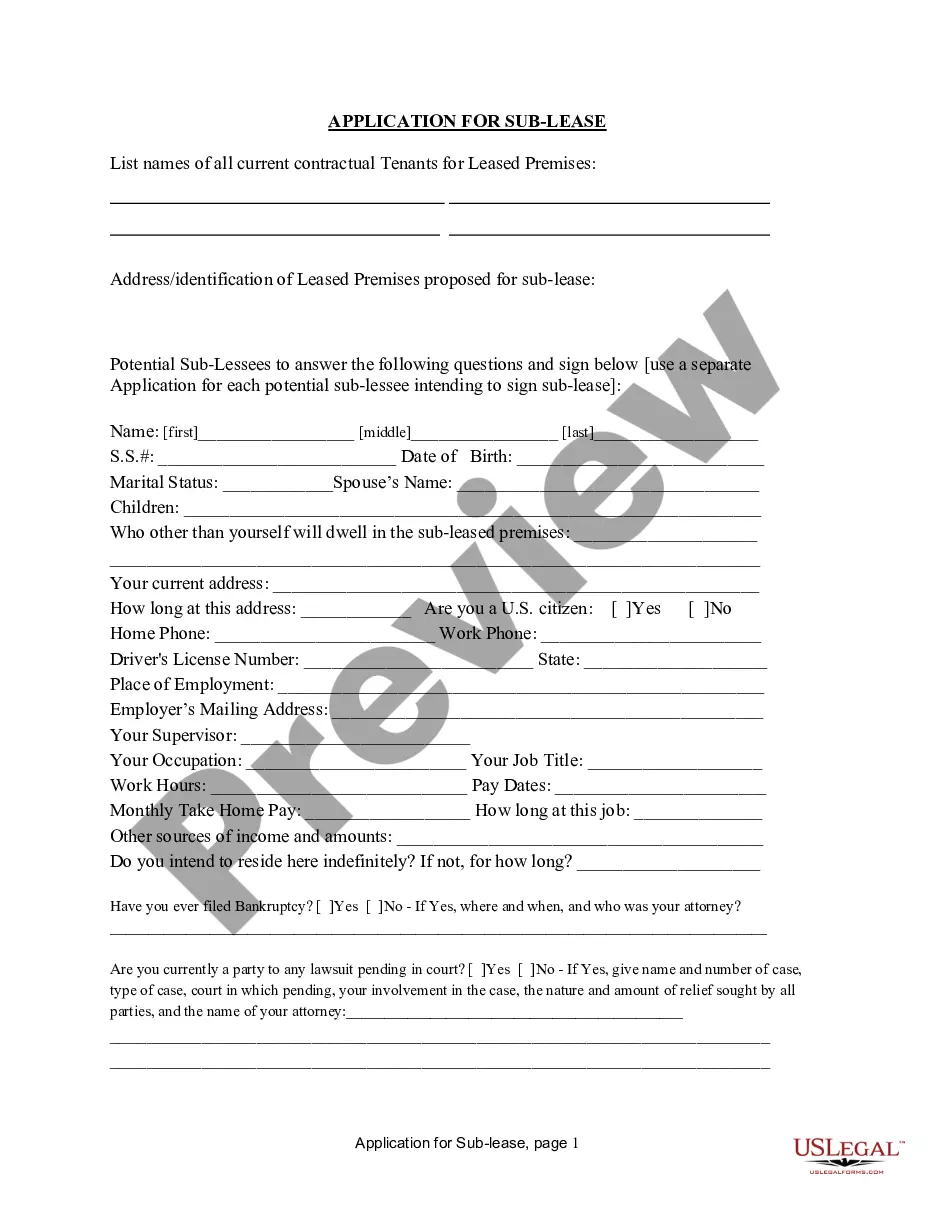

- Step 2. Make use of the Review choice to check out the form`s articles. Don`t overlook to see the explanation.

- Step 3. If you are not satisfied together with the develop, utilize the Research field on top of the display screen to discover other models in the lawful develop design.

- Step 4. Upon having located the shape you need, select the Buy now option. Opt for the pricing plan you like and add your references to register for an accounts.

- Step 5. Procedure the transaction. You may use your Мisa or Ьastercard or PayPal accounts to complete the transaction.

- Step 6. Select the format in the lawful develop and acquire it on your device.

- Step 7. Comprehensive, revise and print out or sign the Kansas Proposed amendment to the restated certificate of incorporation to authorize preferred stock.

Each and every lawful record design you get is your own eternally. You may have acces to each develop you saved in your acccount. Go through the My Forms area and select a develop to print out or acquire yet again.

Contend and acquire, and print out the Kansas Proposed amendment to the restated certificate of incorporation to authorize preferred stock with US Legal Forms. There are many skilled and state-certain kinds you can use for the enterprise or individual requirements.

Form popularity

FAQ

To amend you Kansas articles of incorporation, you can file by mail, fax, or online. To amend your Kansas articles of incorporation online, visit the Kansas.gov Business Center website. You get there by going to the SOS website and clicking on ?Business Filing Center.? Then you can choose to file the amendment.

Local and foreign entities seeking to establish a business in the Philippines are required to submit documents to the Securities and Exchange Commission (SEC) to secure a Certificate of Incorporation, a document that grants juridical existence to an enterprise and allows it to legally engage in business in the ...

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

While most states call this document articles of incorporation, some, including Delaware and New York, refer to it as a certificate of incorporation. Although the title of the document may vary, the content of the document is generally the same.

Generally, the incorporator will be one of the business owners. You can, however, hire a business attorney to prepare the articles?that attorney then assumes the role of the incorporator.

Corporation defined. - A corporation is an artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence.

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

The Articles of Incorporation states the name, purpose, place of office, incorporators, capital stock, and term of the Company upon its establishment. The By-Laws outline the rules on annual and special meetings, voting, quorum, notice of meeting and auditors and inspectors of election.