Rhode Island Terms for Private Placement of Series Seed Preferred Stock

Description

How to fill out Terms For Private Placement Of Series Seed Preferred Stock?

It is possible to invest hrs online looking for the lawful file design which fits the state and federal demands you will need. US Legal Forms offers a large number of lawful forms which are analyzed by professionals. It is possible to obtain or produce the Rhode Island Terms for Private Placement of Series Seed Preferred Stock from your support.

If you already possess a US Legal Forms accounts, it is possible to log in and click on the Obtain option. Next, it is possible to total, change, produce, or signal the Rhode Island Terms for Private Placement of Series Seed Preferred Stock. Every lawful file design you acquire is yours forever. To have another version associated with a acquired kind, check out the My Forms tab and click on the related option.

If you use the US Legal Forms website initially, keep to the easy guidelines beneath:

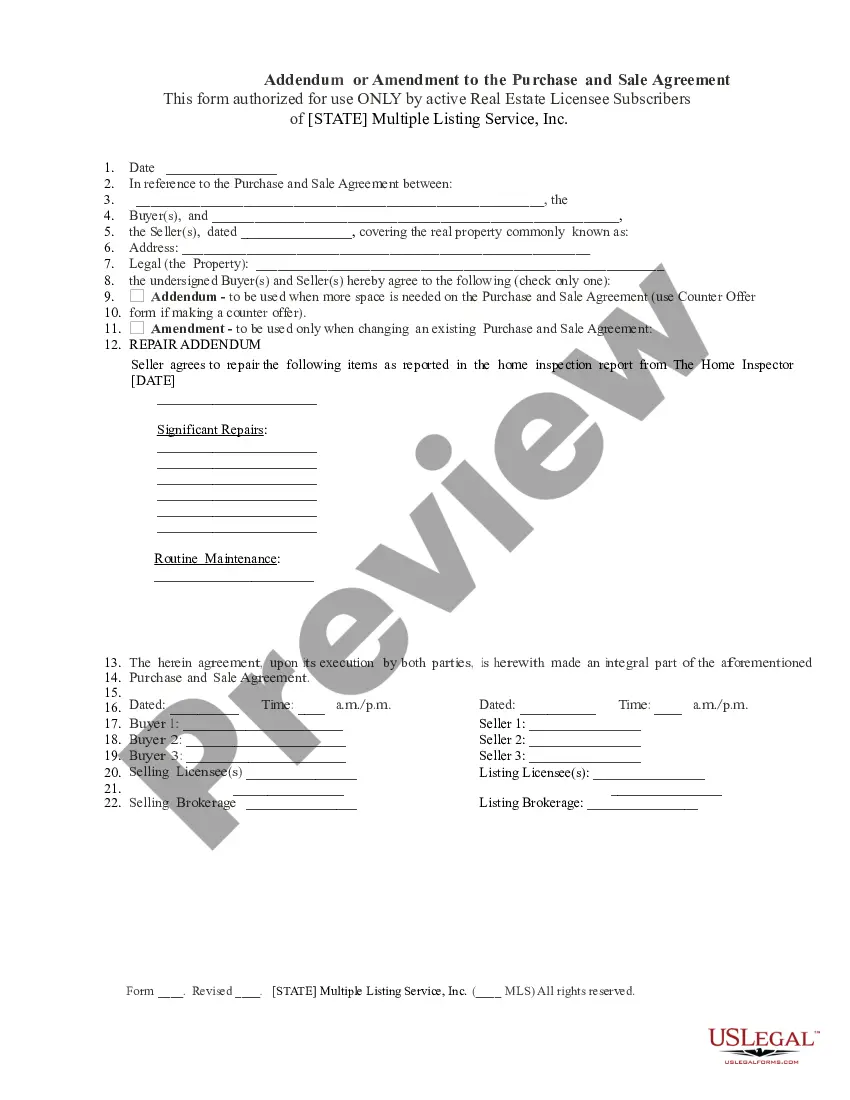

- Initial, make certain you have selected the best file design to the county/town that you pick. Browse the kind explanation to make sure you have picked out the proper kind. If offered, make use of the Preview option to look from the file design as well.

- If you want to find another variation from the kind, make use of the Look for industry to get the design that suits you and demands.

- Once you have found the design you want, just click Get now to continue.

- Choose the costs strategy you want, type in your references, and register for a merchant account on US Legal Forms.

- Complete the deal. You can use your charge card or PayPal accounts to pay for the lawful kind.

- Choose the structure from the file and obtain it to the product.

- Make changes to the file if possible. It is possible to total, change and signal and produce Rhode Island Terms for Private Placement of Series Seed Preferred Stock.

Obtain and produce a large number of file layouts making use of the US Legal Forms web site, that offers the largest selection of lawful forms. Use expert and condition-distinct layouts to deal with your business or personal requires.

Form popularity

FAQ

A private placement is a security that's sold to an investor. Some common examples of private placements include: Real Estate Investment Trusts (REITs) Non-Traded REITs.

A private placement is an offering of unregistered securities to a limited pool of investors. In a private placement, a company sells shares of stock in the company or other interest in the company, such as warrants or bonds, in exchange for cash.

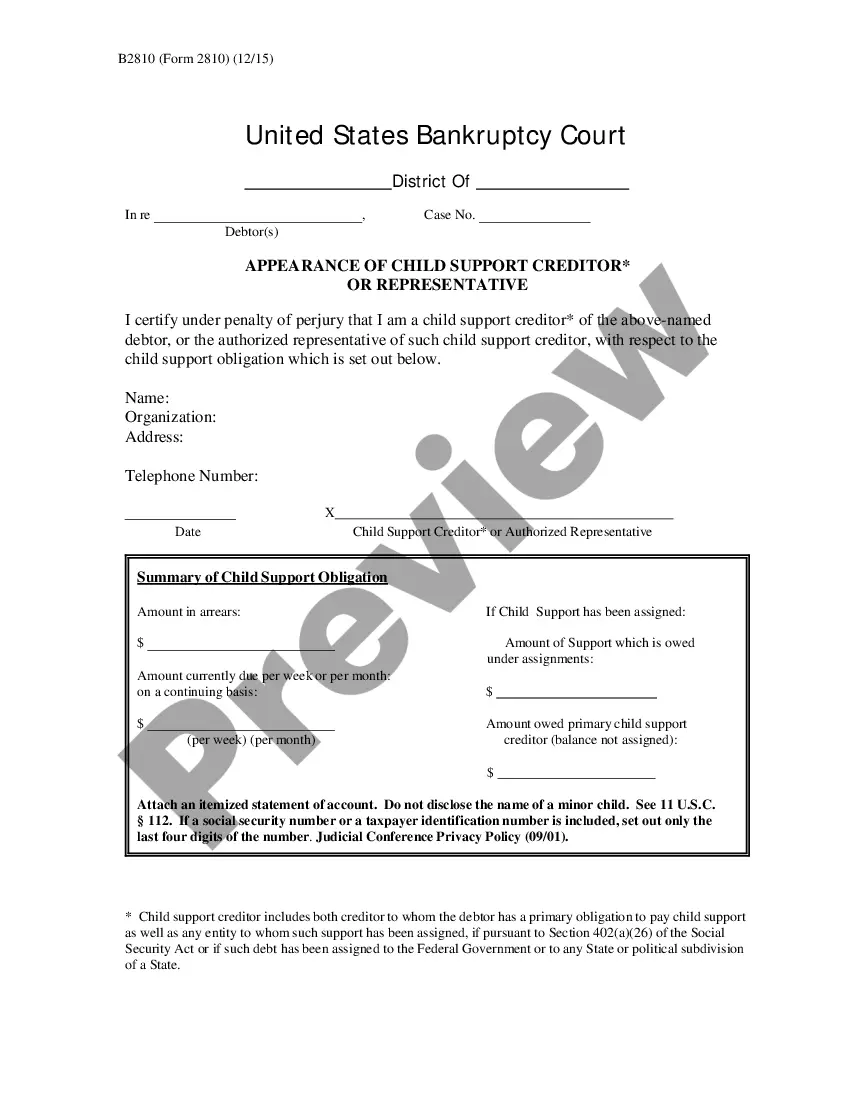

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

What Is a Private Placement? A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

A privately owned business can issue restricted preferred shares through a private placement. By this means, the company avoids going public and does not have to register the shares with the Securities and Exchange Commission.

Private placement is typically done at a negotiated price, while preferential allotment is typically done at a discount to the market price. Private placement is generally considered to be less risky than a public offering, while preferential allotment is considered to be more risky than a rights issue.

Advantages of private placement One major advantage of private placement is that the issuer isn't subject to the SEC's strict regulations for a typical public offering. With a private placement, the issuing company isn't subject to the same disclosure and reporting requirements as a publicly offered bond.

Public Offering is one of the methods of selling securities to general public where there are large number of investors. While, Private Placement is one of the methods of selling securities privately or directly to a few group of individual investors or institutional investors.