Kansas Approval of extension of management services agreement

Description

How to fill out Approval Of Extension Of Management Services Agreement?

Are you presently in a position that you need to have files for either business or person reasons virtually every working day? There are tons of authorized papers templates available on the net, but locating kinds you can trust is not simple. US Legal Forms gives a large number of form templates, much like the Kansas Approval of extension of management services agreement, that happen to be published to fulfill state and federal specifications.

If you are currently acquainted with US Legal Forms web site and get an account, simply log in. Next, you are able to download the Kansas Approval of extension of management services agreement design.

Should you not come with an bank account and need to begin to use US Legal Forms, abide by these steps:

- Discover the form you need and make sure it is to the correct metropolis/region.

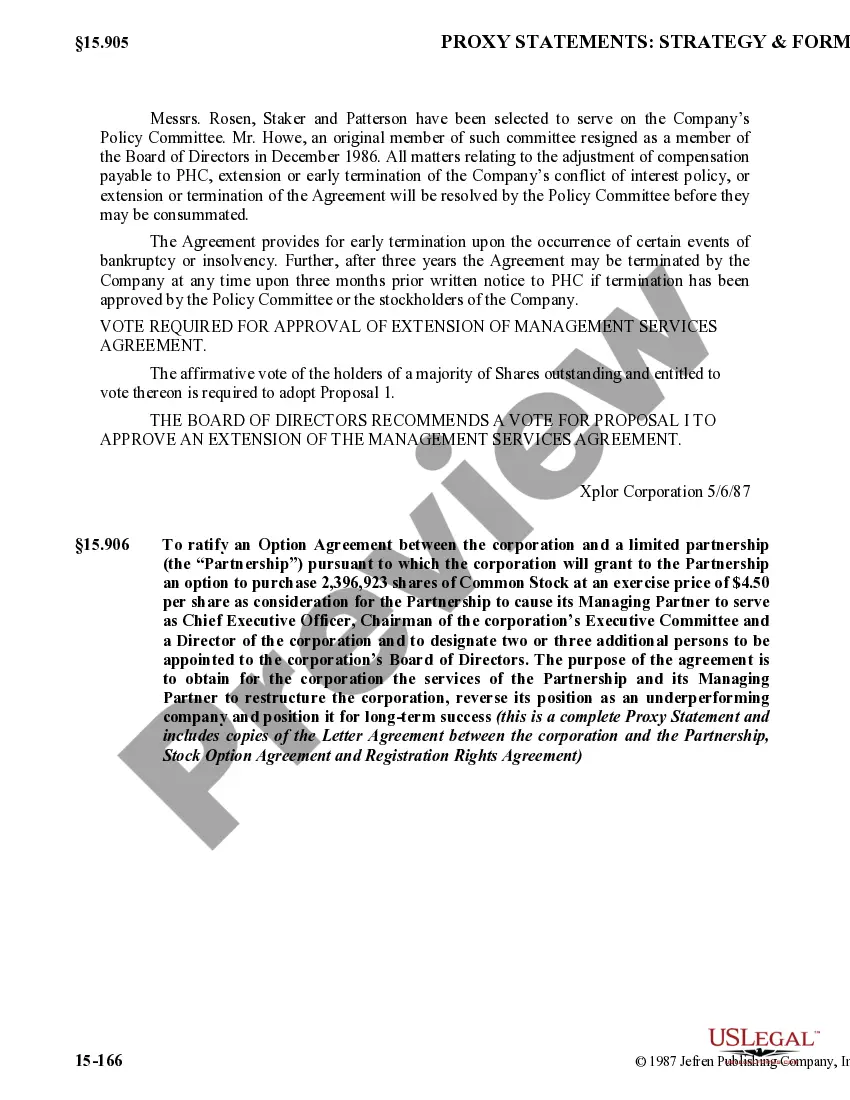

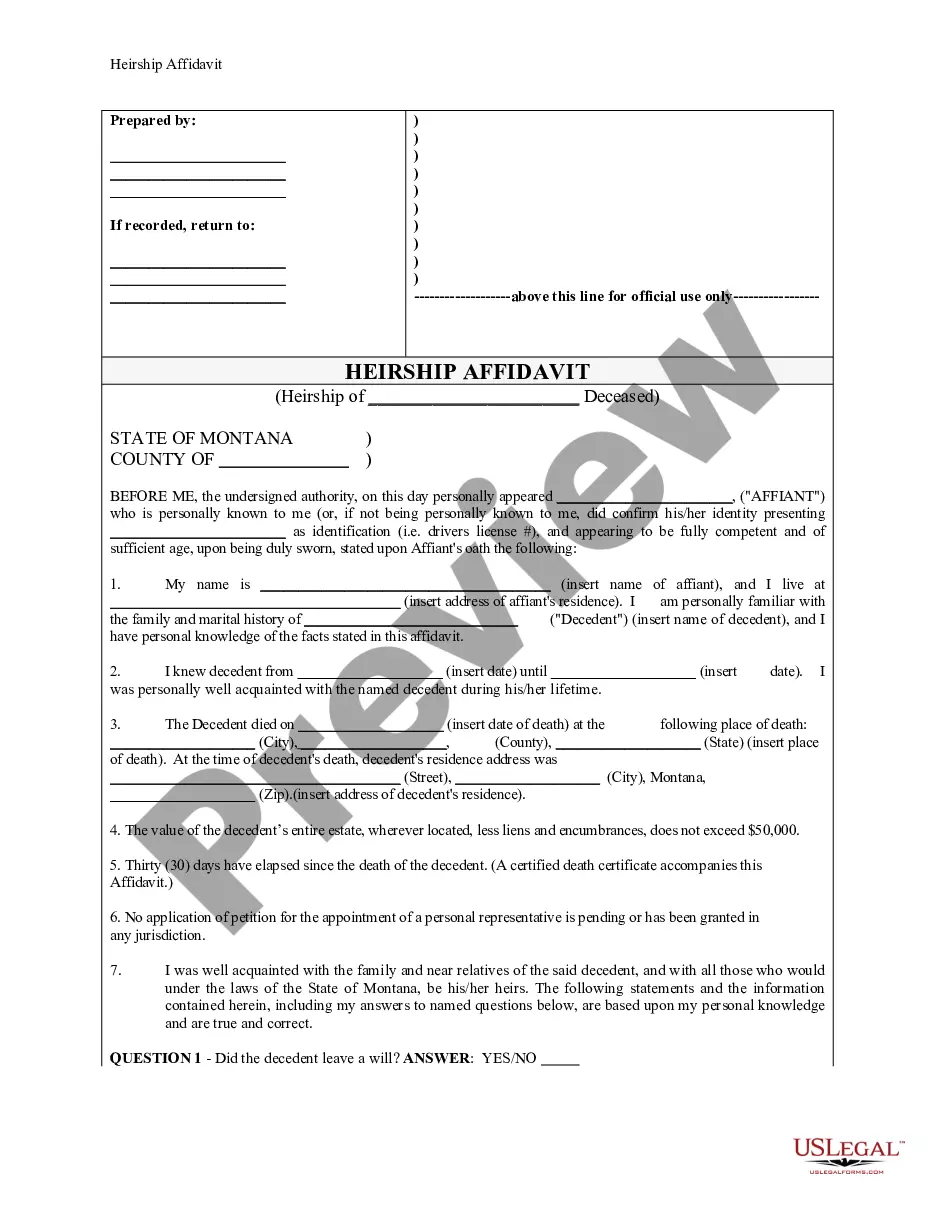

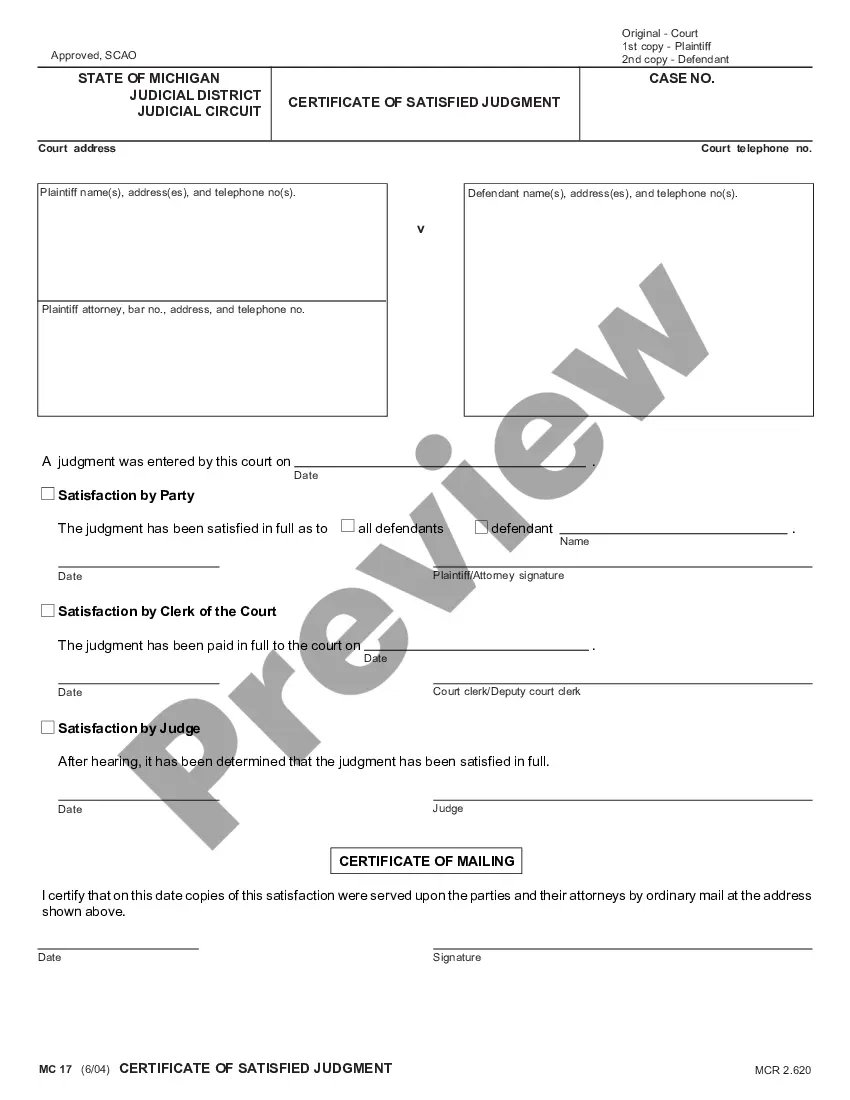

- Utilize the Preview switch to examine the form.

- Look at the description to actually have chosen the appropriate form.

- In the event the form is not what you are trying to find, make use of the Search area to get the form that fits your needs and specifications.

- If you obtain the correct form, click on Buy now.

- Opt for the pricing program you need, fill in the desired info to generate your bank account, and purchase an order utilizing your PayPal or bank card.

- Select a hassle-free paper structure and download your version.

Locate all the papers templates you possess purchased in the My Forms food selection. You may get a extra version of Kansas Approval of extension of management services agreement anytime, if necessary. Just go through the essential form to download or print out the papers design.

Use US Legal Forms, one of the most substantial assortment of authorized types, to save lots of efforts and stay away from errors. The assistance gives professionally produced authorized papers templates that can be used for a selection of reasons. Create an account on US Legal Forms and start producing your daily life easier.

Form popularity

FAQ

If you filed federal form 7004 with the Internal Revenue Service for an extension of time, enclose a copy of that form with your completed K-120S to automatically receive a six-month extension for Partnerships and S Corporations to file your Kansas return. Kansas does not have a separate extension request form.

The state of Kansas doesn't require any extension Form as it automatically grants extensions up to 6 months.

Kansas. The Kansas Department of Revenue recognizes the federal extension. You'll automatically be granted the same extension for your Kansas state return if you file for one with the IRS. Attach a copy of your federal extension to your state return when filing.

Corporations which elect under subchapter S of the Internal Revenue Code not to be taxed as a corporation must file a Kansas Partnership or S Corporation Return (Form K-120S). All other corporations must file a Form K-120.

If you have a valid Federal tax extension (IRS Form 7004), you will automatically be granted an extension for Illinois. However, you are still required to pay your Illinois partnership tax by the original deadline (April 15) to avoid penalties. Also check out Illinois e-Services for Businesses.

Any partnership, joint venture, syndicate, etc., required to file a Partnership return for federal purposes is required to file a Kansas Partnership return if such enterprise receives income or loss from Kansas sources.