Kansas Employee Notice to Correct IRCA Compliance

Description

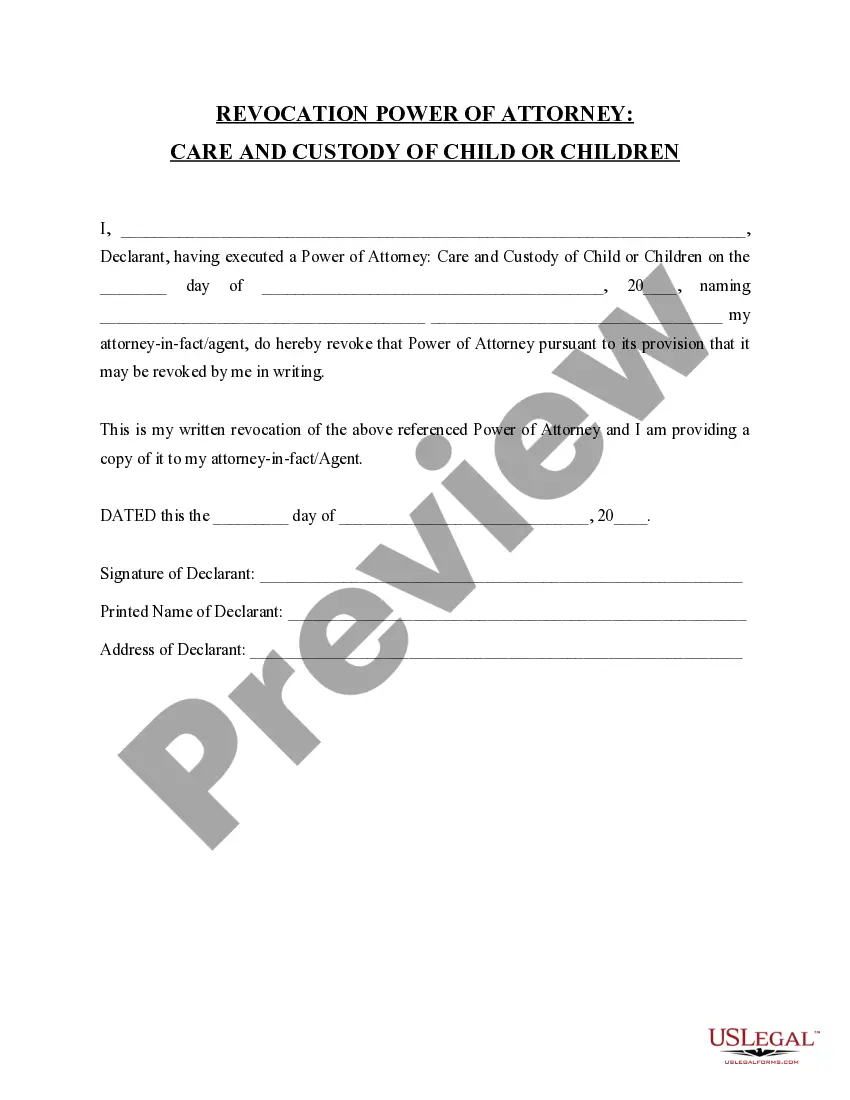

How to fill out Employee Notice To Correct IRCA Compliance?

Are you currently in the situation where you require documents for both business and personal purposes on a daily basis.

There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers a vast selection of document templates, including the Kansas Employee Notice to Correct IRCA Compliance, designed to adhere to state and federal regulations.

Once you locate the appropriate template, click on Buy now.

Select the pricing plan you want, fill in the required details to create your account, and pay for the order with your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Kansas Employee Notice to Correct IRCA Compliance anytime, if needed. Just click on the necessary template to download or print the document. Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes. The service provides professionally crafted legal document templates applicable for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kansas Employee Notice to Correct IRCA Compliance template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you require and ensure it is for the correct city/county.

- Use the Review button to examine the document.

- Read the description to confirm that you have selected the right template.

- If the template is not what you’re looking for, utilize the Search field to find a template that suits your needs.

Form popularity

FAQ

Three-day RuleAn E-Verify case is considered late if you create it later than the third business day after the employee first started work for pay. If the case you create is late, E-Verify will ask why, and you can either select one of the reasons provided or enter you own.

3.2 Create A Case. E-Verify cases must be created no later than the third business day after the employee starts work for pay.

The Immigration Reform and Compliance Act of 1986 (IRCA) prohibits the employment of unauthorized aliens and requires all employers to: (1) not knowingly hire or continue to employ any person not authorized to work in the United States, (2) verify the employment eligibility of every new employee (whether the employee

IRCA prohibits employers from knowingly hiring, recruiting, or referring for a fee any alien who is unauthorized to work. The public policy behind this law reflects the concern that the problem of illegal immigration and employment requires greater control and stronger enforcement mechanisms by the federal government.

IRCA applies to all employers with four or more employees. Who does this law protect? This law protects all those authorized to work in the US: US citizens, non-citizen nationals, lawful permanent residents, and non-citizens who are authorized to work.

A. If an employee is unable to present the required document or documents within 3 business days of the date employment begins, the employee must produce a receipt showing that he or she has applied for the document. In addition, the employee must present the actual document to you within 90 days of the hire.

The document review and certification must occur by the third day after the employee begins employment. Employers may elect whether or not to photocopy (and retain) the documents submitted by employees for the Form I-9 process (8 C.F.R. § 274a.

The Immigration Act of 1990 created a new immigration category, the Diversity Immigrant Visa Program. The program issued visas specifically for immigrants who are citizens of countries from where fewer than 50,000 immigrants came to the United States over the previous five years.

The IRCA applies to employers with 4 or more employees, to employees who are citizens or nationals of the United States, and aliens who are lawfully admitted for permanent residence, granted temporary residence status, admitted as refugees, or granted asylum.

IRCA granted legal status to individuals residing in the United States without legal permission who met certain conditions; this provision of the law applied only to individuals who had entered the country before January 1, 1982. Ultimately, 2.7 million individuals were granted legal status under the law.