Kansas Personal Guaranty - Guarantee of Lease to Corporation

Description

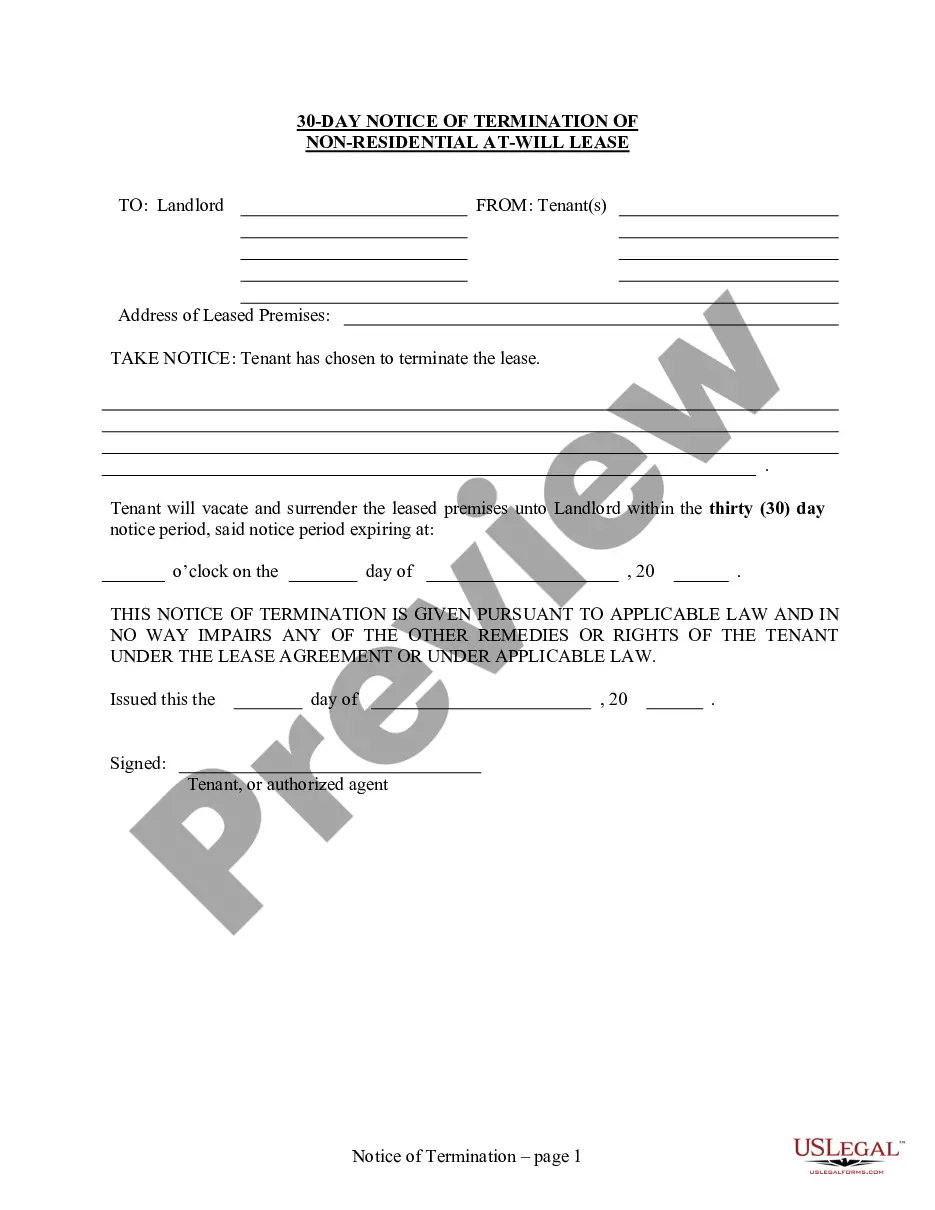

How to fill out Personal Guaranty - Guarantee Of Lease To Corporation?

Selecting the optimal valid document format can be challenging.

Of course, there are numerous templates available online, but how can you find the specific document type you need.

Utilize the US Legal Forms website. The service provides an extensive array of templates, including the Kansas Personal Guaranty - Guarantee of Lease to Corporation, which can be utilized for both business and personal purposes.

You can preview the document using the Preview option and read the document description to make sure it is suitable for you.

- All the templates are reviewed by experts and meet state and federal requirements.

- If you are already registered, Log In to your account and click the Download button to access the Kansas Personal Guaranty - Guarantee of Lease to Corporation.

- Use your account to review the legal templates you have previously obtained.

- Visit the My documents section of your account to download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have chosen the correct template for your area/state.

Form popularity

FAQ

The person who gives the guarantee is called the 'surety'; the person in respect of whose default the guarantee is given is called the 'principal debtor', and the person to whom the guarantee is given is called the 'creditor'. A guarantee may be either oral or written. "

A corporate guarantee is an agreement in which one party, called the guarantor, takes on the payments or responsibilities of a debt if the debtor defaults on the loan.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A corporate guaranty is one usually signed by a parent or more developed affiliated company. It is a comfort to a landlord to have an extra set of assets to go after should its tenant default.

To be enforceable as a personal guaranty, the signatory must sign the guaranty in his or her personal capacity and not as the president or CEO of the company receiving the loan, which is its own legal entity, separate and apart from the people that run and operate it.

Guarantors can validly guarantee the liability of an 2022 assignee on a further assignment (whether that is an assignment back to the original tenant or a new tenant).

A guarantor is a person, third party or organisation that agrees to guarantee your loan. The guarantee is a legal assurance given by the guarantor to pay the loan if the borrower defaults and is unable to pay.

The difference between corporate and personal guarantors is quite simple: a personal guarantor is an individual who agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantor is a corporation that takes on payment responsibilities.

Under the Landlord and Tenant (Convenants) Act 1995 (LTCA 1995), a lease cannot be assigned by a tenant to that tenant's guarantor, even if the guarantor agrees.

Can I get out of a personal guarantee?Take Out Personal Guarantee Insurance.Renegotiating The Contract Upon Which the Personal Guarantee Is Attached.Go into an Individual Voluntary Arrangement (IVA)Go Bankrupt.