Kansas Employment Form

Description

How to fill out Employment Form?

It is feasible to spend hours online trying to locate the legal document template that fulfills the federal and state requirements you need.

US Legal Forms provides a vast array of legal forms that have been evaluated by experts.

You can easily obtain or create the Kansas Employment Form from my service.

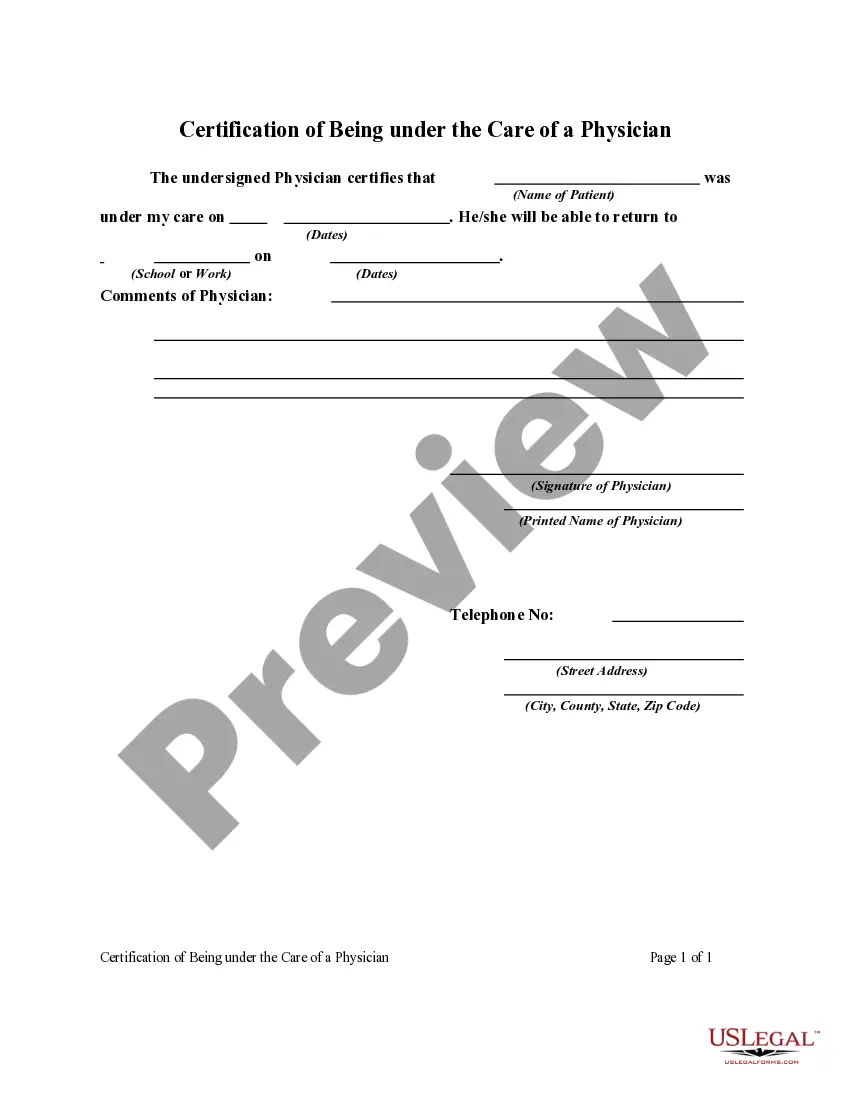

If available, utilize the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you may sign in and click on the Obtain button.

- Afterwards, you can fill out, modify, create, or sign the Kansas Employment Form.

- Each legal document template you purchase is yours forever.

- To retrieve another copy of the purchased document, visit the My documents section and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your state/city of choice.

- Review the form description to confirm you have picked the right form.

Form popularity

FAQ

The New Hire Reporting form (K-CNS 436) is fillable and can be submitted via mail or fax to (888) 219-7798. Login to the KansasEmployer.gov site. Choose the Select button that corresponds to the "Enter new hire information" option. Enter the hiring company's FEIN and Kansas Serial Number.

There are currently seven states which utilize the Federal Withholding elections declared on the Federal Form W-4 for state tax purposes.Colorado.Delaware.Nebraska.New Mexico.North Dakota.South Carolina.Utah.

Companies who pay employees in Kansas must register with the KS Department of Revenue for a Withholding Account Number and the KS Department of Labor for an Employer Serial Number. Apply online at the DOR's Customer Service Center to receive a Withholding Account Number within 48 hours of completing the application.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

The Kansas Form K-4 should be completed as soon as an employee is hired or taxable payments begin. The amount of tax withheld should be reviewed each year and new forms should be filed whenever there is a change in either the marital status or number of exemptions of the individual.

Form I-9 and E-Verify System for Employment Eligibility As an employer, it is your responsibility to document the eligibility of new employees to work in the U.S. For this you'll use Form I-9, Employment Eligibility Verification, which must be completed by each new hire.

A completed withholding allowance certificate will let your employer know how much Kansas income tax should be withheld from your pay on income you earn from Kansas sources. Kansas Form K-4 to their employer on or before the date of employment.

Kansas requires employers to obtain a completed Form K-4, in addition to federal Form W-4, to assist employees in calculating the Kansas employer withholding tax rate.

Unemployment FAQs To request a new 1099-G for a previous year to be mailed to you, log into GetKansasBenefits.gov and click Request 1099-G Reprint.

A completed withholding allowance certificate will let your employer know how much Kansas income tax should be withheld from your pay on income you earn from Kansas sources. Kansas Form K-4 to their employer on or before the date of employment.