Kansas Salary Adjustment Request

Description

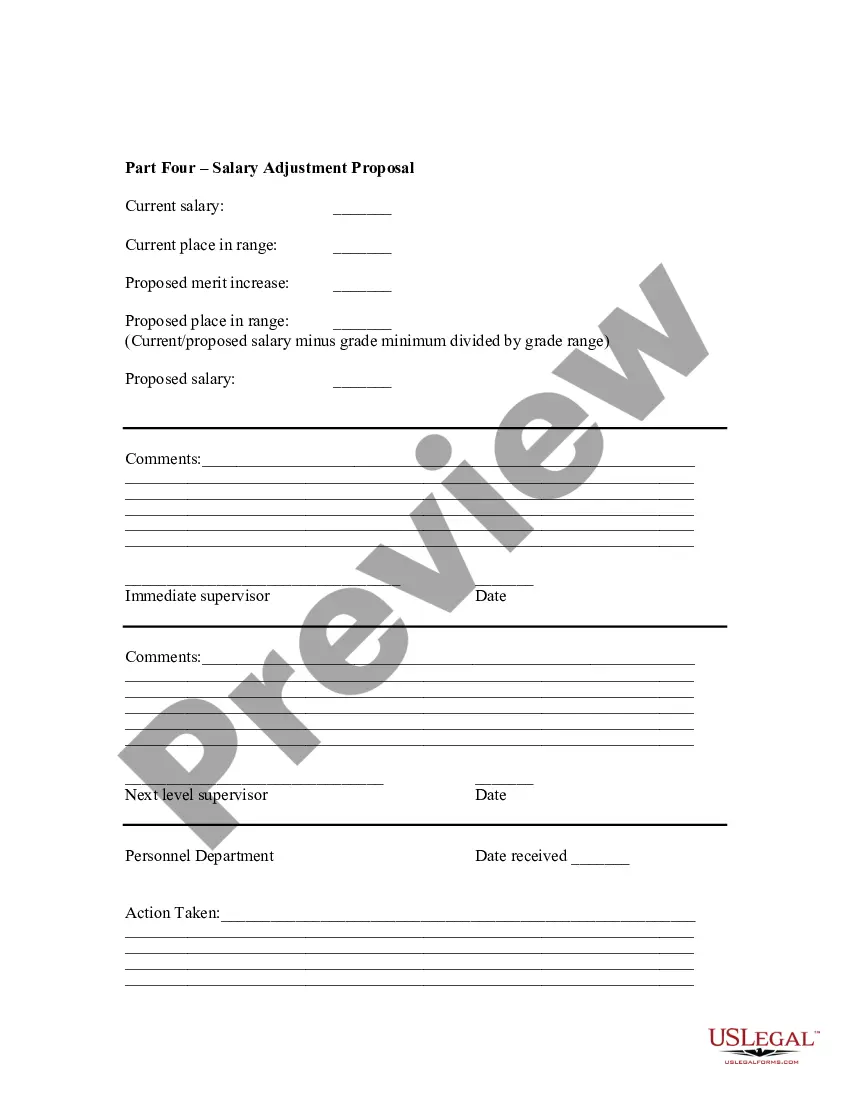

How to fill out Salary Adjustment Request?

You can spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that can be reviewed by experts.

You can quickly download or create the Kansas Salary Adjustment Request utilizing the service.

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Kansas Salary Adjustment Request.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area/city of choice.

- Refer to the form description to confirm that you have chosen the right kind.

Form popularity

FAQ

If you're eligible for unemployment benefits after your initial benefits period has ended, you can immediately refile by applying for extended benefits. There's no wait time. You could, for example, exhaust all your benefits, get another job and become unemployed a day later.

If the due date for filing your tax return has passed, you can submit an amended tax return to correct most mistakes. You can't electronically file an amended tax return. You must mail it to the IRS. If you realize you made a mistake but the due date for filing hasn't passed, don't file an amended tax return.

Purpose of the K-4 form: A completedwithholding allowance certificate will let your employer know how much Kansas income tax should be withheld from your pay on income you earn from Kansas sources. Because your tax situation may change, you may want to re-figure your withholding each year.

If you need to change or amend an accepted Kansas State Income Tax Return for the current or previous Tax Year you need to complete Form K-40. Form K-40 is a Form used for the Tax Return and Tax Amendment. You can prepare a 2021 Kansas Tax Amendment Form on eFile.com, however you can not submit it electronically.

Contact the Kansas Department of LaborKansas City (913) 596-3500.Topeka (785) 575-1460.Wichita (316) 383-9947.Toll-Free (800) 292-6333.

Correcting your application for unemployment benefits can be a simple as visiting your state's unemployment compensation website or obtaining the correct form from a local unemployment office.

How can I correct this? For specific assistance with your claim, you will need to contact a Regional Claims Center. You can also email esuiclaims@labor.mo.gov with any questions.

If you want to make changes after the original tax return has been filed, you must file an amended tax return using a special form called the 1040-X, entering the corrected information and explaining why you are changing what was reported on your original return. You don't have to redo your entire return, either.

K-CNS 111 is to amend a previously filed Quarterly Wage Report & Unemployment Tax Return, K-CNS 100. Complete this adjustment in duplicate and keep one copy for your records. NOTE: If no tax is due, you may fax the adjustment to 785-291-3425.

Schedule S (Form 1120-F) is used by foreign corporations to claim an exclusion from gross income under section 883 and to provide reporting information required by the section 883 regulations.