Kansas Shipping Reimbursement

Description

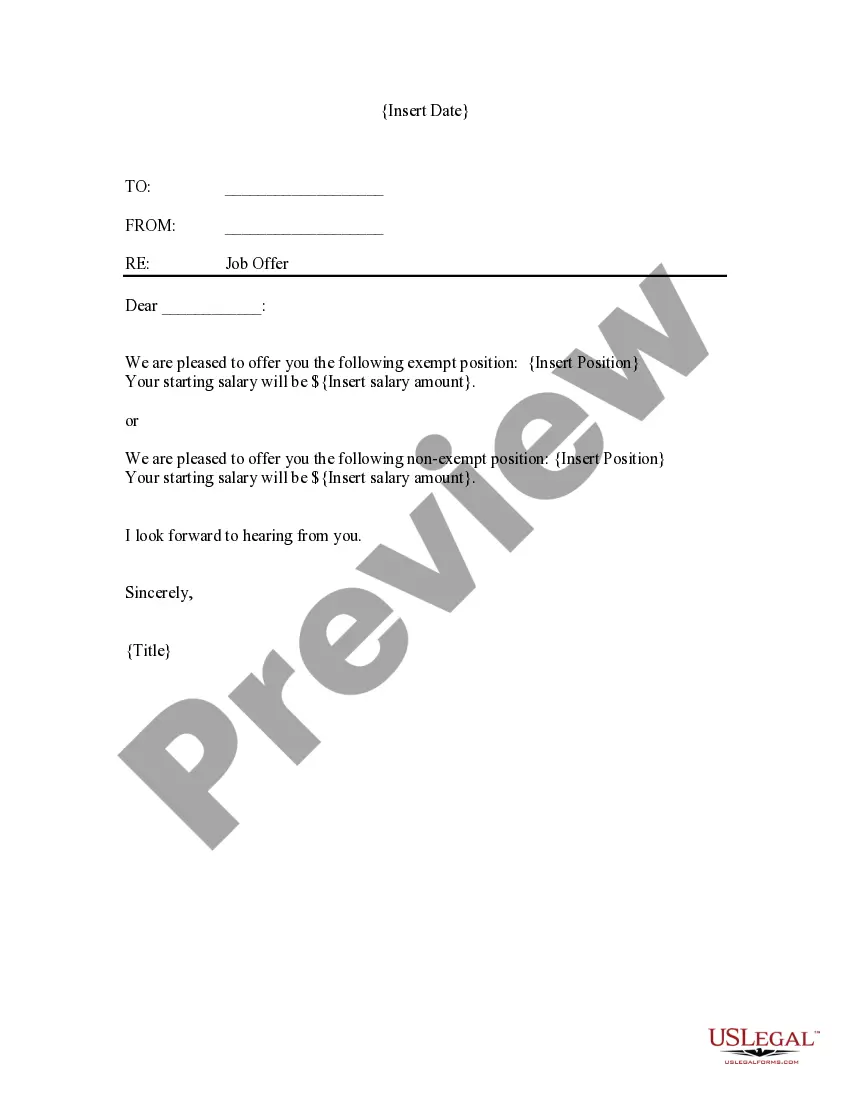

How to fill out Shipping Reimbursement?

If you wish to obtain, acquire, or create lawful document templates, utilize US Legal Forms, the largest assortment of legal forms, which is accessible online.

Take advantage of the website’s simple and convenient search to find the documents you require.

Numerous templates for business and personal purposes are sorted by categories and states, or keywords.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal document and download it to your device. Step 7. Fill out, modify, and print or sign the Kansas Shipping Reimbursement.

- Use US Legal Forms to get the Kansas Shipping Reimbursement with a few clicks.

- If you are already a US Legal Forms client, Log In to your account and then click the Download button to locate the Kansas Shipping Reimbursement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your details to register for the account.

Form popularity

FAQ

The majority of states (Arkansas, Connecticut, Georgia, Illinois, Kansas, Kentucky, Michigan, Mississippi, Nebraska, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Washington, West Virginia and

For taxable sales, delivery and shipping charges that are included in the sale price are generally subject to state sales tax. Sellers can only separately state the delivery charge if the buyer can avoid it (i.e., by picking up the goods). Different rules may apply for local sales tax.

Beginning July 1, 2021, remote e-commerce sellers who fit the following criteria are considered to have Kansas economic nexus: More than $100,000 of cumulative gross receipts from sales to customers in the state for the period of January 1, 2021, through June 30, 2021 or.

Summary: Kansas has passed an economic nexus law, effective July 1, 2021, requiring that all out-of-state sellers and marketplace facilitators register for the collection and remittance of sales and compensating use tax if they have over $100,000 in gross sales during the previous or current calendar year.

Kansas uses the market-based method for the sourcing of intangibles. For transactions occurring on or after April 1, 2014, retail sales of taxable services are sourced to where the purchaser makes first use of such services.

Kansas is a destination-based state. This means you're responsible for applying the sales tax rate determined by the ship-to address on all taxable sales. For additional information, see the Kansas sourcing rules.

Sales Tax Exemptions in KansasAll construction materials and prescription drugs (including prosthetics and devices used to increase mobility) are considered to be exempt. While groceries are not tax exempt, any food that is used to provide meals for the elderly or homebound is considered to be exempt from taxes.

Generally, a business has nexus in Kansas when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives. However, out-of-state sellers can also establish nexus in the ways described below.

WHAT IS TAXABLE IN KANSAS? Kansas Retailers' Sales Tax generally applies to: 1) the retail sale, rental, or lease of tangible personal property, and, 2) the sale of labor services to install, apply, repair, service, alter, or maintain tangible personal property.

Kansas: Shipping and handling charges are generally taxable in Kansas whether included in the sale price, separately stated, or billed separately.