Kansas Purchase Order for Non Inventory Items

Description

How to fill out Purchase Order For Non Inventory Items?

Have you ever found yourself in a position where you need documents for both professional and personal reasons almost every working day.

There are numerous official document templates accessible online, but finding reliable ones isn’t simple.

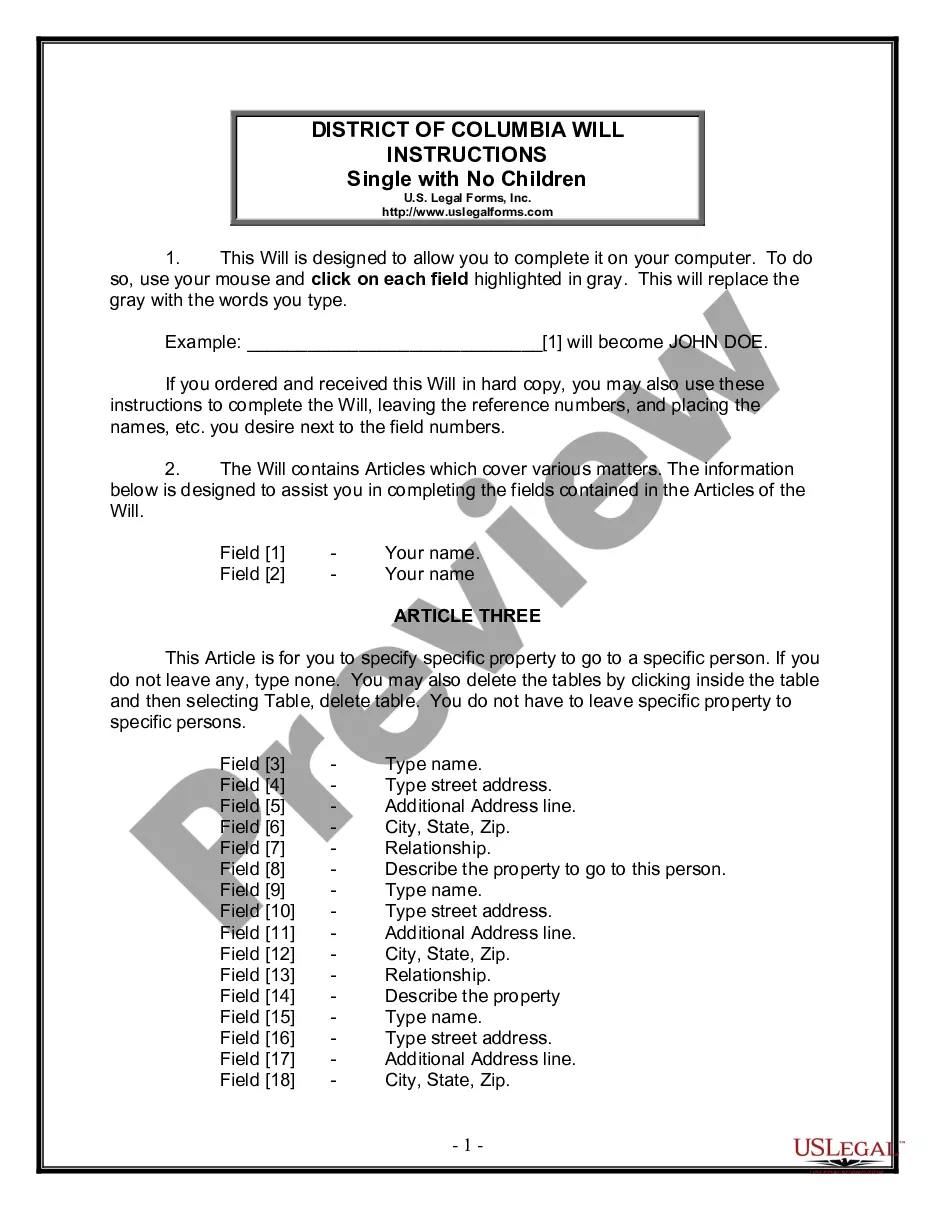

US Legal Forms offers a wide array of form templates, such as the Kansas Purchase Order for Non-Inventory Items, which can be printed to comply with federal and state regulations.

Once you find the appropriate form, click Buy now.

Choose the pricing plan you want, fill in the required information to create your account, and make the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you will be able to download the Kansas Purchase Order for Non-Inventory Items template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Preview button to review the form.

- Read the description to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search section to find the form that addresses your needs and requirements.

Form popularity

FAQ

Non-inventory items refer to products or services that a business does not store or track as part of its inventory. These items typically represent costs that do not require stock management. By using a Kansas Purchase Order for Non Inventory Items, you can streamline your financial processes, ensuring you account for all expenses without the need for complicated tracking systems.

Items that are not included in inventory generally consist of services, supplies, and fixed assets. For instance, office supplies or maintenance contracts fall into non-inventory categories. Utilizing a Kansas Purchase Order for Non Inventory Items helps you categorize these expenses accurately, making it easier to assess your overall financial health.

Examples of non-inventory items in QuickBooks include services like consulting fees, labor charges, or other expenses that do not involve physical products. When you use a Kansas Purchase Order for Non Inventory Items, you can efficiently track these types of charges without cluttering your inventory list. This makes accounting simpler and ensures you only manage what truly requires monitoring in your stock.

An example of a non-inventory item could be software licenses, which organizations purchase for use but do not physically stock. These items are critical for operations but do not fall under traditional inventory. Recognizing these items is important for budget planning and spending control. Utilizing a Kansas Purchase Order for Non Inventory Items ensures that you manage these purchases effectively.

inventory purchase order (PO) is a document used to authorize the purchase of goods and services that are not kept in stock. This PO helps businesses track expenses and maintain a clear record of spending for items like services or tools. By issuing a Kansas Purchase Order for Non Inventory Items, you can ensure accuracy and accountability in your purchasing processes.

Inventory items are goods that a business actively sells and stores, while non-inventory items are those that are not stocked for sale. Inventory includes products like electronics or clothing, whereas non-inventory may consist of services or items like furniture and supplies. Recognizing this difference is crucial for effective inventory management. A Kansas Purchase Order for Non Inventory Items facilitates clear record-keeping for non-stock purchases.

Non-inventory items refer to products that a business does not keep in stock for resale. These can include services like consulting, office supplies like printers, or maintenance services like cleaning. Understanding these types of expenditures is essential, especially when managing budgets. Using a Kansas Purchase Order for Non Inventory Items can help streamline your procurement process for these goods and services.