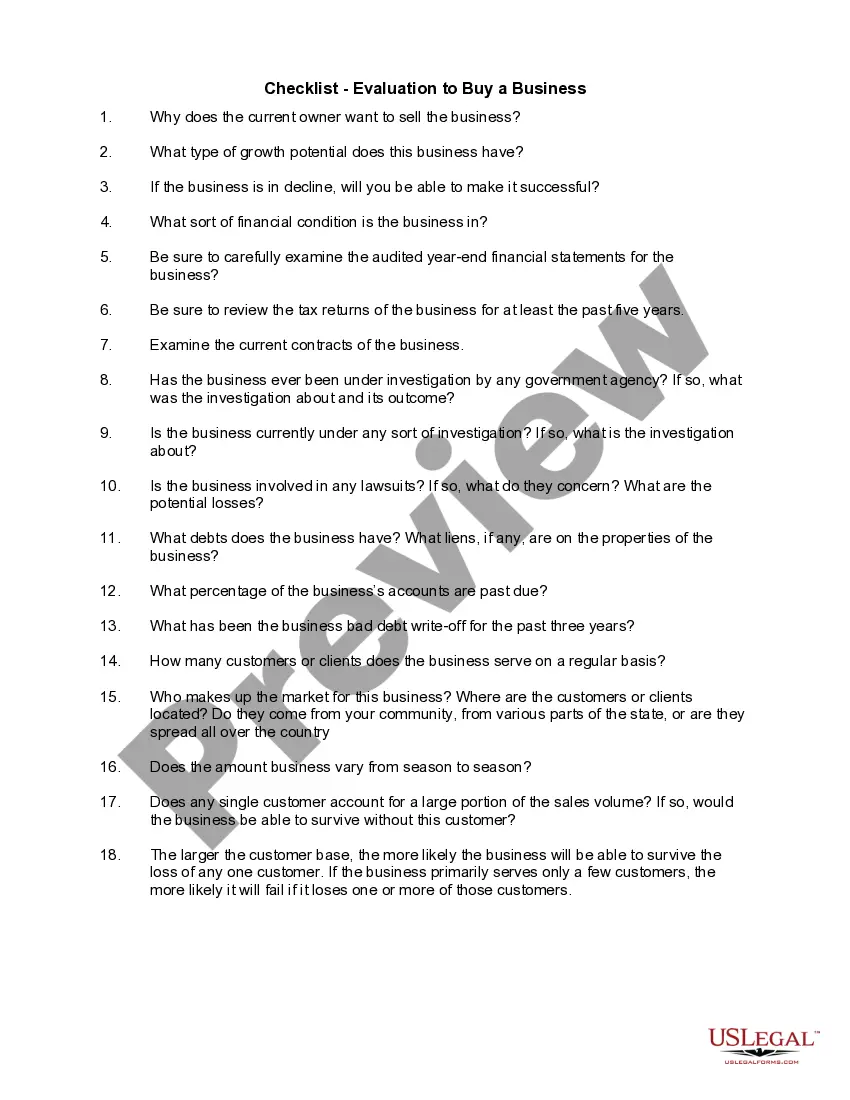

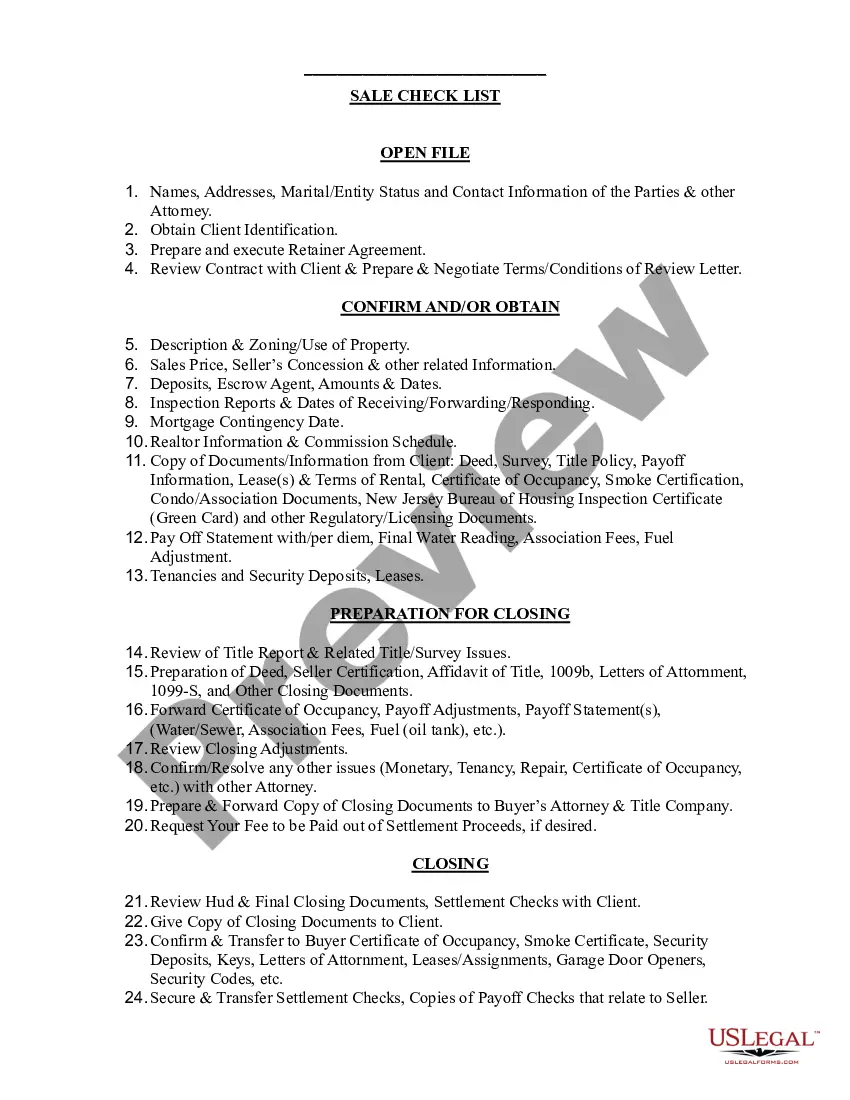

Kansas Checklist - Sale of a Business

Description

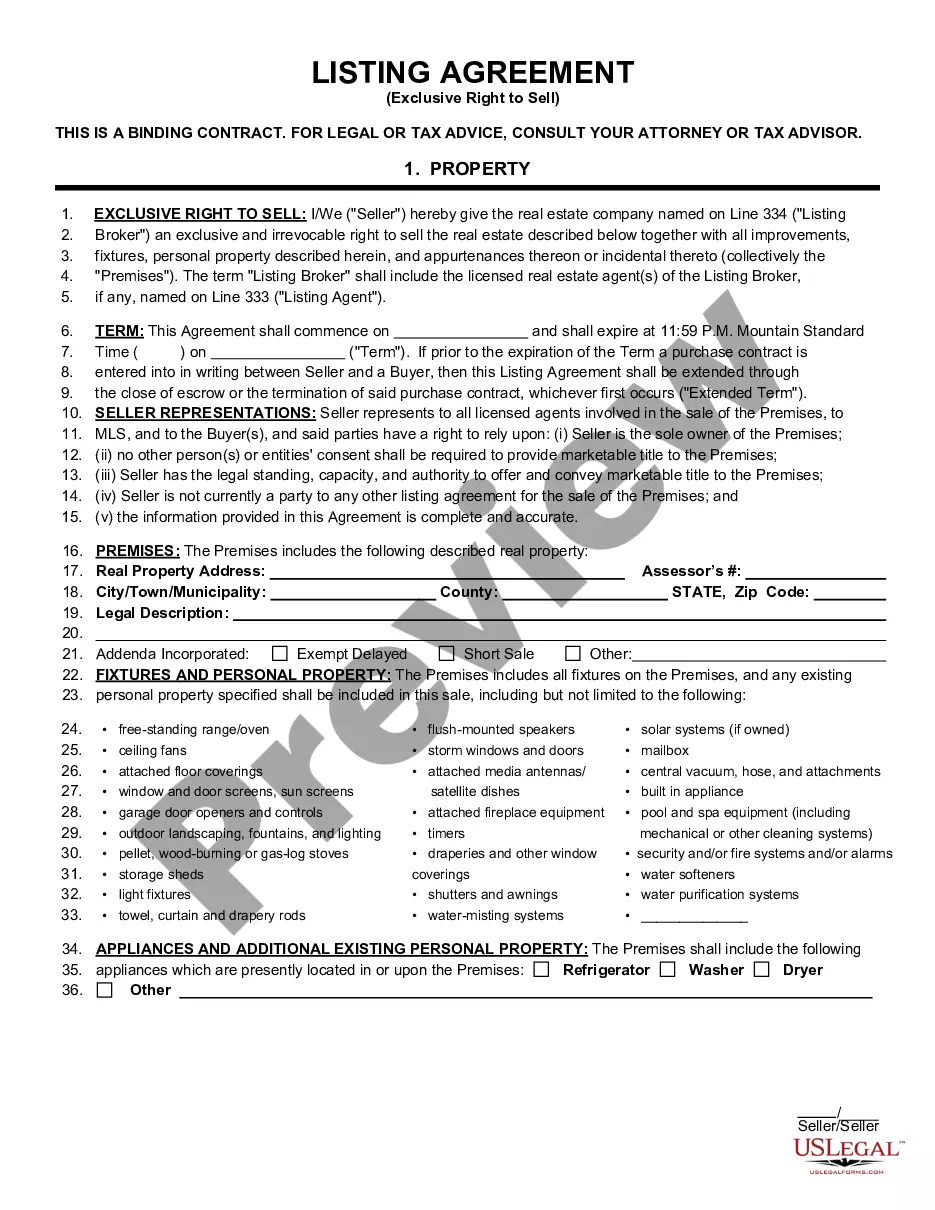

How to fill out Checklist - Sale Of A Business?

If you desire to be thorough, obtain, or produce valid document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the website's straightforward and convenient search feature to locate the documents you need.

Various templates for commercial and personal use are organized by categories and states, or keywords.

Step 4. After finding the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize your purchase.

- Utilize US Legal Forms to locate the Kansas Checklist - Sale of a Business in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Kansas Checklist - Sale of a Business.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the contents of the form. Be sure to read the information carefully.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative templates in the legal form repository.

Form popularity

FAQ

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

Kansas does not require LLCs to have operating agreements, but it is highly advisable to have one. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.

Kansas's corporation tax rate is a flat 4% of federal taxable income (with state-specific adjustments) plus a 3% surtax on taxable income above $50,000. The tax is payable to the state's Department of Revenue (DOR). Use the state's corporation income tax return (Form K-120) to pay the tax.

A Kansas LLC operating agreement is a legal document that may be utilized by companies of all sizes, to establish businesses, member relationships (multi-member entities), standard operating procedures, company policies, and many other aspects of a business.

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesn't pay taxes on business income. The members of the LLC pay taxes on their share of the LLC's profits. State or local governments might levy additional LLC taxes.

Kansas corporations are subject to Kansas's corporate income tax at the flat 4% rate, with an additional 3% surtax on income over $50,000.

No. State law does not require or permit the registration or filing of DBAs or fictitious names.

What to do when I sellComplete the Notice of Business Closure (CR-108)Return the completed form to Kansas Department of Revenue, 915 SW Harrison Street, Topeka, KS 66625-9000 or FAX to 785-291-3614.Include information on the date the business was sold.Include the name and address of the new owner.More items...

California LLCs are required to have an Operating Agreement. This agreement can be oral or written. If it's written, the agreementsand all amendments to itmust be kept with the company's records. Limited Liability Companies in New York must have a written Operating Agreement.

Kansas does not require LLCs to have operating agreements, but it is highly advisable to have one. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.