Kansas Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

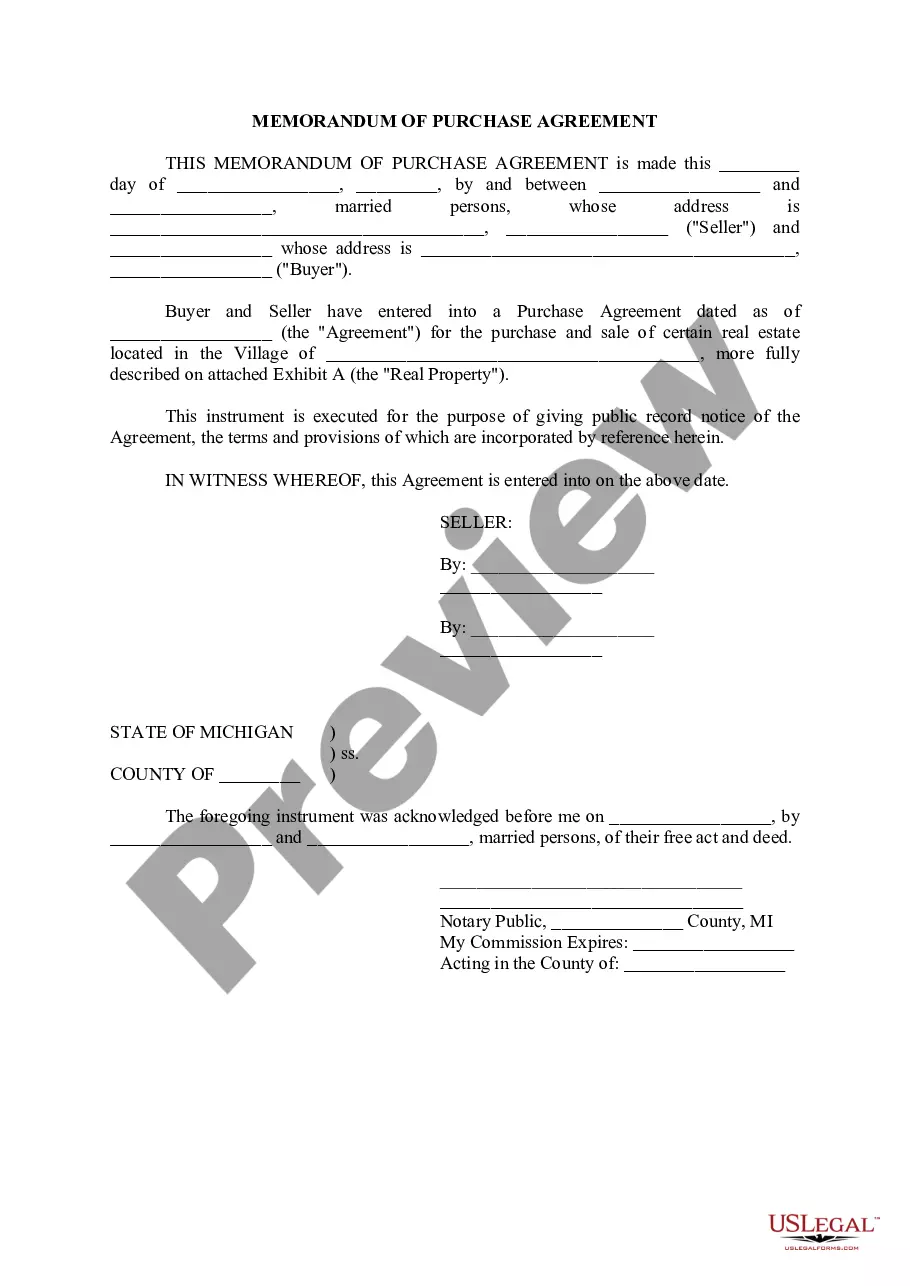

How to fill out Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

US Legal Forms - one of the largest libraries of lawful kinds in the United States - offers an array of lawful papers web templates you can acquire or print. Utilizing the website, you can get 1000s of kinds for organization and personal purposes, sorted by types, states, or search phrases.You can get the latest versions of kinds just like the Kansas Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage within minutes.

If you already possess a subscription, log in and acquire Kansas Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage in the US Legal Forms catalogue. The Obtain switch will show up on every single form you see. You have accessibility to all previously downloaded kinds from the My Forms tab of your respective account.

In order to use US Legal Forms for the first time, here are basic guidelines to help you get started off:

- Make sure you have picked the right form to your town/county. Click the Preview switch to examine the form`s articles. See the form explanation to ensure that you have chosen the correct form.

- In case the form does not satisfy your specifications, take advantage of the Lookup discipline on top of the screen to obtain the one who does.

- In case you are pleased with the form, verify your choice by clicking on the Acquire now switch. Then, choose the rates plan you want and give your accreditations to register for an account.

- Procedure the deal. Make use of your Visa or Mastercard or PayPal account to complete the deal.

- Select the structure and acquire the form on your gadget.

- Make modifications. Fill out, modify and print and indicator the downloaded Kansas Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

Each design you put into your bank account lacks an expiry time and it is the one you have for a long time. So, if you want to acquire or print yet another backup, just proceed to the My Forms section and click on around the form you need.

Obtain access to the Kansas Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage with US Legal Forms, by far the most considerable catalogue of lawful papers web templates. Use 1000s of skilled and condition-certain web templates that meet up with your small business or personal needs and specifications.

Form popularity

FAQ

A second mortgage, however, allows you to use your home's equity and put it to work. Instead of having that money tied up in your home, it's available for expenses you have right now. This option can be a help or a hindrance, depending on your financial goals.

A first mortgage is a primary lien on the property that secures the mortgage. The second mortgage is money borrowed against home equity to fund other projects and expenditures.

TL;DR: The primary mortgage market is used for homebuyers and lenders. Lenders finance a borrower's purchase of a home. The secondary mortgage market is between lenders and mortgage investors. Lenders will sell the debt to the investor who will buy it to make a profit.

The Bottom Line Because the second mortgage also uses the same property for collateral as the first mortgage, the original mortgage has priority on the collateral should the borrower default on their payments. If the loan goes into default, the first mortgage lender gets paid before the second mortgage lender.

First Mortgagee means any person named as a mortgagee or beneficiary in any First Mortgage, or any successor to the interest of any such person under such First Mortgage.