Kansas Sample Letter for Debtor Examination

Description

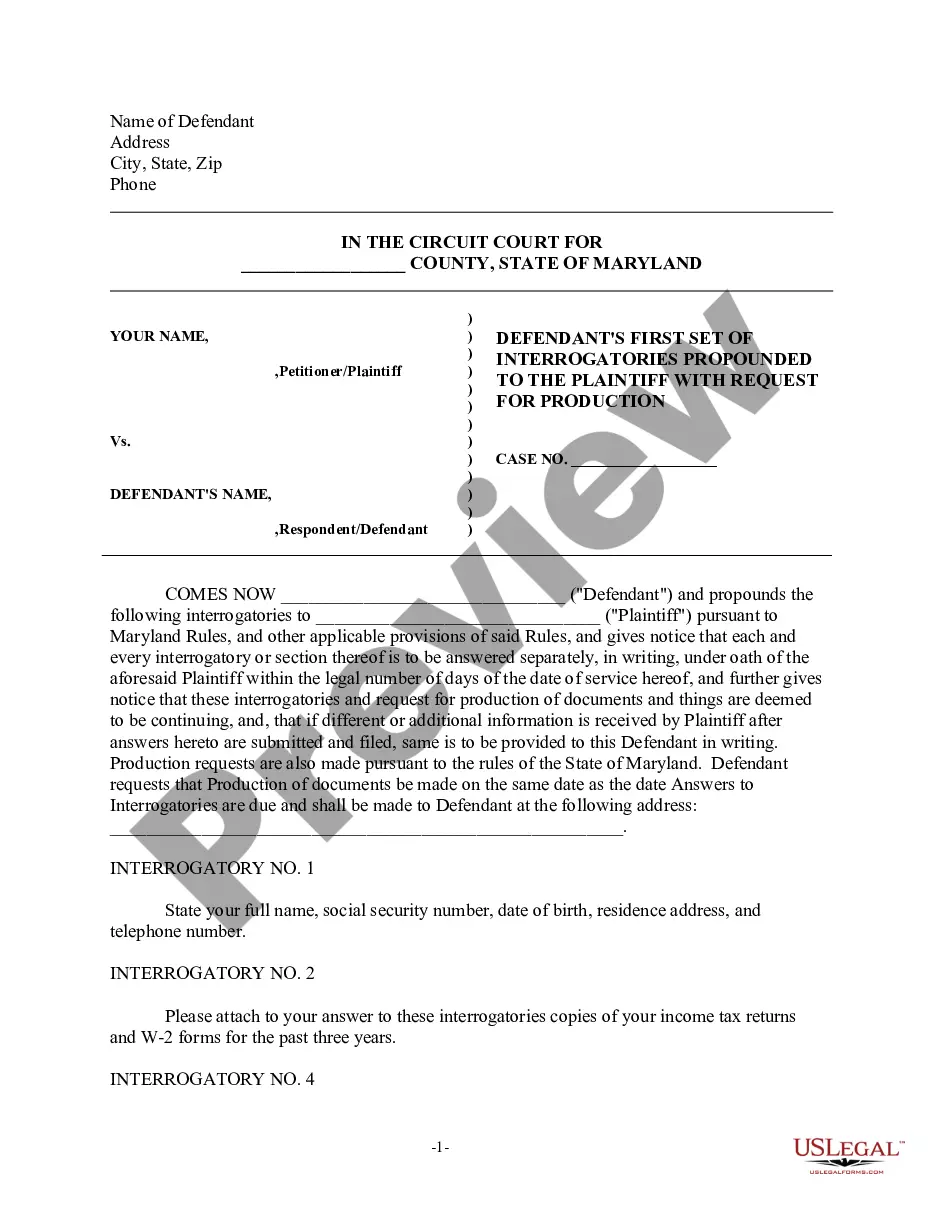

How to fill out Sample Letter For Debtor Examination?

You are able to spend time on-line trying to find the legal document format which fits the state and federal specifications you need. US Legal Forms supplies thousands of legal types that are evaluated by pros. It is possible to download or printing the Kansas Sample Letter for Debtor Examination from the service.

If you have a US Legal Forms account, you are able to log in and then click the Acquire button. After that, you are able to full, change, printing, or sign the Kansas Sample Letter for Debtor Examination. Every single legal document format you purchase is yours for a long time. To get one more version associated with a acquired form, proceed to the My Forms tab and then click the corresponding button.

If you use the US Legal Forms internet site the very first time, keep to the straightforward recommendations listed below:

- Initial, be sure that you have selected the best document format for your county/area of your liking. See the form information to make sure you have chosen the proper form. If accessible, use the Review button to appear through the document format too.

- In order to discover one more version of the form, use the Search industry to get the format that suits you and specifications.

- Once you have found the format you need, just click Buy now to continue.

- Choose the costs program you need, key in your credentials, and register for a merchant account on US Legal Forms.

- Total the purchase. You should use your bank card or PayPal account to purchase the legal form.

- Choose the structure of the document and download it for your system.

- Make modifications for your document if required. You are able to full, change and sign and printing Kansas Sample Letter for Debtor Examination.

Acquire and printing thousands of document layouts while using US Legal Forms site, which provides the most important selection of legal types. Use specialist and status-distinct layouts to take on your small business or specific demands.

Form popularity

FAQ

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

Don't pay, don't promise to pay and don't give any payment information the collector may use later. Ask for information on the debt and say you'll call back to discuss it later. Making a single payment ? even just $5 or $10 ? is an acknowledgment of the debt and can have serious repercussions.

You contacted me by [phone/mail], on [date] and identified the debt as [any information they gave you about the debt]. I do not have any responsibility for the debt you're trying to collect. If you have good reason to believe that I am responsible for this debt, mail me the documents that make you believe that.

A default judgment becomes final after thirty (30) days. case for a status hearing and then a trial approximately 90 (ninety) days later. After a judgment becomes final, a garnishment can be sent to the Sheriff.

If you have a reason why you don't owe this money, tell the Court You should write a reply to this lawsuit and file it with the Clerk of the District Court. This is called an ?Answer?. ... If you file an answer before your appearance date, you do not need to appear in court on the date stated in a Chapter 61 summons.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Dear debt collector: I am responding to your contact about collecting a debt. You contacted me by [phone/mail], on [date] and identified the debt as [any information they gave you about the debt]. You can contact me about this debt, but only in the way I say below.