Kansas Sample Letter regarding Discharge of Debtor

Description

How to fill out Sample Letter Regarding Discharge Of Debtor?

If you want to total, obtain, or produce authorized papers themes, use US Legal Forms, the most important selection of authorized types, that can be found on the Internet. Utilize the site`s simple and easy practical look for to obtain the papers you will need. Different themes for organization and person purposes are sorted by classes and states, or search phrases. Use US Legal Forms to obtain the Kansas Sample Letter regarding Discharge of Debtor with a couple of clicks.

In case you are currently a US Legal Forms customer, log in for your accounts and click the Obtain option to get the Kansas Sample Letter regarding Discharge of Debtor. You may also entry types you in the past acquired within the My Forms tab of your respective accounts.

Should you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for that proper area/country.

- Step 2. Use the Preview method to look over the form`s articles. Don`t forget about to learn the explanation.

- Step 3. In case you are unsatisfied using the develop, utilize the Lookup area near the top of the display screen to locate other models in the authorized develop format.

- Step 4. Once you have discovered the shape you will need, click the Buy now option. Opt for the costs strategy you choose and add your references to register to have an accounts.

- Step 5. Procedure the deal. You can utilize your Мisa or Ьastercard or PayPal accounts to complete the deal.

- Step 6. Pick the file format in the authorized develop and obtain it on your own system.

- Step 7. Total, revise and produce or indicator the Kansas Sample Letter regarding Discharge of Debtor.

Each authorized papers format you purchase is yours forever. You have acces to each develop you acquired within your acccount. Click the My Forms portion and choose a develop to produce or obtain once again.

Remain competitive and obtain, and produce the Kansas Sample Letter regarding Discharge of Debtor with US Legal Forms. There are many specialist and express-particular types you may use for your personal organization or person requires.

Form popularity

FAQ

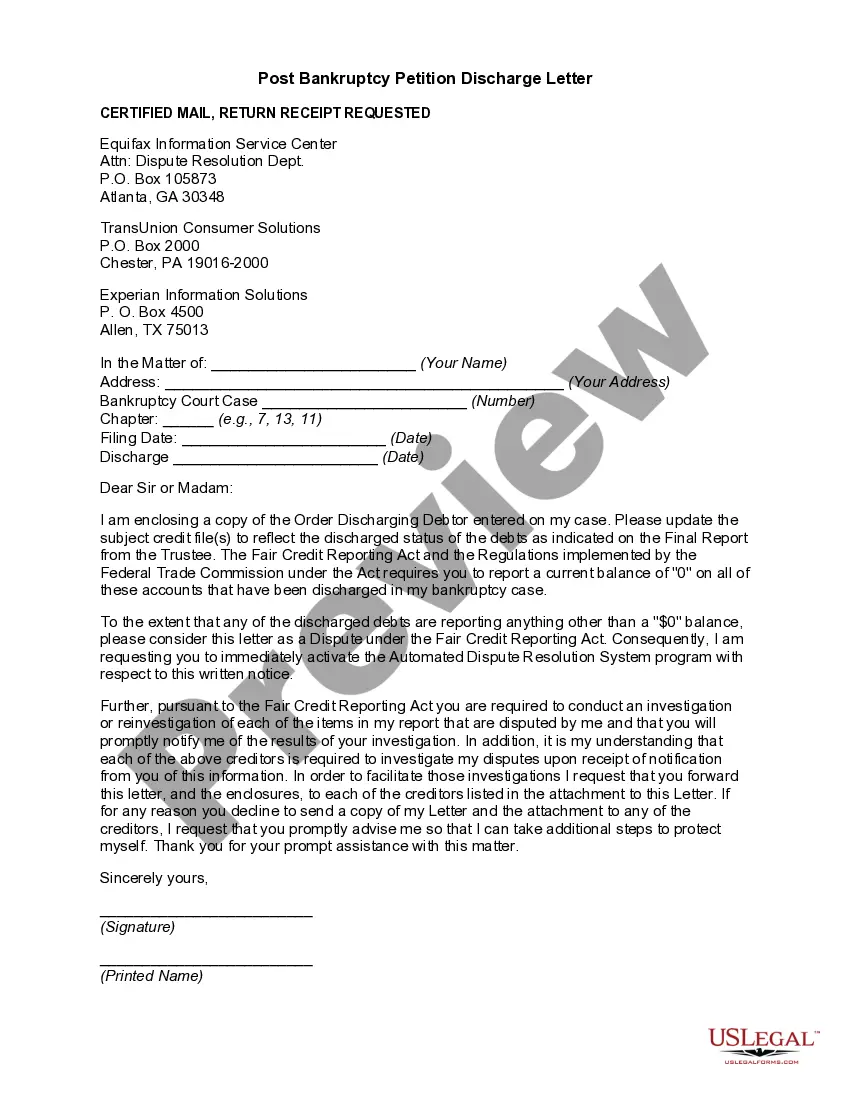

An individual receives a discharge for most of his or her debts in a chapter 7 bankruptcy case. A creditor may no longer initiate or continue any legal or other action against the debtor to collect a discharged debt. But not all of an individual's debts are discharged in chapter 7.

May the debtor pay a discharged debt after the bankruptcy case has been concluded? A debtor who has received a discharge may voluntarily repay any discharged debt. A debtor may repay a discharged debt even though it can no longer be legally enforced.

Courts can issue a discharge ruling when the debtor meets the discharge requirements under Chapter 7 or Chapter 11 of federal bankruptcy law, or the ruling is based on a debt canceling. A canceling of debt happens when the lender agrees that the rest of the debt is forgiven.

Generally, a discharge removes the debtors' personal liability for debts owed before the debtors' bankruptcy case was filed. Also, if this case began under a different chapter of the Bankruptcy Code and was later converted to chapter 7, debts owed before the conversion are discharged.

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.

People who file for personal bankruptcy get a discharge ? a court order that says they don't have to repay certain debts. Bankruptcy is generally considered your last option because of its long-term negative impact on your credit.

The Process of a Debt Discharge The bankruptcy court will look at your plan and decide whether it is fair and in ance with the law. You will also need to work with a trustee who will distribute these payments to the creditors. The trustee will pay creditors ing to priority.

From filing to discharge (wiping out debts), Chapter 7 bankruptcy cases typically take 4-6 months. As far as personal bankruptcies go, Chapter 7 is the fastest. By comparison, Chapter 13 can take up to five years because a repayment plan is involved.