Kansas General Form of Amendment to Partnership Agreement

Description

How to fill out General Form Of Amendment To Partnership Agreement?

If you want to accumulate, procure, or create valid document templates, utilize US Legal Forms, the largest assortment of authentic forms, which are accessible online.

Employ the site’s straightforward and convenient search to find the documents you need.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Every legal document template you download is yours forever. You have access to every form you saved in your account.

Go to the My documents section and select a form to print or download again. Stay competitive and acquire, and print the Kansas General Form of Amendment to Partnership Agreement with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Kansas General Form of Amendment to Partnership Agreement with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Obtain button to locate the Kansas General Form of Amendment to Partnership Agreement.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct state/country.

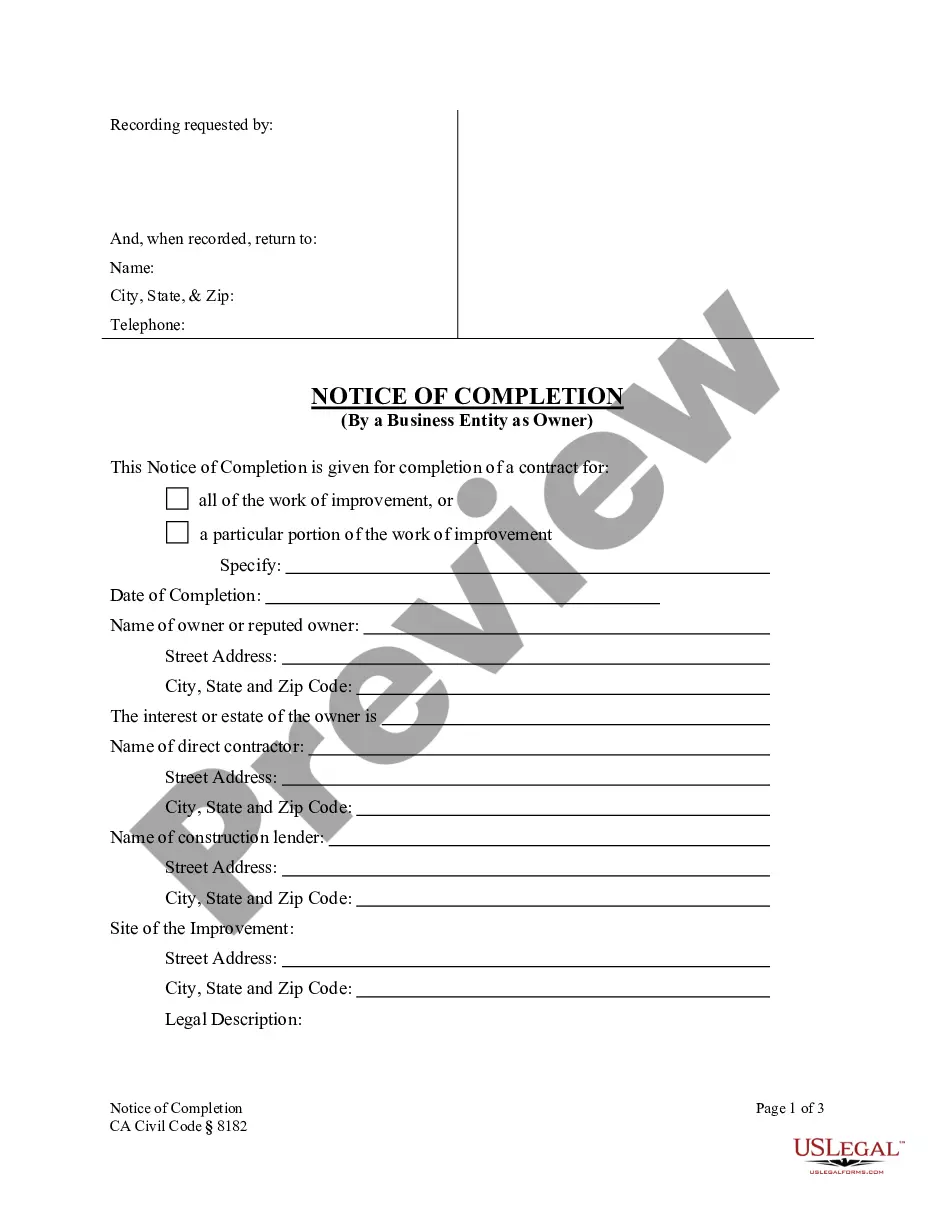

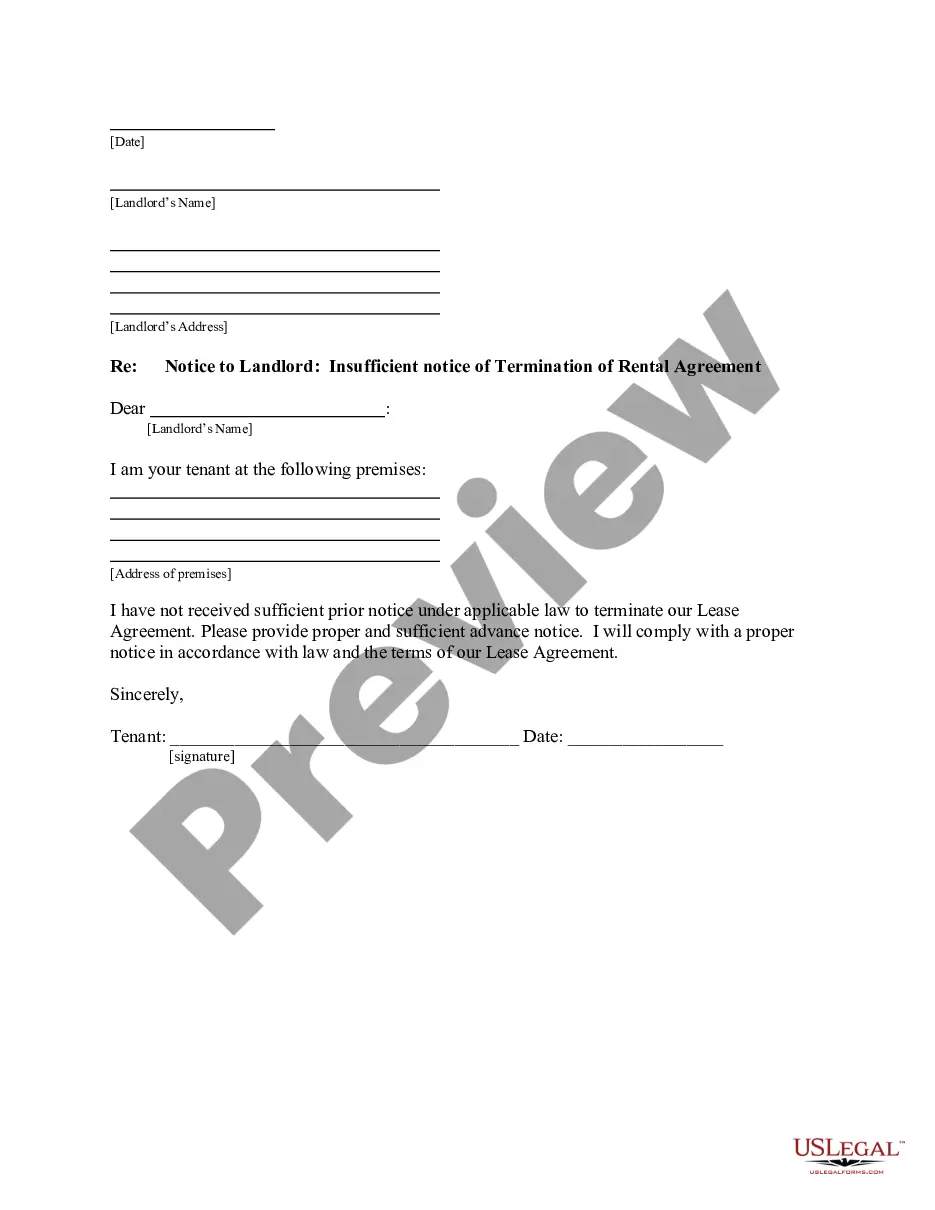

- Step 2. Use the Preview feature to review the form’s content. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search area at the top of the screen to find alternative versions of your legal form template.

- Step 4. After identifying the form you need, select the Acquire now button. Choose the pricing plan you desire and enter your details to register for an account.

- Step 5. Process the transaction. You may use your credit card or PayPal account to complete the payment.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Kansas General Form of Amendment to Partnership Agreement.

Form popularity

FAQ

To transition your LLC to an S Corporation in Kansas, first, you need to ensure your LLC meets the IRS requirements for S Corporation status. Then, you will need to file Form 2553 with the IRS for S Corporation election. Additionally, you may want to utilize the Kansas General Form of Amendment to Partnership Agreement to update your operating agreement accordingly. It's essential to consult a legal expert or use USLegalForms to simplify this process and ensure compliance with state regulations.

A change in a partnership agreement is commonly referred to as an amendment. This alteration can affect various aspects of your partnership and requires proper documentation. To ensure that your changes are legally recognized, consider utilizing the Kansas General Form of Amendment to Partnership Agreement, which streamlines this process.

You absolutely can amend a partnership agreement. This process typically involves preparing and filing the Kansas General Form of Amendment to Partnership Agreement, which is designed to guide you through the necessary steps. By amending your agreement, you can address any new circumstances and ensure your partnership operates smoothly.

Yes, a partnership agreement can be modified or changed. It is essential to follow the correct procedures to ensure the modification is legally recognized. By using the Kansas General Form of Amendment to Partnership Agreement, you can formally document these changes and keep your partnership structure up to date.

A partnership agreement may become void for several reasons, such as a lack of agreement between partners, illegal activities, or failure to adhere to required formalities. Understanding these factors can help you maintain a valid partnership agreement. For clarity and compliance, consider utilizing the Kansas General Form of Amendment to Partnership Agreement to document any important changes.

To change your registered agent in Kansas, you may need to complete a specific form provided by the Secretary of State's office. This process often involves submitting the Kansas General Form of Amendment to Partnership Agreement, which allows you to update the registered agent's information while ensuring your partnership remains compliant with state regulations.

Yes, you can modify an agreement, including a partnership agreement. To do so effectively, you may use the Kansas General Form of Amendment to Partnership Agreement. This form ensures that all modifications are documented correctly and legally binding, allowing your partnership to reflect any necessary changes.

To remove someone from an LLC in Kansas, first, review your operating agreement for specific procedures. A vote or mutual agreement from members is typically required. Once the decision is confirmed, you can use a Kansas General Form of Amendment to Partnership Agreement to formalize the change. This approach not only clarifies the membership status but also helps maintain legal compliance.

To change ownership of an LLC in Kansas, you must follow the procedures outlined in your operating agreement. This often involves documenting the sale or transfer and obtaining necessary approvals from existing members. Utilize a Kansas General Form of Amendment to Partnership Agreement to officially record any changes to ownership. Ensure that the changes are filed with the state if applicable.

To kick someone out of an LLC, follow the procedures outlined in your operating agreement. Generally, a proper vote or consensus among the remaining members is necessary. Once a decision is reached, create a Kansas General Form of Amendment to Partnership Agreement to document the member's removal officially. This protects your LLC from potential legal complications related to the removal.