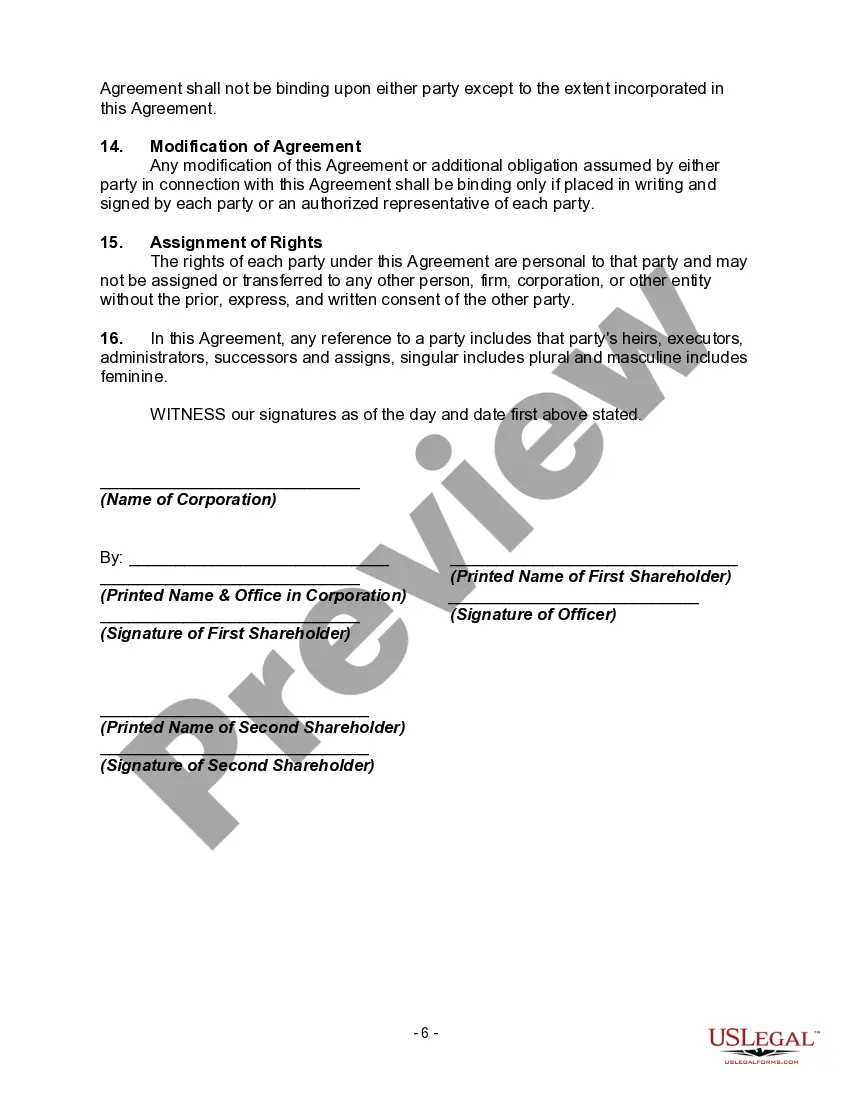

Kansas Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions

Description

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

How to fill out Shareholders' Agreement Between Two Shareholders Of Closely Held Corporation With Buy Sell Provisions?

You might invest numerous hours online attempting to locate the authentic document format that fulfills the federal and state requirements you require.

US Legal Forms offers thousands of authentic templates that are examined by experts.

You can acquire or print the Kansas Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy-Sell Provisions through their service.

If available, use the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the Kansas Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy-Sell Provisions.

- Every authentic document template you buy is yours permanently.

- To get another copy of an acquired form, go to the My documents section and click the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the correct document template for the state/city you choose.

- Check the form description to verify that you have selected the appropriate form.

Form popularity

FAQ

To qualify as a closely held corporation, a business must fit the following requirements:Have more than 50% of the value of its outstanding stock owned, directly or indirectly, by five or fewer individuals at any time during the last half of the tax year.Not be a personal service corporation1feff

Shareholders may own common voting shares, non-voting shares, or preferred shares, each conferring a different level of power over how a company is run or dictating how dividends are distributed.

Despite the above benefits, a closely held corporation also has some drawbacks, including: Raising capital. It is more difficult to use share equity to raise funds, since the shares of a closely held corporation are not listed on a public stock exchange for investors to purchase.

Close corporation taxation Close corporations are taxed as a C corporation unless the owners and shareholders decide to seek S corporation status from the IRS. This means the income of the corporation may be subject to double taxation.

Closely held corporations, where permitted, may be able to forgo filing information returns to the IRS annually. In addition, the closely held corporation may qualify as an S corporation for tax purposes, allowing income to be passed through to shareholders and/or owners.

Like any other corporate entity, if a closely held corporation meets IRS conditions for S corporation status, it can elect to be taxed as an S corp. by filing Election by a Small Business Corporation (Form 2553). If you do not make this election, the corporation is taxed as a C corporation.

Closely held company: It is a company in which the public are not substantially interested.

A shareholder agrees to vote its voting shares generally or in favour of a specific proposal and against any contrary proposal. Voting agreements are commonly used in business combination transactions to assure the purchaser that significant shareholders will vote to approve the subject transaction.

Unlike voting trusts, voting agreements can be for any duration and do not need to be filed with the corporation.

A Share Sale and Purchase Agreement is an agreement for the sale and purchase of a stated number of shares at an agreed price. The shareholder selling their shares is the seller and the party buying the shares is the buyer. This agreement details the terms and conditions of the sale and purchase of the shares.