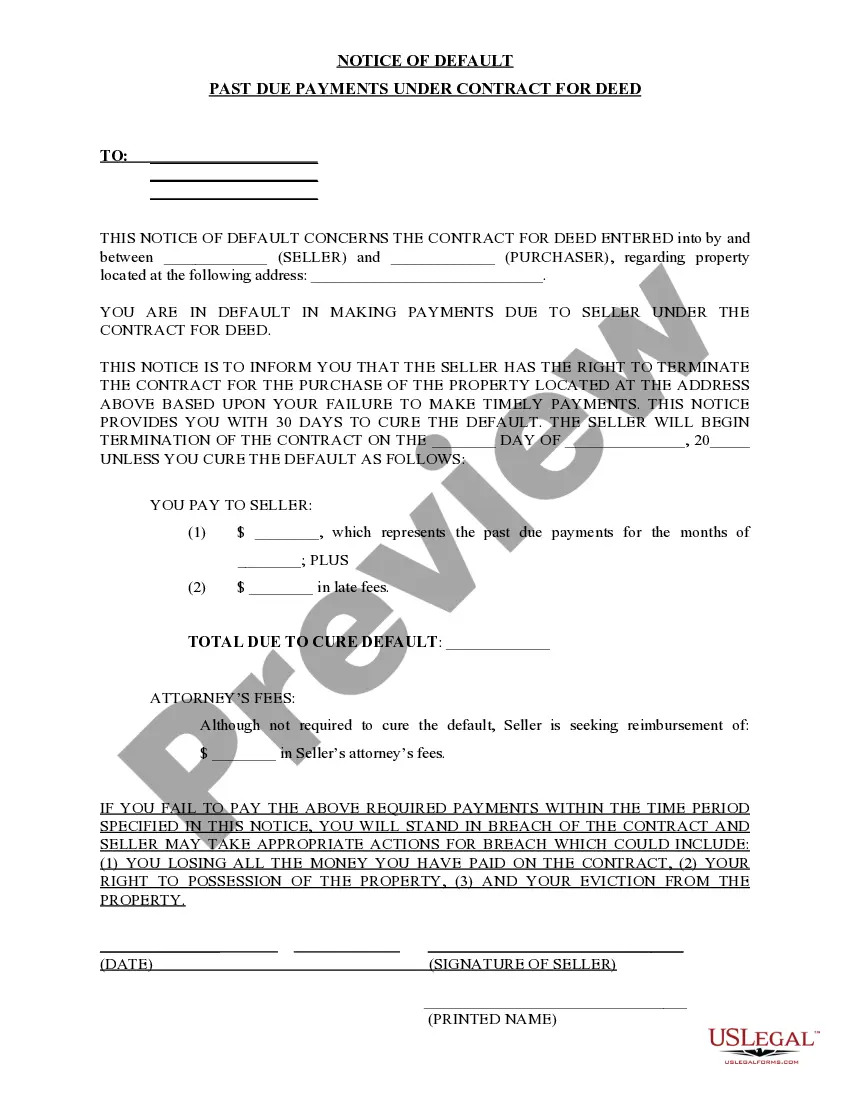

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Iowa Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Iowa Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to obtain a printable Iowa Notice of Default for Unpaid Payments associated with Contract for Deed.

Our legally admissible forms are composed and routinely refreshed by qualified attorneys.

Ours is the most comprehensive Forms collection on the web and provides economical and precise samples for consumers, legal practitioners, and small to medium-sized businesses.

- Documents are categorized by state-based divisions.

- Some forms may be previewed prior to download.

- To obtain templates, users must possess a subscription and must Log In to their account.

- Click Download next to any template you require and locate it in My documents.

- For those without a subscription, follow the instructions below to quickly find and download Iowa Notice of Default for Unpaid Payments associated with Contract for Deed.

- Ensure you select the correct form relating to the necessary state.

Form popularity

FAQ

Typically, a bank can take anywhere from several months to over a year to complete the foreclosure on a house. This duration is often influenced by the homeowner’s response to the Iowa Notice of Default for Past Due Payments in connection with Contract for Deed. Factors such as court availability and any disputes from the borrower can extend this timeline. To navigate this process effectively, turning to platforms like USLegalForms can provide essential legal guidance and support.

A legal notice of default is an official communication sent by a lender when a borrower fails to make timely payments. This notice serves as a formal warning regarding the borrower’s Iowa Notice of Default for Past Due Payments in connection with Contract for Deed. It outlines the amount owed and the actions the lender may take if the situation is not rectified. Understanding this document is vital, as it marks the start of the foreclosure process.

In Iowa, a borrower generally faces foreclosure after missing three consecutive payments, which triggers the Minnesota Notice of Default for Past Due Payments in connection with Contract for Deed. However, the exact timeline can vary based on the terms outlined in the contract. It's crucial to address payment issues as soon as possible to avoid stepping into foreclosure territory. Consulting resources such as USLegalForms can help guide you through your options.

The foreclosure process in Iowa typically lasts between six months to a year, depending on various factors such as court schedules and lender practices. It starts with the issuance of an Iowa Notice of Default for Past Due Payments in connection with Contract for Deed. Once this notice is served, the borrower has a specific timeframe to respond and rectify the missed payments before the legal proceedings continue. Engaging with legal experts or platforms like USLegalForms can provide clarity during this crucial period.

A notice of default on a land contract is a formal notification indicating that the buyer has failed to make timely payments as agreed in the contract. This document initiates the process for the seller to potentially reclaim the property. When you receive an Iowa Notice of Default for Past Due Payments in connection with a Contract for Deed, it is essential to respond promptly. Understanding your rights and obligations can help protect your interests in the property.

Writing a contract for deed involves outlining specific terms between the buyer and seller. Start by including essential details such as payment schedule, interest rate, and property description. It is crucial to incorporate clauses regarding the Iowa Notice of Default for Past Due Payments in connection with Contract for Deed. Using a reliable platform like uslegalforms can simplify this process, helping you create a legally sound document that protects both parties.

Upon the default of a buyer under a land sales contract, the seller should issue an Iowa Notice of Default for Past Due Payments, informing the buyer of the situation. This notice outlines the default, and the actions required to remedy it. It is vital for sellers to document this process properly to protect their rights. Utilizing resources such as US Legal Forms can streamline this process and provide essential documents.

The timeframe to foreclose on a house in Iowa varies, but it typically takes several months to complete the process. Factors such as the type of foreclosure and potential delays in court can affect the duration. It is crucial for sellers to understand timeframes to effectively manage defaults under a Contract for Deed. An Iowa Notice of Default for Past Due Payments can help expedite the situation.

Yes, a seller can back out of a Contract for Deed under specific circumstances, particularly if the buyer defaults on payments. However, the seller must follow the appropriate legal procedures, such as issuing an Iowa Notice of Default for Past Due Payments. This process protects the seller's interests while ensuring compliance with Iowa law. Legal guidance can assist sellers in making informed decisions.

Iowa Code 654.20 addresses the provisions related to Contracts for Deed. This statute outlines the rights of sellers and buyers in cases of default, ensuring all parties understand their obligations. It also underscores the importance of issuing an Iowa Notice of Default for Past Due Payments when necessary. Familiarizing yourself with this code can help in navigating potential disputes effectively.