Kansas Software Support Agreement

Description

Software is often divided into two categories: Systems Software includes the operating system and all the utilities that enable the computer to function; and Applications Software includes programs that do real work for users (e.g., word processors, spreadsheets, and database management systems).

How to fill out Software Support Agreement?

If you need to obtain, download, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require. Various templates for corporate and personal use are categorized by types, states, or keywords.

Employ US Legal Forms to acquire the Kansas Software Support Agreement in just a few clicks.

Every legal document template you acquire is yours permanently. You have access to all the forms you saved within your account. Click on the My documents section and select a form to print or download again.

Be proactive and download and print the Kansas Software Support Agreement using US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal requirements.

- If you are a current customer of US Legal Forms, Log In to your account and click the Obtain button to locate the Kansas Software Support Agreement.

- You can also access forms you have previously saved under the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review feature to examine the form’s details. Be sure to read the description.

- Step 3. If the form does not meet your needs, use the Search box at the top of the page to find alternative versions of the legal document template.

- Step 4. Once you have found the form you require, click the Purchase now button. Choose the payment plan you prefer and provide your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Kansas Software Support Agreement.

Form popularity

FAQ

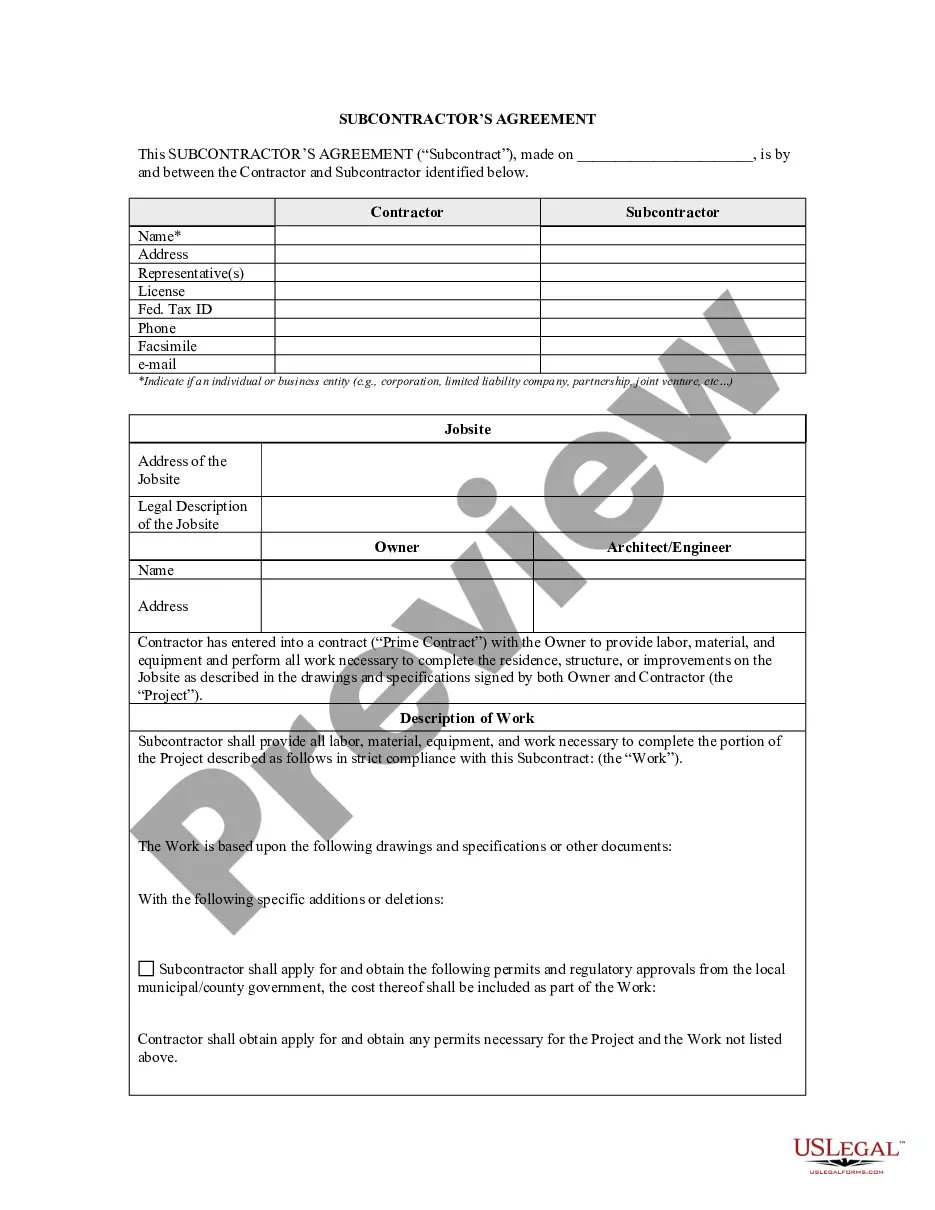

Filling out a contractor agreement begins by entering accurate information about both parties and the project details. Clearly outline the terms of service, payment structure, and any specific requirements tied to the Kansas Software Support Agreement. Checking premade templates from uslegalforms can streamline filling out this document, making it simple and efficient.

To create a simple contract agreement, state the parties involved and define the agreement's purpose in straightforward language. List the agreed terms, including any deadlines and payment conditions, ensuring alignment with the Kansas Software Support Agreement standards. Clear documentation is key to maintaining a good relationship and avoiding potential conflicts.

Writing your own service agreement involves starting with a clear identification of the parties and the services to be provided. Make sure to include terms of payment, service duration, and conditions, particularly the aspects mentioned in the Kansas Software Support Agreement. Consider exploring resources on platforms like uslegalforms to ensure your agreement covers essential legal aspects.

When writing a construction contract agreement, it is crucial to specify the project scope, materials, labor, and costs involved. Include timelines and deadlines, along with any relevant conditions from the Kansas Software Support Agreement. This ensures that all parties understand their responsibilities and reduces the risk of disputes.

A simple written agreement should clearly state the parties involved and the purpose of the agreement. Define the terms, including what each party expects from the other, ensuring it aligns with the Kansas Software Support Agreement guidelines. Clarity will prevent future misunderstandings, making the agreement easier to follow.

To fill out an agreement, start with the basic information such as names, addresses, and the nature of the contract. Expand on specific terms and conditions, ensuring they adhere to the Kansas Software Support Agreement framework. Utilizing legal forms through platforms like uslegalforms can simplify this process.

Filling out a contractor agreement involves clearly defining the terms of your project. Begin by outlining the scope, deliverables, and deadlines. Ensure to include payment details and any conditions related to the Kansas Software Support Agreement—this makes your responsibilities clear and protects both parties.

When working with a contractor, you typically need to fill out a Kansas Software Support Agreement, which includes basic details such as project scope, payment terms, and timelines. Additionally, contracts might require forms like W-9 for tax purposes. Using platforms like uslegalforms can help streamline this process by providing templates and guidance.

Typically, SaaS services are taxable in many regions, including Kansas, treating the software as a sale of property rather than a service. However, tax regulations can vary widely and may change. It is beneficial to refer to a Kansas Software Support Agreement for guidance on your specific situation. Staying informed helps you manage your business’s finances more effectively.

Yes, in Kansas, many IT services are subject to sales tax, including those related to software installation and maintenance. However, not all IT services may be taxed, so understanding the specifics is vital. Utilizing a Kansas Software Support Agreement can clarify which services are taxable. Ensure you are informed to manage costs effectively.