Kansas Disputed Open Account Settlement

Description

How to fill out Disputed Open Account Settlement?

Are you currently in the location where you require documents for either business or personal purposes almost every time.

There are numerous authentic document templates accessible online, but locating those you can trust is not simple.

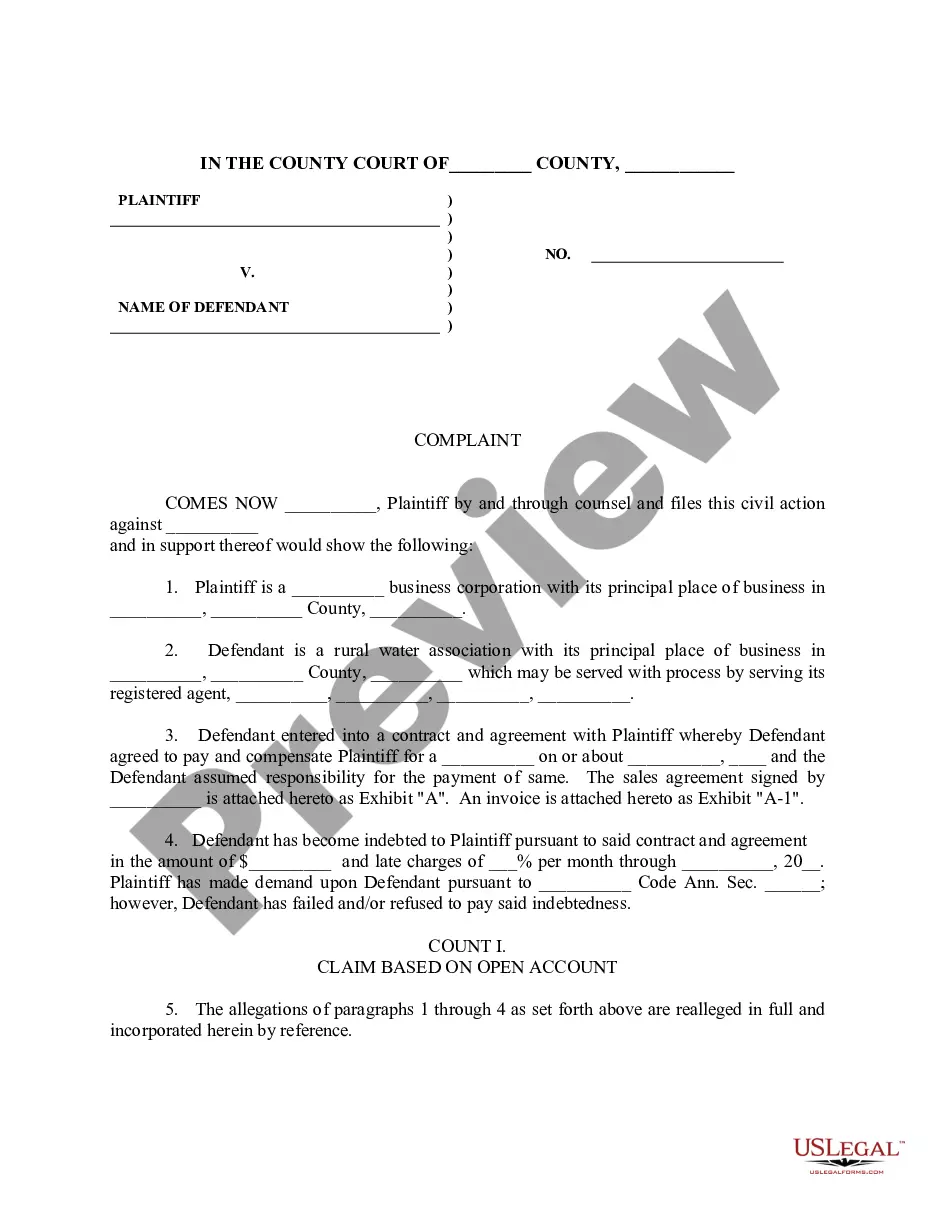

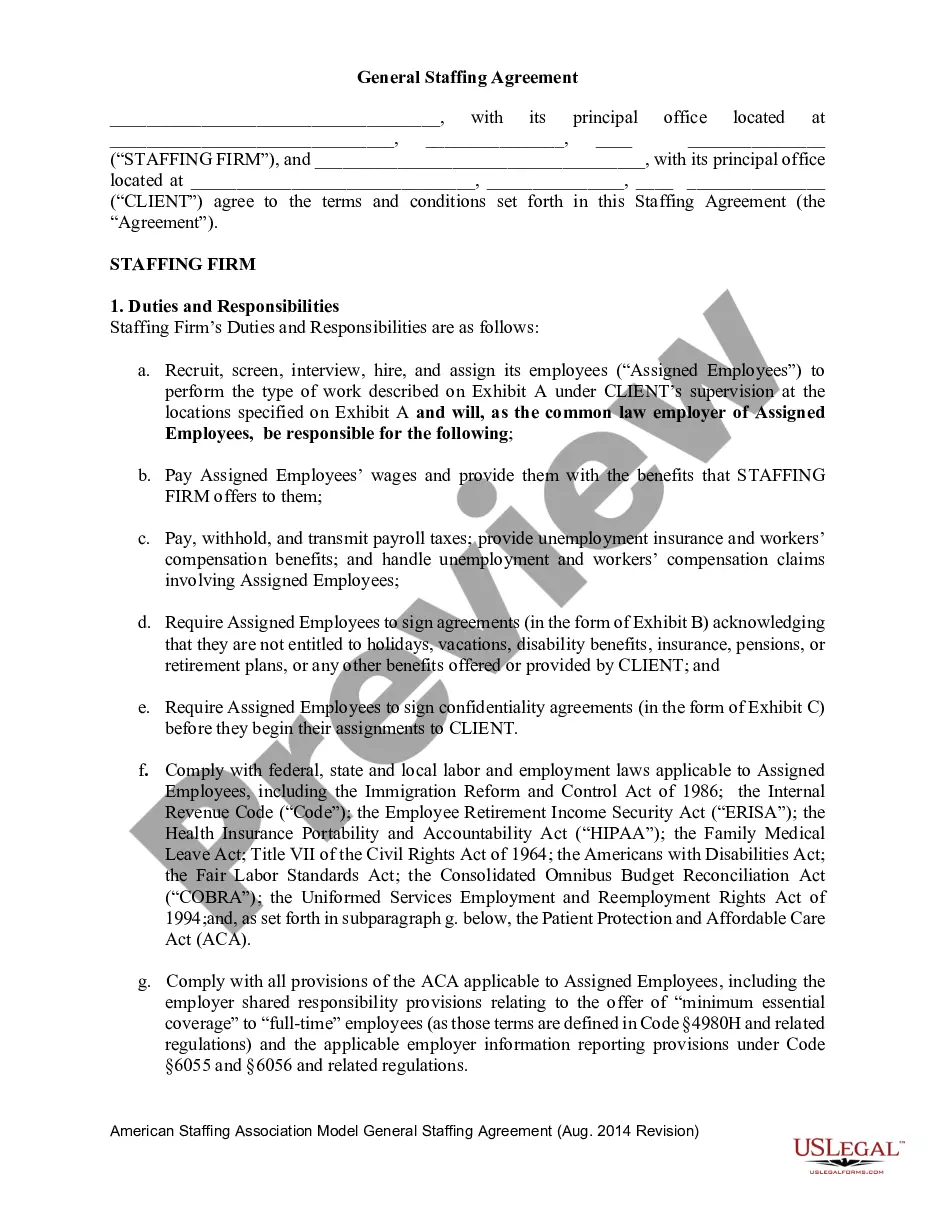

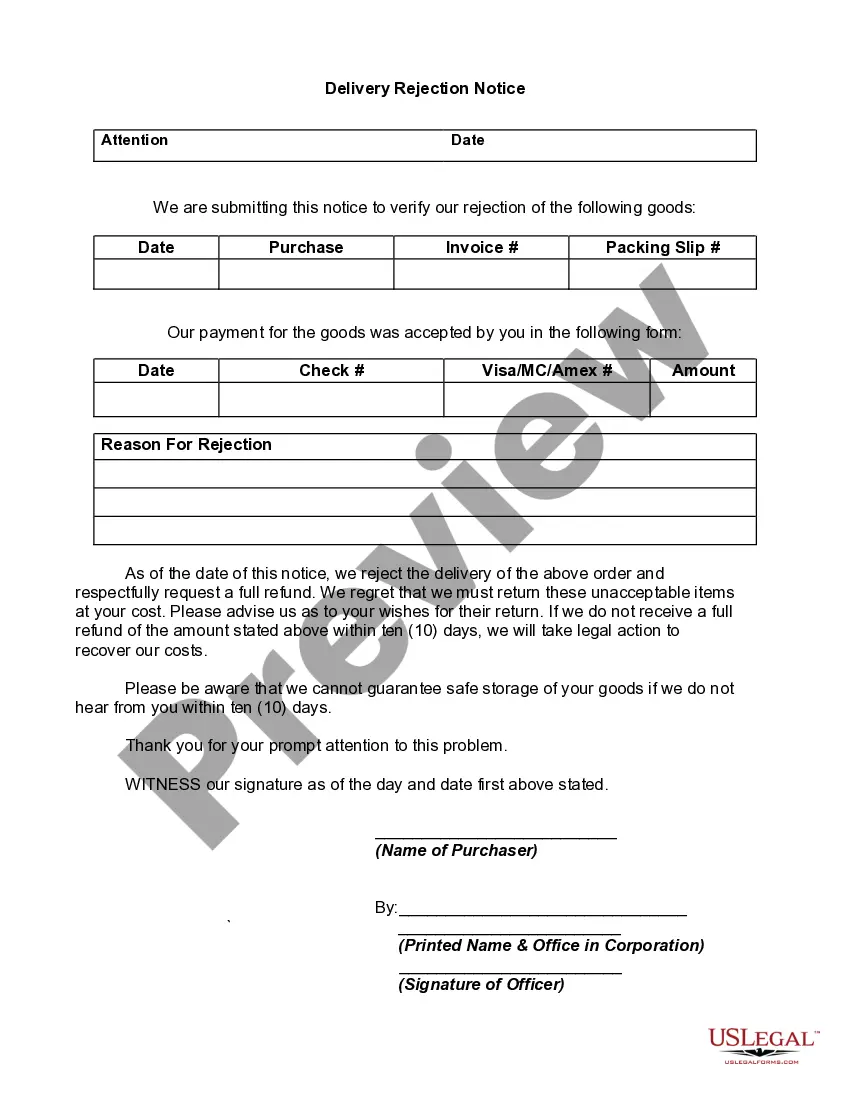

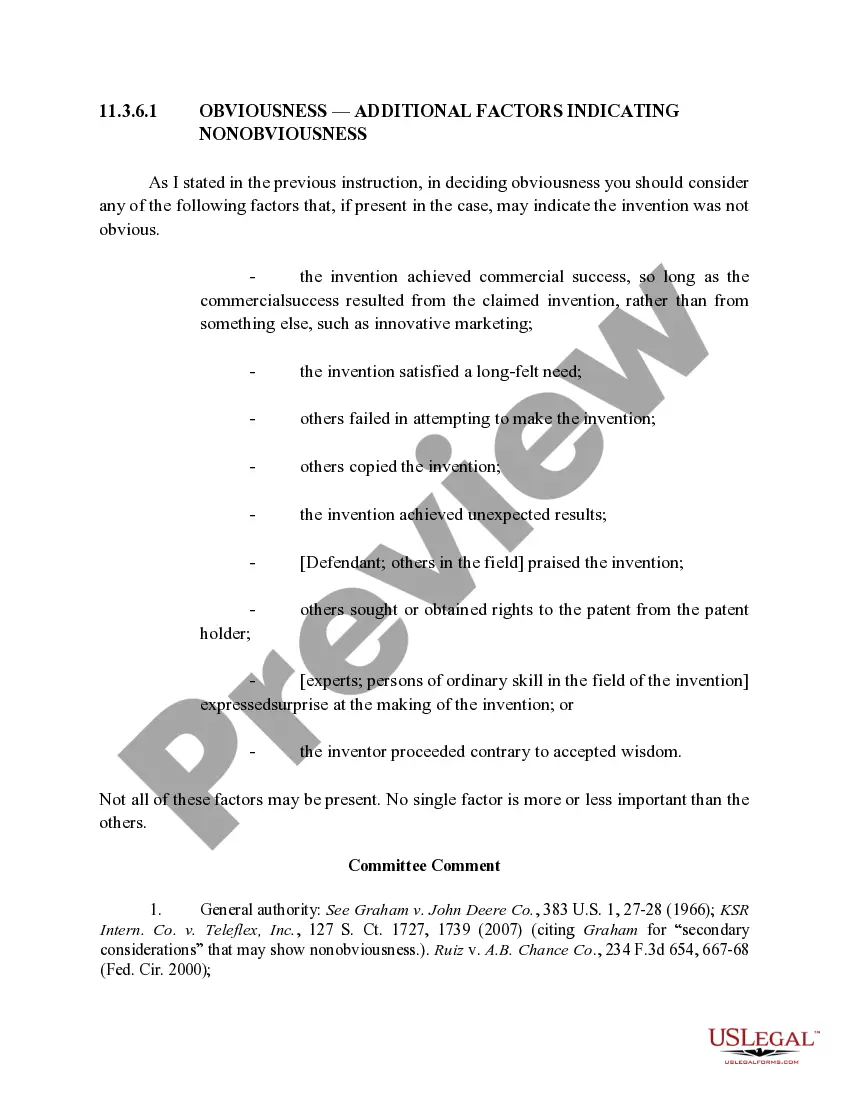

US Legal Forms offers thousands of template documents, including the Kansas Disputed Open Account Settlement, that are designed to comply with federal and state regulations.

When you locate the appropriate form, click Acquire now.

Choose the pricing plan you need, fill out the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kansas Disputed Open Account Settlement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for your correct area/county.

- Use the Preview button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

The Kansas Treasury Offset Program (KTOP) collects delinquent accounts receivable by matching State of Kansas debt against federal non-tax payments.

If you believe you already paid the debt, do not owe the debt, the amount is incorrect, or that it's not even your debt, you may send a written request to the debt collector to dispute the debt or receive more information.

Removing a settled account from your credit report isn't easy, but it is possible with some effort and persistence. If the original creditor or collection agency won't agree to remove the account, file a dispute with one of the three major bureaus.

You can dispute settled accounts with the credit bureaus by submitting a dispute letter. The FCRA requires the bureaus to investigate any dispute within 30 days. When writing dispute letters: Dispute online or via certified mail.

Unless the information reported to the credit bureaus is incorrect, you won't be able to remove the settled account from your credit report. You can try to negotiate with the creditor, but legally the debt can stay on your credit report, regardless of payment status.

(785) 296-4500 The Kansas Treasury Offset Program (KTOP) does not have detailed information regarding debts and will only be able to provide callers with the contact name and phone number of the creditor agency to which their debt is owed, as well as the debt amount.

Typically, a closed account can only be removed from your credit report if it is an error. For example, suppose an account was closed because the information was listed incorrectly. In that case, you can file a dispute to have it removed.

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts.