The Fair Credit Reporting Act regulates the use of information on a consumer's personal and financial condition. The most typical transaction which this Act would cover would be where a person applies for a personal loan or other consumer credit. Consumer credit is credit for personal, family, or household use, and not for business or commercial transactions. The purpose of the Act is to insure that consumer information obtained and used is done in such a way as to insure its confidentiality, accuracy, relevancy and proper utilization. Credit reporting bureaus are not permitted to disclose information to persons not having a legitimate use for this information. It is a federal crime to obtain or to furnish a credit report for an improper purpose.

Kansas Complaint by Consumer against Wrongful User of Credit Information

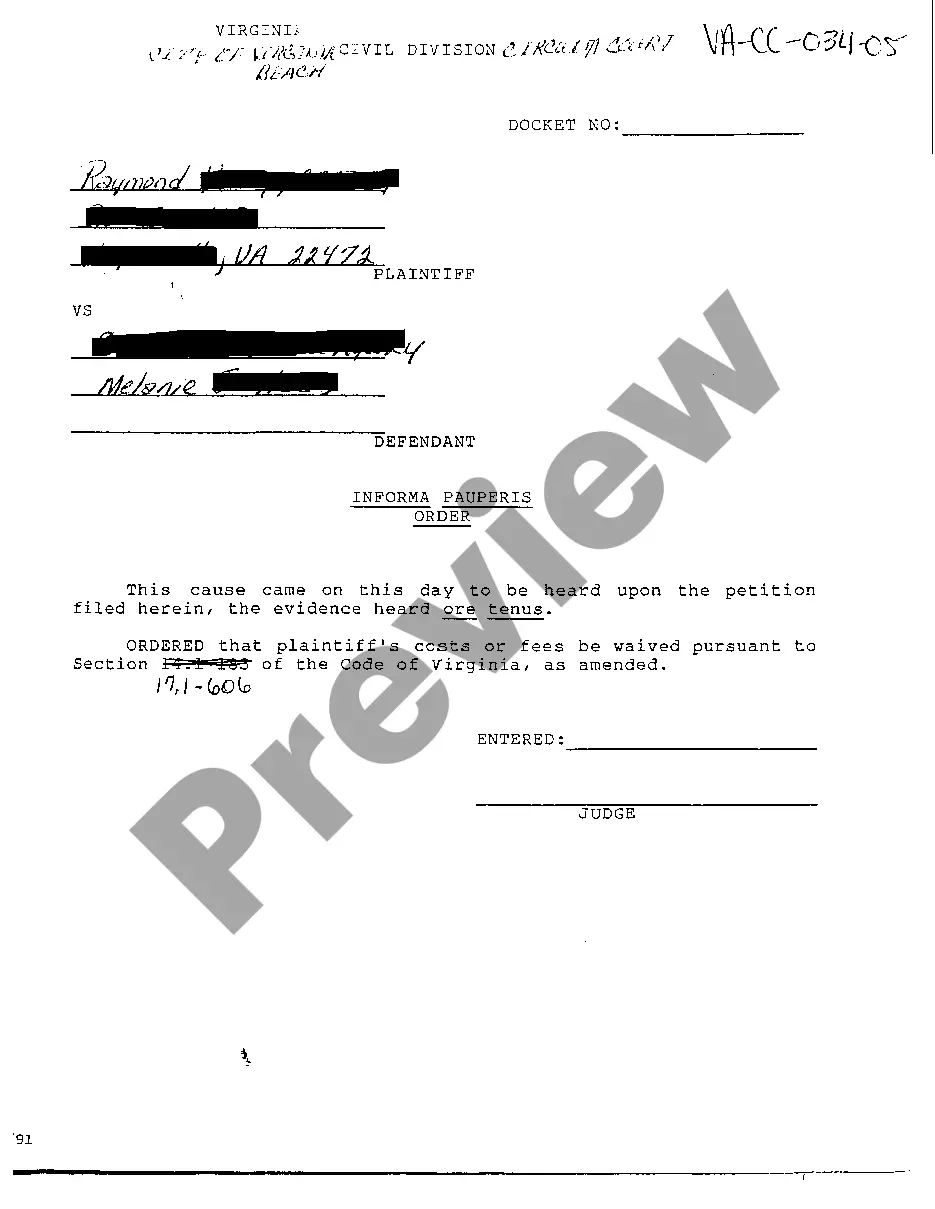

Description

How to fill out Complaint By Consumer Against Wrongful User Of Credit Information?

US Legal Forms - one of the largest libraries of authorized varieties in America - delivers a wide range of authorized papers templates it is possible to down load or print out. Making use of the internet site, you will get a large number of varieties for enterprise and individual purposes, categorized by classes, says, or keywords and phrases.You can get the most up-to-date variations of varieties just like the Kansas Complaint by Consumer against Wrongful User of Credit Information in seconds.

If you currently have a monthly subscription, log in and down load Kansas Complaint by Consumer against Wrongful User of Credit Information from the US Legal Forms catalogue. The Obtain option can look on each and every type you look at. You gain access to all earlier delivered electronically varieties from the My Forms tab of the bank account.

In order to use US Legal Forms initially, allow me to share basic guidelines to get you started:

- Be sure you have selected the best type to your city/region. Click the Preview option to review the form`s content. See the type explanation to ensure that you have chosen the proper type.

- When the type doesn`t satisfy your needs, make use of the Look for area on top of the screen to find the one which does.

- If you are pleased with the shape, verify your choice by clicking on the Purchase now option. Then, choose the rates prepare you favor and offer your references to register to have an bank account.

- Method the deal. Make use of credit card or PayPal bank account to accomplish the deal.

- Find the formatting and down load the shape in your product.

- Make changes. Complete, modify and print out and sign the delivered electronically Kansas Complaint by Consumer against Wrongful User of Credit Information.

Every design you added to your money does not have an expiration particular date which is yours forever. So, if you want to down load or print out another version, just go to the My Forms section and then click on the type you need.

Obtain access to the Kansas Complaint by Consumer against Wrongful User of Credit Information with US Legal Forms, probably the most considerable catalogue of authorized papers templates. Use a large number of expert and condition-particular templates that fulfill your organization or individual needs and needs.

Form popularity

FAQ

The statute of limitations under the KCPA is three years. Many KCPA violations do not require proof of intent on the part of suppliers to be actionable under the law. This makes it easier for you to pursue a legal remedy.

Statutes of limitations for each state (in number of years) StateWritten contractsOpen-ended accounts (including credit cards)Kansas53Kentucky155Louisiana103Maine6647 more rows ?

FDCPA ? Fair Debt Collection Practices Act Prohibits third-party debt collectors from employing deceptive or abusive conduct in the collection of consumer debts incurred for personal, family or household purposes. This Act does not pertain to financial institutions that collect debt that they originated.

The Attorney General's Office provides legal services to state agencies and boards, promotes open and accountable government, issues Attorney General's Opinions, protects consumers from fraud, assists the victims of crime and defends the state in civil proceedings.

If you wish to file a complaint by phone please call 785-296-1270.

Summary: The Fair Debt Buying Practices Act would establish clear procedures, minimum documentation requirements, and affirmative obligations before a debt buyer can contact a debtor, initiate a lawsuit, or obtain and collect on a judgment.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.

FDCPA ? Fair Debt Collection Practices Act Prohibits third-party debt collectors from employing deceptive or abusive conduct in the collection of consumer debts incurred for personal, family or household purposes. This Act does not pertain to financial institutions that collect debt that they originated.