Kansas Option to Purchase Stock - Long Form

Description

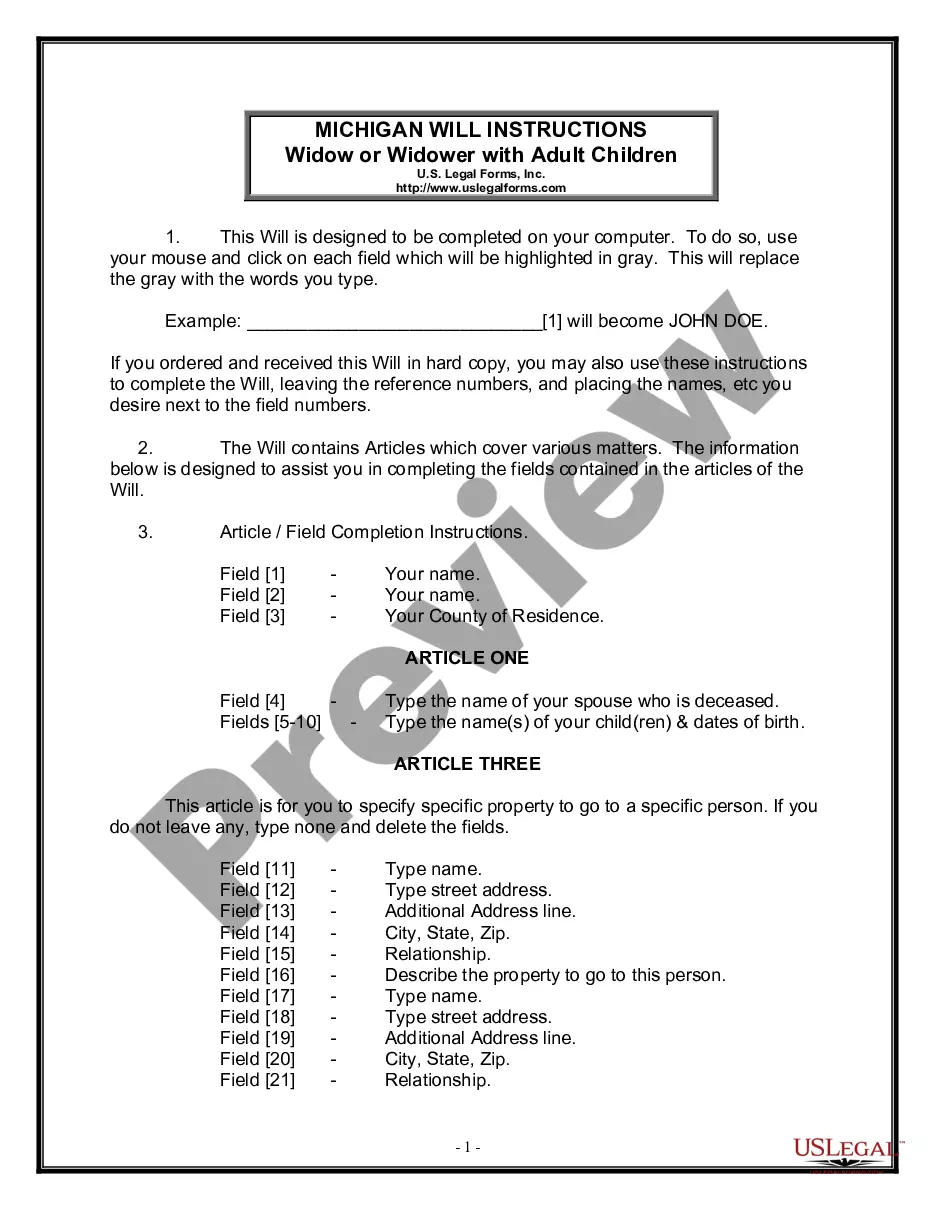

How to fill out Option To Purchase Stock - Long Form?

Locating the appropriate legal document template can be challenging.

Certainly, there are numerous online templates available on the web, but how can you obtain the legal form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some straightforward steps you can follow: First, ensure you have selected the correct form for your location/state. You can preview the form using the Preview option and read the form description to confirm it is the suitable one for you.

- The service offers thousands of templates, such as the Kansas Option to Purchase Stock - Long Form, that can be utilized for both business and personal purposes.

- All forms are vetted by experts and adhere to federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Kansas Option to Purchase Stock - Long Form.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the document you need.

Form popularity

FAQ

Investors can establish long positions in securities such as stocks, mutual funds, or currencies, or even in derivatives such as options and futures. Holding a long position is a bullish view. A long position is the opposite of a short position (also known simply as "short").

Options are derivatives of financial securitiestheir value depends on the price of some other asset. Examples of derivatives include calls, puts, futures, forwards, swaps, and mortgage-backed securities, among others.

term holding period is one year or more with no expiration. Any investments that have a holding of less than one year will be shortterm holds.

Since a single option contract usually represents100 shares, to run this strategy, you must own at least 100 shares for every call contract you plan to sell. As a result of selling (writing) the call, you'll pocket the premium right off the bat.

In writing a call option, the seller (writer) of the call option gives the right to the buyer (holder) to buy an asset by a certain date at a certain price. A writing call option can be done through two different ways viz. writing a covered call and writing a naked call.

Long call option: A long call option is, simply, your standard call option in which the buyer has the right, but not the obligation, to buy a stock at a strike price in the future. The advantage of a long call is that it allows you to plan ahead to purchase a stock at a cheaper price.

Traders write an option by creating a new option contract that sells someone the right to buy or sell a stock at a specific price (strike price) on a specific date (expiration date). In other words, the writer of the option can be forced to buy or sell a stock at the strike price.

You initiate a long trade when you buy an asset with the expectation to sell it at a higher price in the future and make a profit. A short trade is initiated by borrowing an asset to sell it, with the intent to repurchase it at a lower price, take a profit, and return the shares to the owner.

Going long or shortIf you believe an asset is going to rise in price, you can buy a position in that asset through a spread bet. This is known as going long.

An option writer, also known as a granter or seller, is someone who sells an option and collects a premium from the buyer, by opening a position. The answer to who is option writer is that it is someone who creates a new options contract and sells it to a trader seeking to buy that contract.