Kansas Option to Purchase Stock - Short Form

Description

How to fill out Option To Purchase Stock - Short Form?

If you need to thorough, obtain, or create valid document templates, utilize US Legal Forms, the largest selection of valid forms, accessible online.

Leverage the site’s simple and convenient search to find the documents you require.

Many templates for business and individual purposes are organized by categories and states, or keywords. Use US Legal Forms to acquire the Kansas Option to Purchase Stock - Short Form in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you obtained in your account. Go to the My documents section and choose a form to print or download again.

Compete and download, and print the Kansas Option to Purchase Stock - Short Form with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Kansas Option to Purchase Stock - Short Form.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

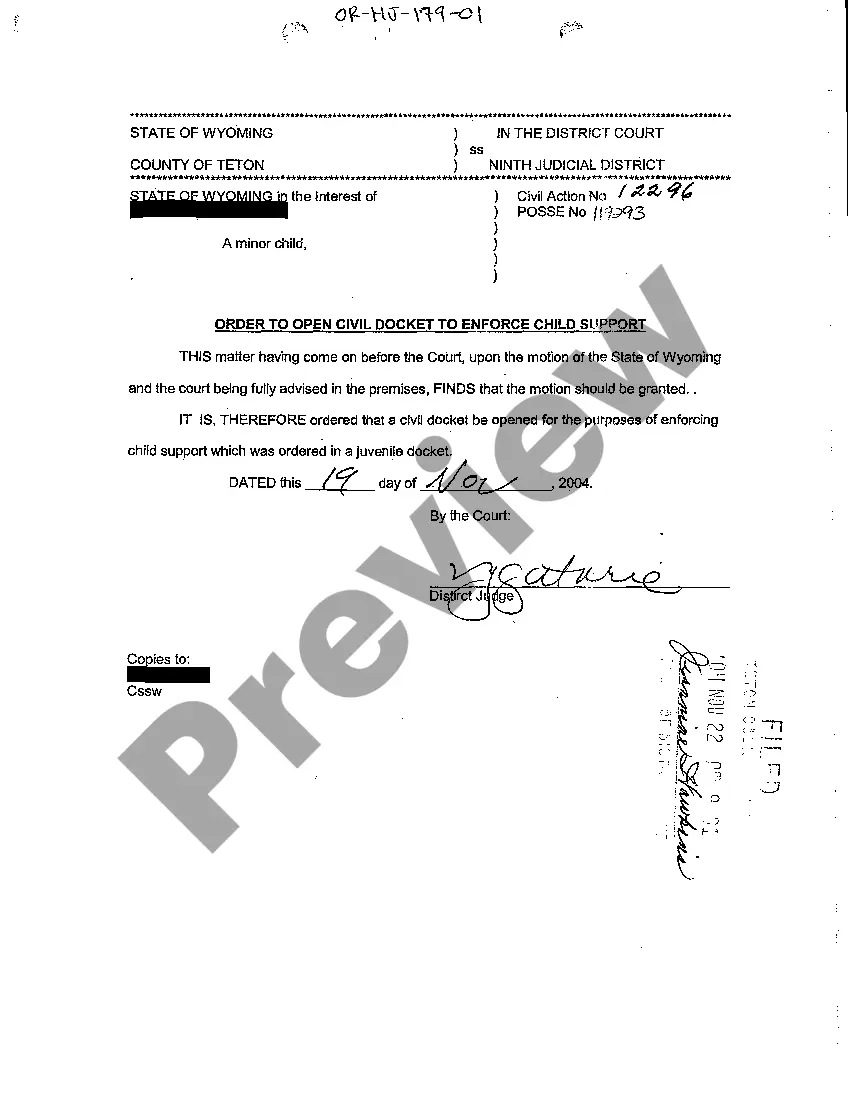

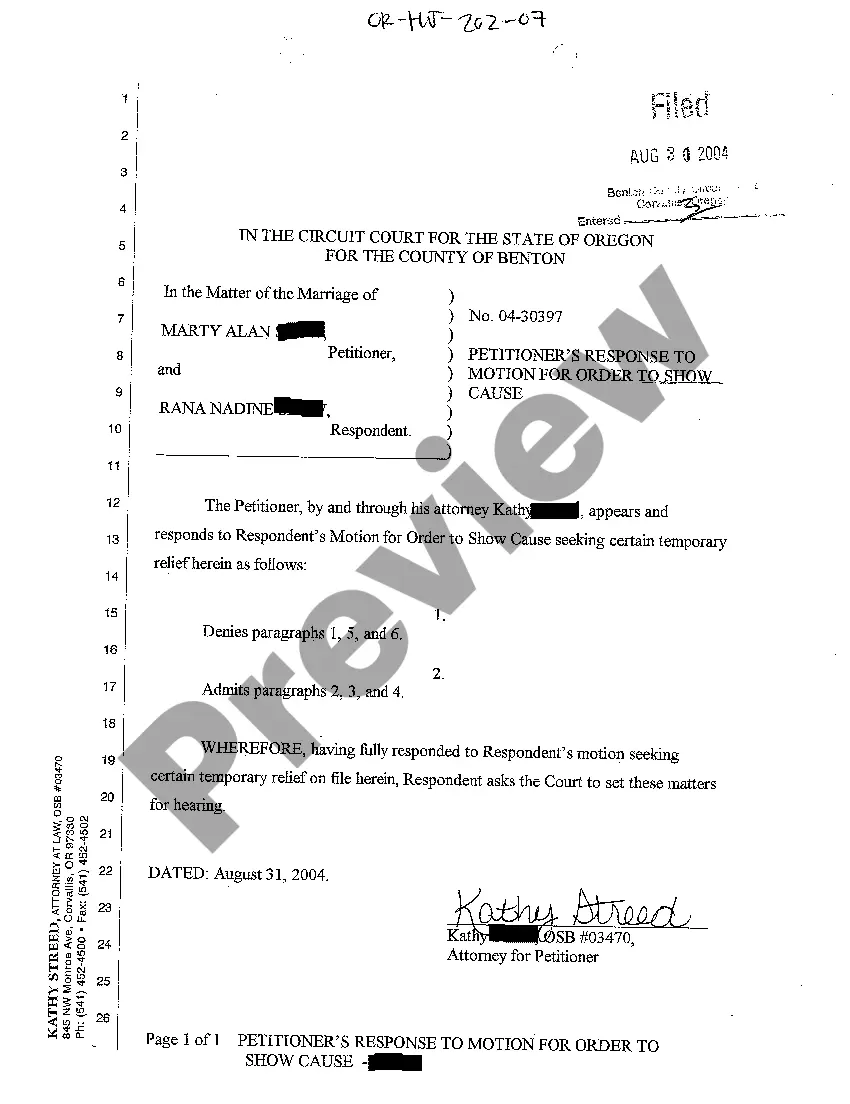

- Step 2. Utilize the Preview option to review the form’s contents. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Kansas Option to Purchase Stock - Short Form.

Form popularity

FAQ

The Short Position is a technique used when an investor anticipates that the value of a stock will decrease in the short term, perhaps in the next few days or weeks. In a short sell transaction the investor borrows the shares of stock from the investment firm to sell to another investor.

How to Short a Stock in Five StepsOpen a Margin Account With Your Brokerage Firm.Identify the Type of Account You Want to Open.Direct Your Broker to Execute a Short Sale on a Specific Stock.Make Sure You Know the Rules Before You Sign Off on the Short Sale Order.Buy the Stock Back and Pay Off the Loan.

Short selling is when a trader borrows shares from a broker and immediately sells them with the expectation that the stock price will fall shortly after. If it does, the trader can buy the shares back at the lower price, return them to the brokerage and keep the difference as profit.

The traditional way of shorting involves borrowing shares from your broker and selling them in the open market. Clearly, you want the value of the stock to decline, so you can buy the shares back at a lower price. Your profit is simply the price sold minus the price purchased pretty straightforward.

A short position in a put option is called writing a put. Traders who do so are generally neutral to bullish on a particular stock in order to earn premium income. They also do so to purchase a company's stock at a price lower than its current market price.

A "short" position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value. If the price drops, you can buy the stock at the lower price and make a profit.

Long Put Strategy vs.A long put option is similar to a short stock position because the profit potentials are limited. A put option will only increase in value up to the underlying stock reaching zero. The benefit of the put option is that risk is limited to the premium paid for the option.

This means you're going long on a put on Company A's stock, while the seller is said to be short on the put. A short put, on the other hand, occurs when you write or sell a put option on an asset.

The cost of borrowing a stock to short can vary but typically ranges from 0.3% to 3% per year. The fees are applied on a daily basis. The borrowing fee can be much higher than 3%, and can even exceed 100% in extraordinary cases, as it is influenced by multiple factors.

To short sell, investors borrow shares that they believe are poised for a drop in value. The shares are sold in the public market, where if all goes well they do, in fact, lose value. The investor then buys the shares back in the open market at the lower price, and returns the borrowed shares to the broker.