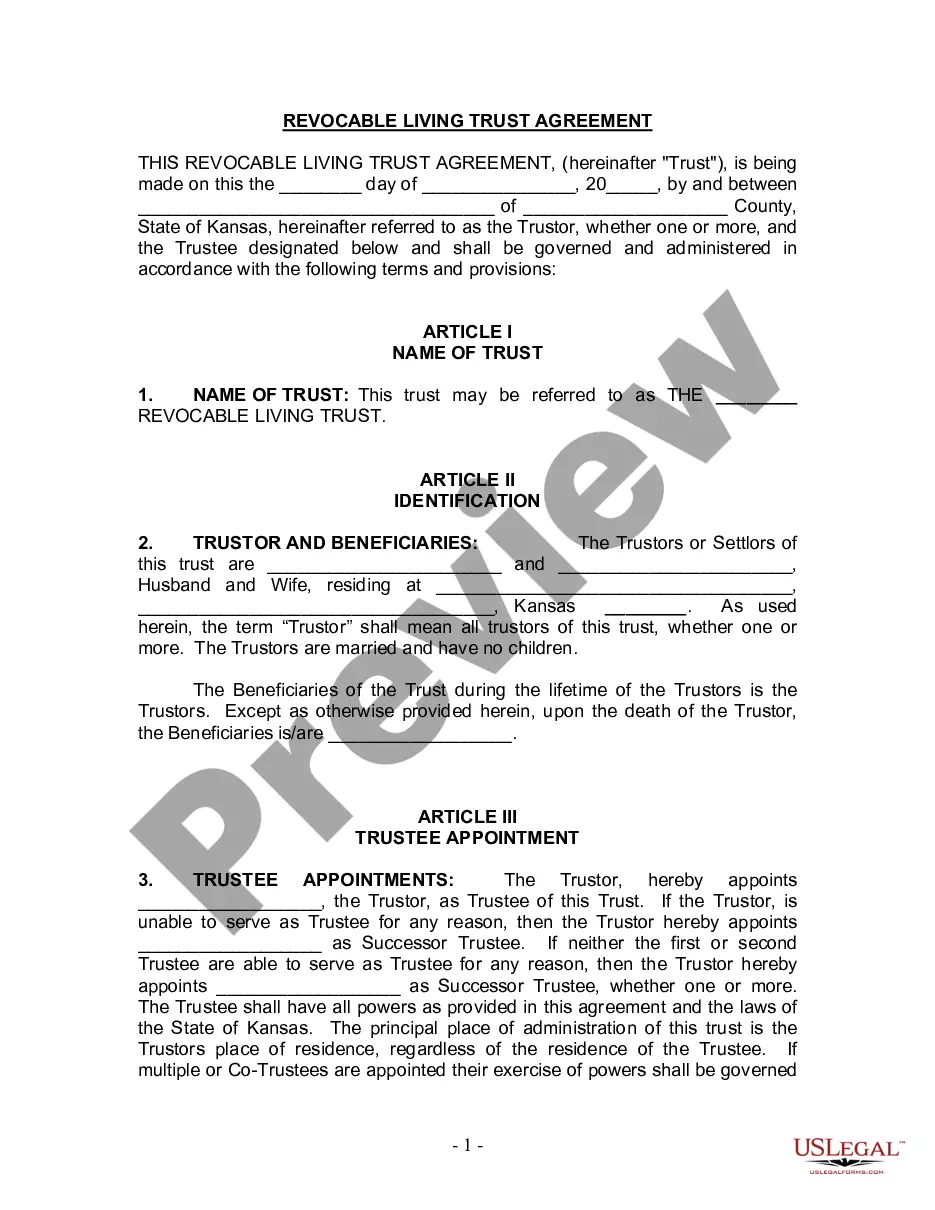

Kansas Living Trust for Husband and Wife with No Children

Description

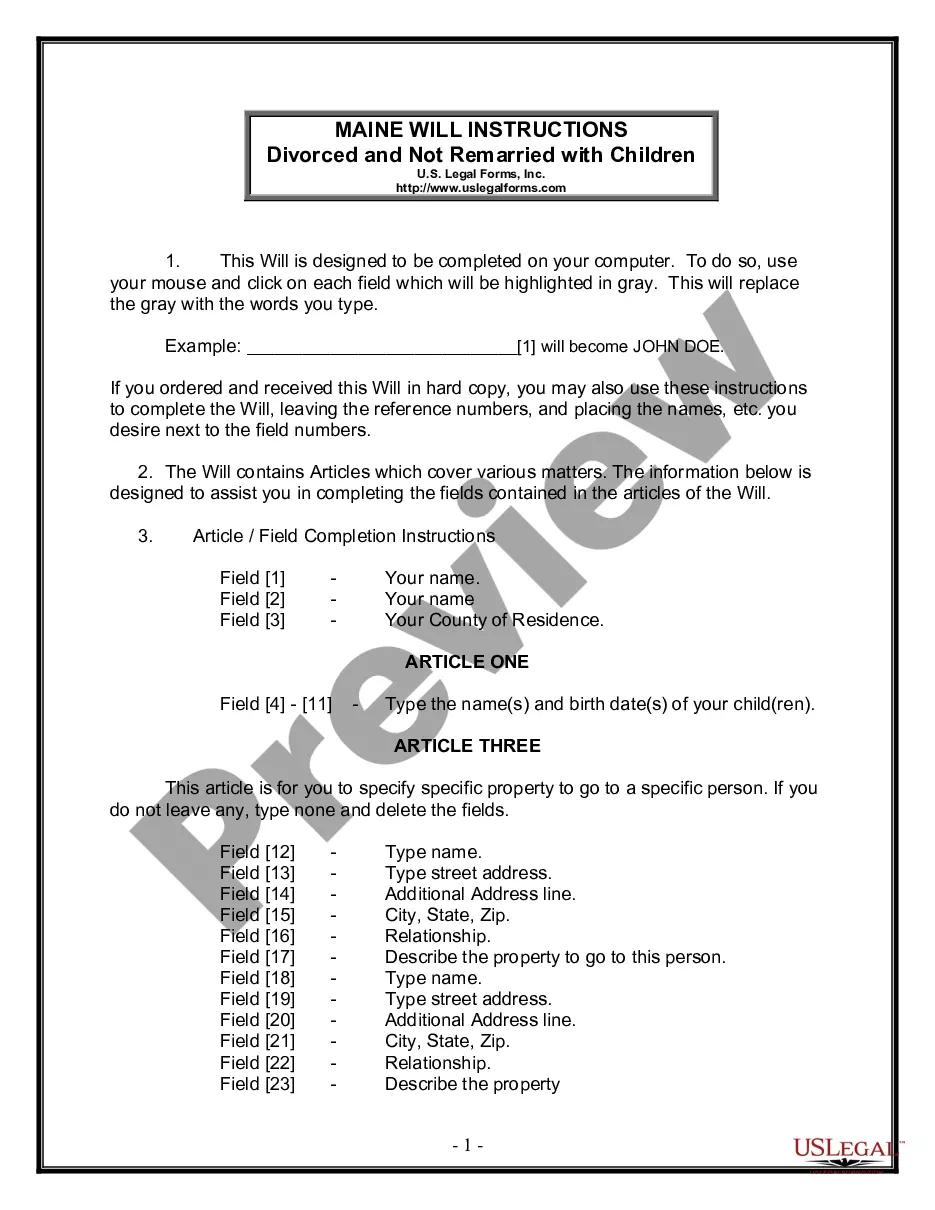

How to fill out Kansas Living Trust For Husband And Wife With No Children?

Attempting to locate a Kansas Living Trust for Married Couples with No Offspring template and completing it can be challenging.

To save substantial time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your state in just a few clicks.

Our attorneys prepare all documents, so you only need to fill them in. It's truly that simple.

Choose your payment method with a credit card or via PayPal. Download the form in your chosen file format. You can now either print the Kansas Living Trust for Married Couples with No Children template or complete it using any online editor. No need to worry about typographical errors because your template can be utilized and submitted as many times as you wish. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Access your account through this link and return to the form's webpage to save the template.

- Your saved forms can be found in My documents and are available anytime for future use.

- If you haven't signed up yet, you should create an account.

- Review our comprehensive instructions on how to obtain your Kansas Living Trust for Married Couples with No Children form in just a few minutes.

- To obtain a qualified form, verify its relevance to your state.

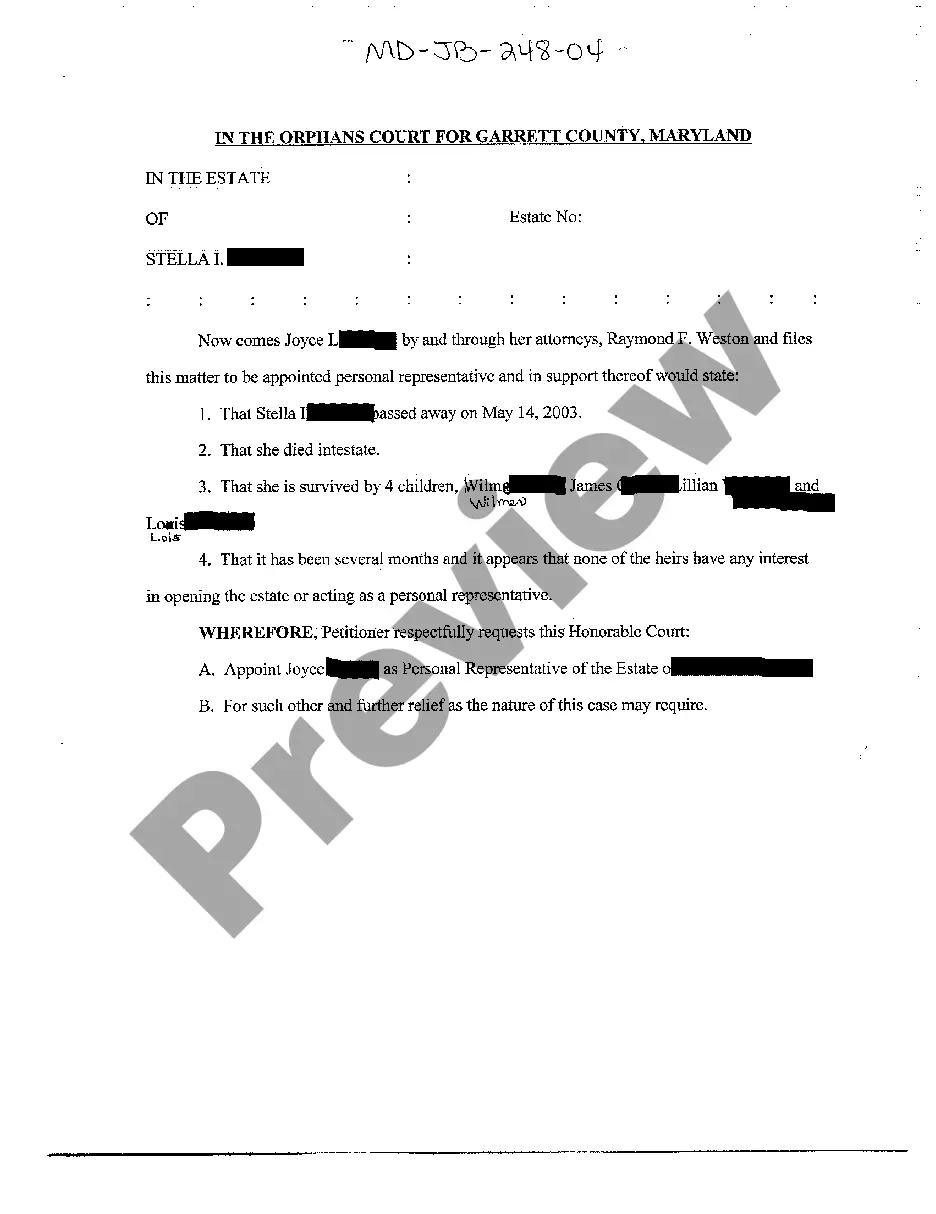

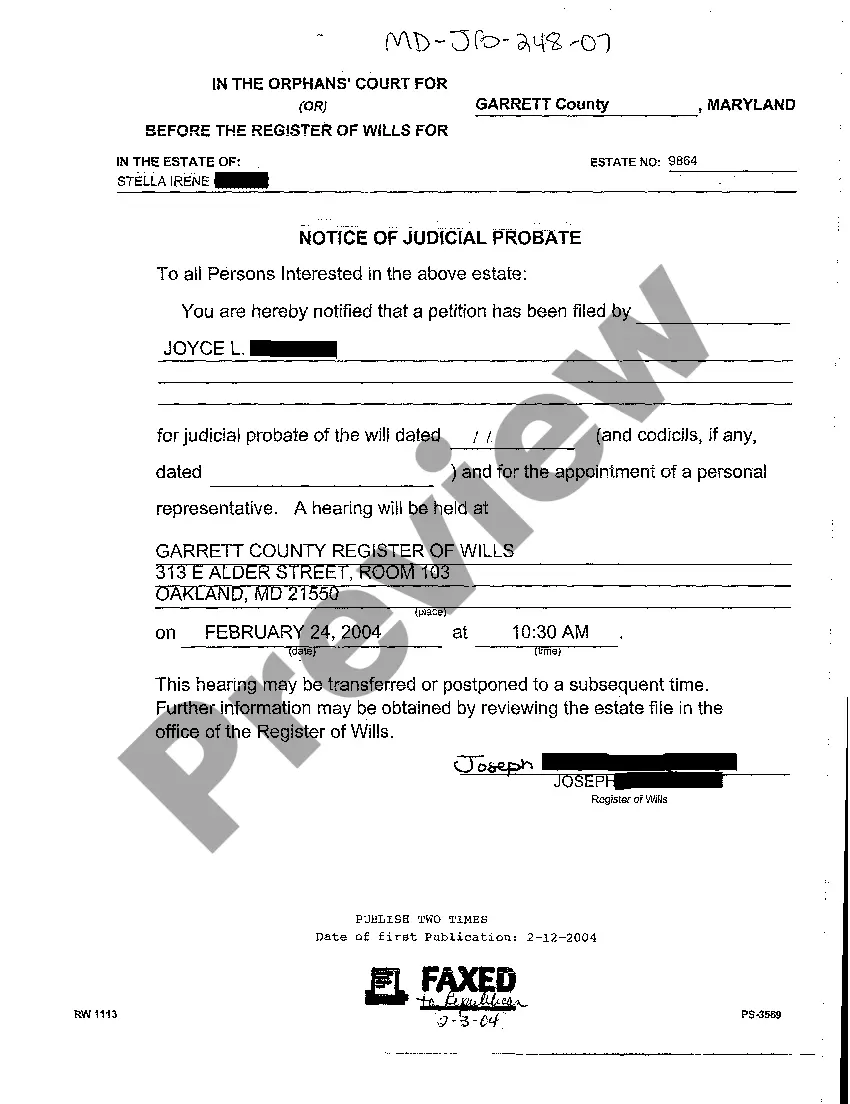

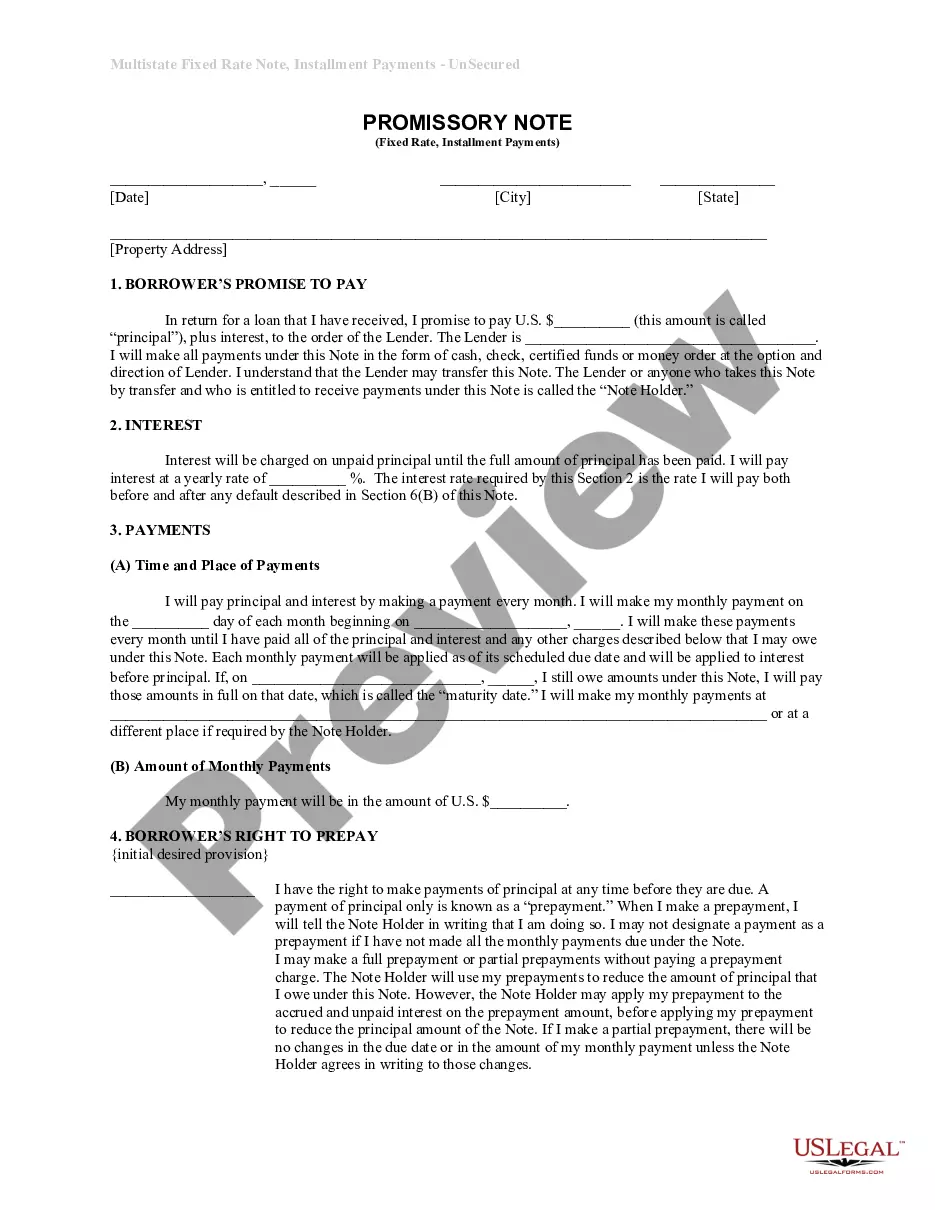

- Examine the illustration using the Preview feature (if available).

- If there is a description, read it to understand the details.

- Click on the Buy Now button if you've found what you're looking for.

Form popularity

FAQ

When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.Because the surviving spouse becomes the outright owner of the property, he or she will need a Will to direct its disposition at his or her subsequent death.

Under Hindu Law: the wife has a right to inherit the property of her husband only after his death if he dies intestate. Hindu Succession Act, 1956 describes legal heirs of a male dying intestate and the wife is included in the Class I heirs, and she inherits equally with other legal heirs.

Select the type of trust that best suits your current situation. Take inventory on your property. Select your trust's trustee. Create a trust document. Sign the trust document in front of a notary public. Fund the trust by transferring property and assets into it.

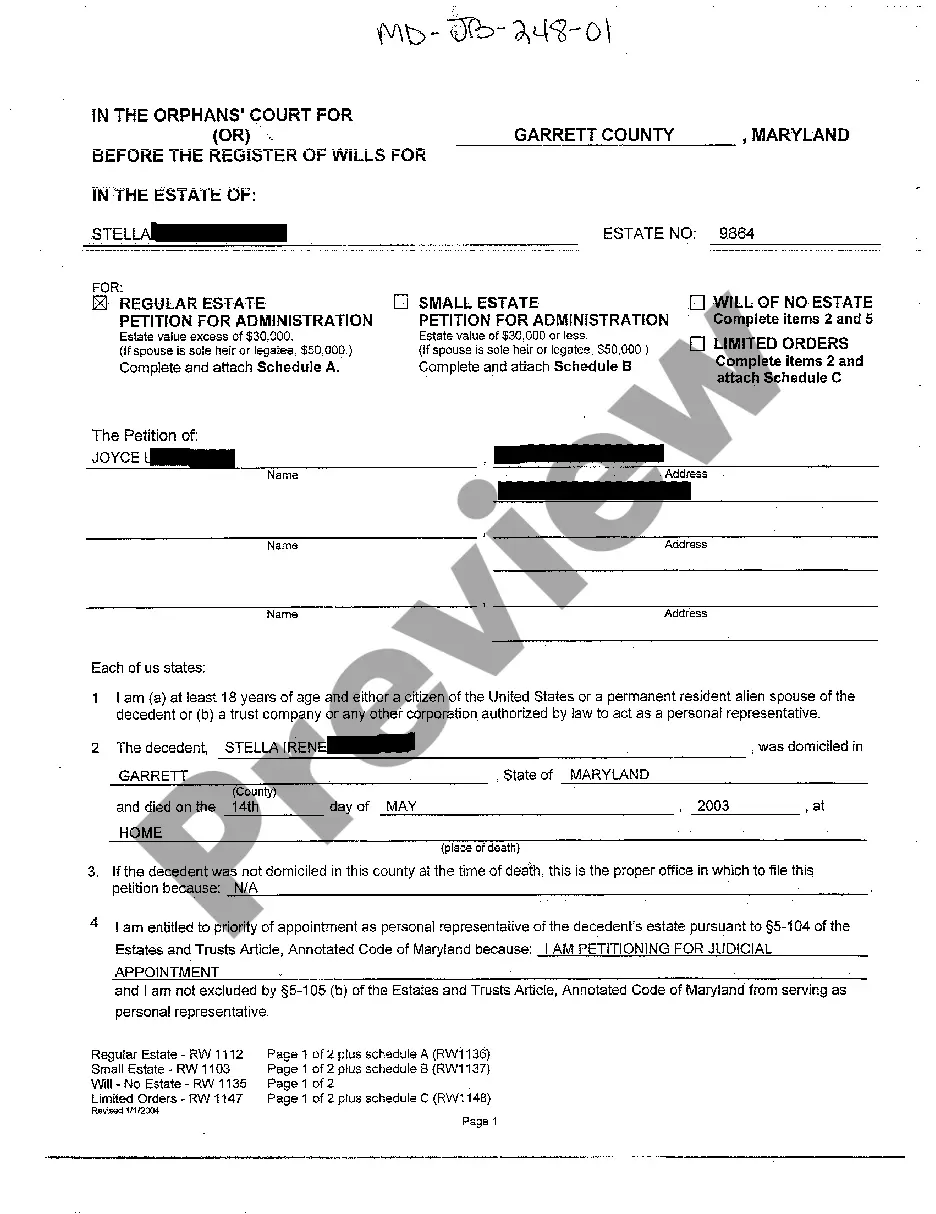

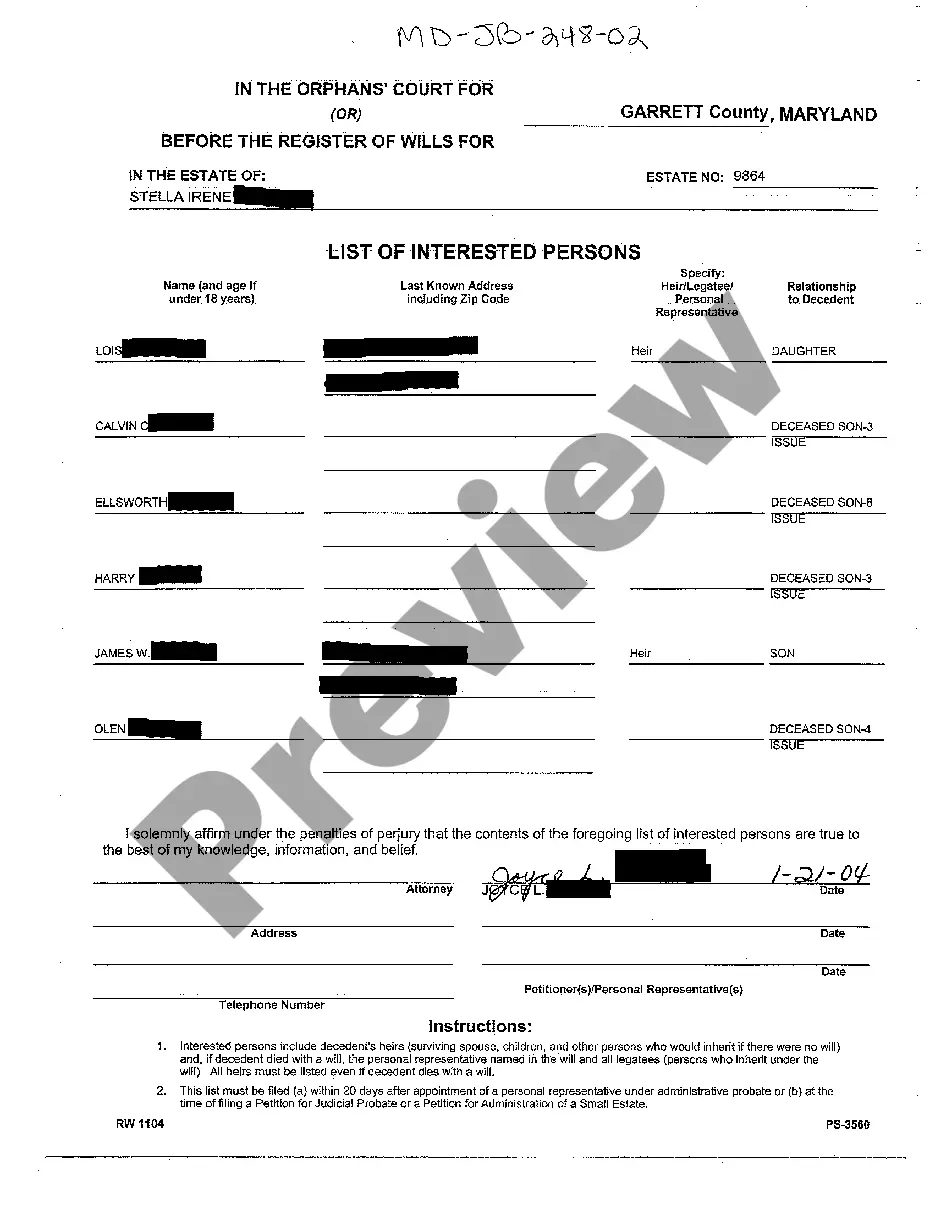

Probate proceedings are usually only required if the deceased person owned any assets in their name only.Kansas also offers a simplified probate procedure. However, if the affidavit procedure has been used, there is no need to use this process.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

Married partners and civil partners. Married partners or civil partners inherit under the rules of intestacy only if they are actually married or in a civil partnership at the time of death. So if you are divorced or if your civil partnership has been legally ended, you can't inherit under the rules of intestacy.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

In Kansas, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).