This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Indiana Last Will and Testament with All Property to Trust called a Pour Over Will

Description

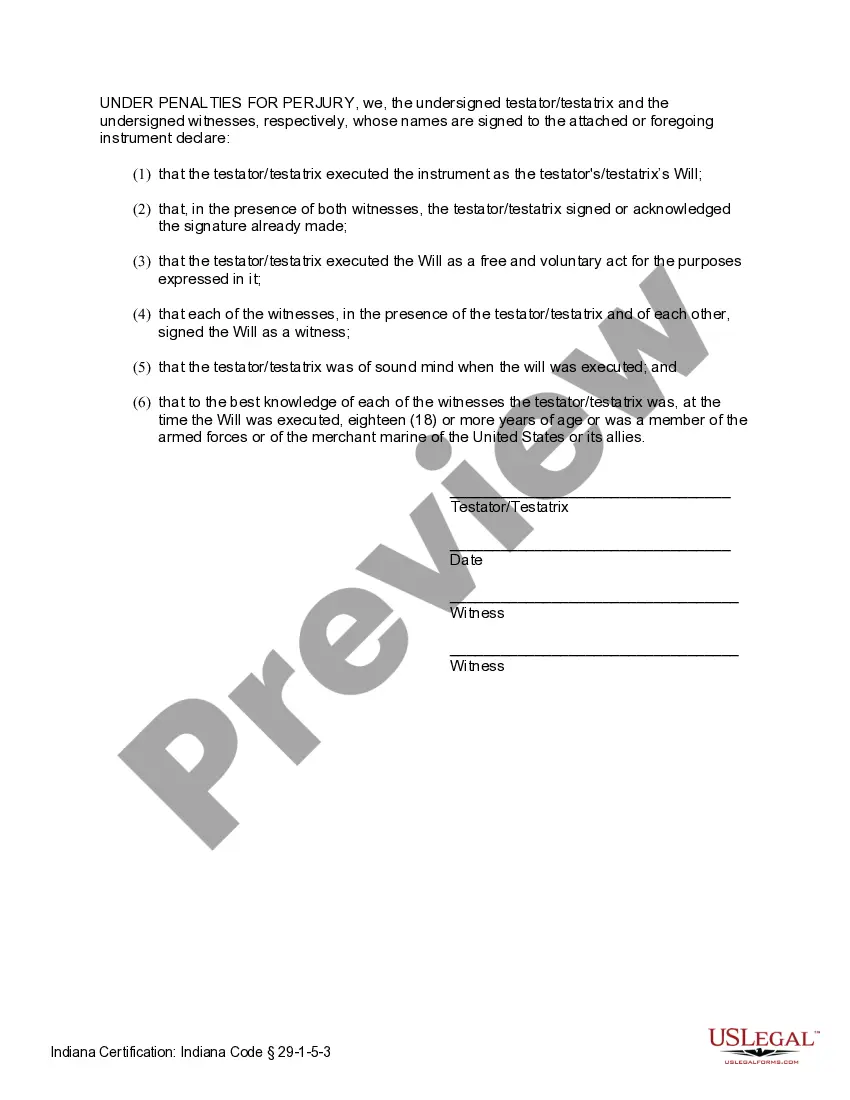

How to fill out Indiana Last Will And Testament With All Property To Trust Called A Pour Over Will?

Searching for the Indiana Legal Last Will and Testament Form inclusive of All Property to Trust, referred to as a Pour Over Will, and completing these may pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms to discover the appropriate sample specifically tailored for your state within just a few clicks.

Our legal experts draft each document, so you only need to complete them. It is incredibly straightforward.

Select your payment method, either via credit card or PayPal. Save the document in your preferred format. You can print the Indiana Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will template or complete it using any online editor. Don’t worry about making errors, as your form can be utilized and submitted, and printed as many times as you need. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and return to the form's webpage to download the document.

- All your saved samples are stored in My documents and are available at all times for future use.

- If you haven’t yet subscribed, you will need to register.

- Review our detailed instructions on how to obtain the Indiana Legal Last Will and Testament Form inclusive of All Property to Trust known as a Pour Over Will sample in just a few moments.

- To obtain a valid sample, verify its relevance for your state.

- Examine the form using the Preview feature (if available).

- If there is a description, review it to understand the details.

- Click on the Buy Now button if you found what you're searching for.

Form popularity

FAQ

Spillover Trusts definition: Spillover trusts are established to hold any remaining assets after all other instructions from the will are carried out.

A pour-over will is a just-in-case will that states that your living trust is the beneficiary for any property in your name that's not in the trust at the time of your death, thereby moving any forgotten or remaining assets into the trust.One of the main reasons to create a living trust is to avoid probate.

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

The pour over will does not need to be notarized; however, in California it does need to be signed by two disinterested witnesses.

A will and a trust are separate legal documents that usually have a common goal of coordinating a comprehensive estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, in the event that there are issues between the two.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

One document that is explicitly written to supersede a will is a codicil, which is a separate document that amends the latest version of a last will and testament. The codicil must control distribution of the assets it references and supersede certain sections of the latest document.