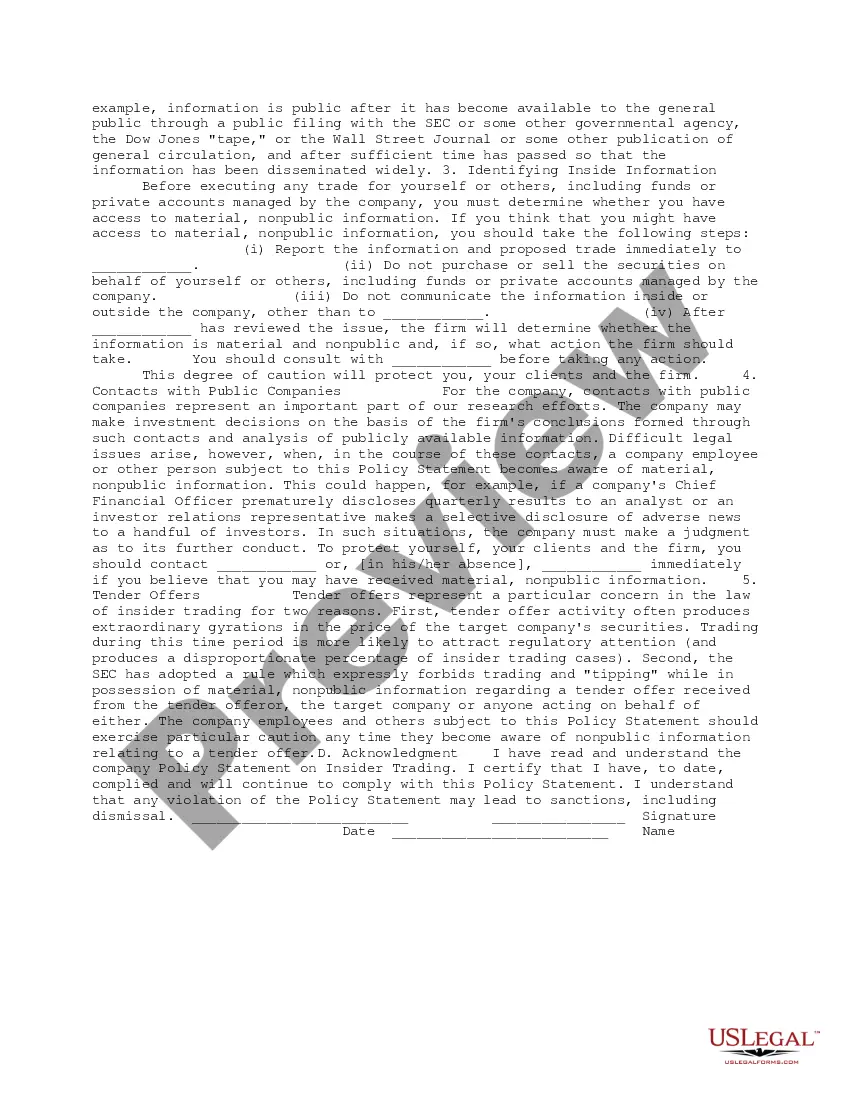

This Policy Statement implements procedures to deter the misuse of material, nonpublic information in securities transactions. The Policy Statement applies to securities trading and information handling by directors, officers and employees of the company (including spouses, minor children and adult members of their households).

Indiana Policies and Procedures Designed to Detect and Prevent Insider Trading

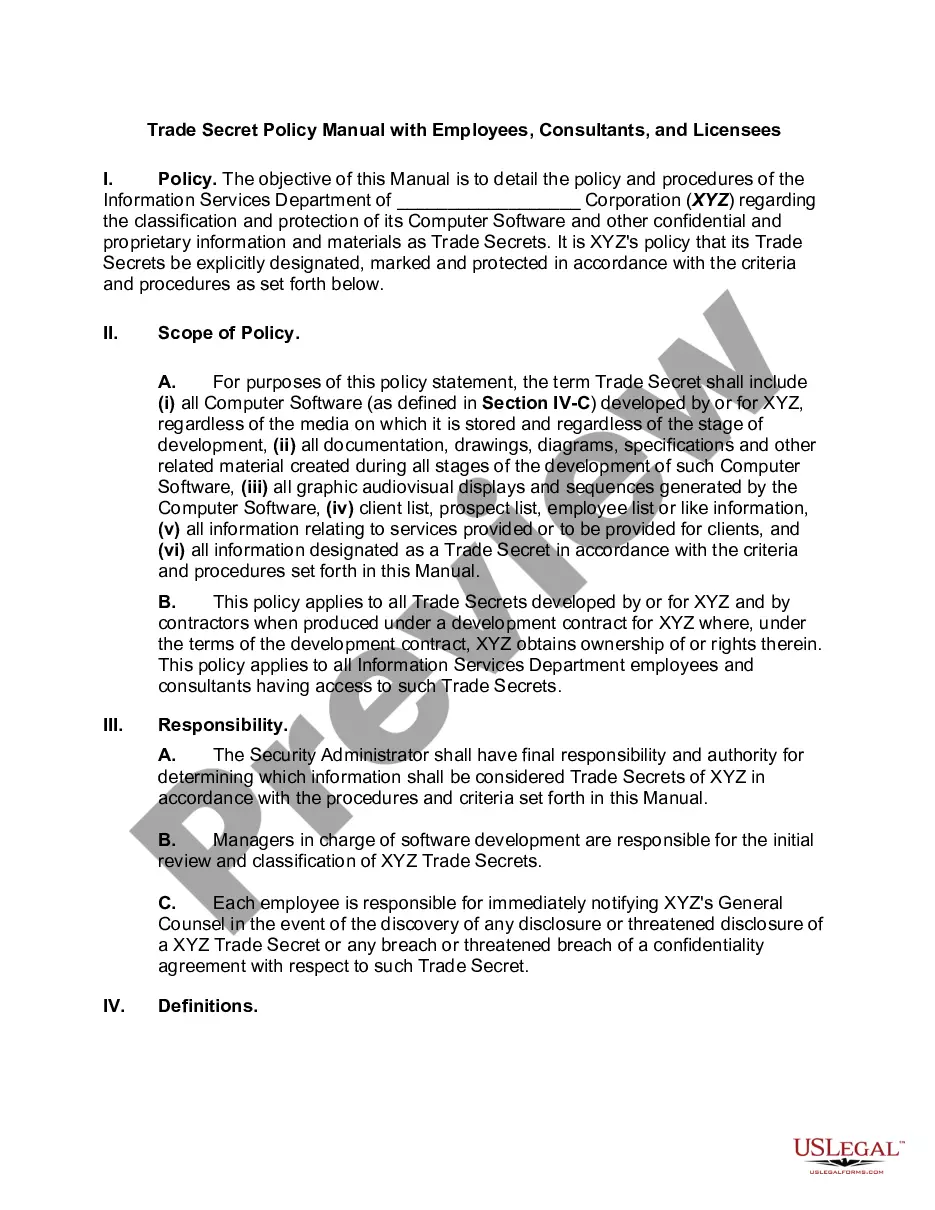

Description

How to fill out Policies And Procedures Designed To Detect And Prevent Insider Trading?

Choosing the right legitimate file design could be a have a problem. Obviously, there are a variety of templates accessible on the Internet, but how will you get the legitimate kind you require? Use the US Legal Forms web site. The assistance gives a large number of templates, such as the Indiana Policies and Procedures Designed to Detect and Prevent Insider Trading, that you can use for enterprise and personal needs. Every one of the kinds are inspected by professionals and meet state and federal needs.

In case you are currently listed, log in to the profile and click the Acquire option to find the Indiana Policies and Procedures Designed to Detect and Prevent Insider Trading. Utilize your profile to search through the legitimate kinds you have ordered previously. Check out the My Forms tab of the profile and obtain another backup of your file you require.

In case you are a brand new end user of US Legal Forms, here are straightforward directions that you can stick to:

- Initial, make certain you have chosen the right kind for your metropolis/county. You may check out the form using the Review option and browse the form explanation to make sure it is the right one for you.

- In case the kind fails to meet your requirements, utilize the Seach field to discover the right kind.

- When you are certain the form is suitable, click on the Acquire now option to find the kind.

- Choose the pricing program you desire and enter in the needed info. Design your profile and pay money for the order with your PayPal profile or charge card.

- Select the submit file format and download the legitimate file design to the system.

- Total, edit and print and indicator the attained Indiana Policies and Procedures Designed to Detect and Prevent Insider Trading.

US Legal Forms may be the biggest library of legitimate kinds for which you will find numerous file templates. Use the company to download expertly-produced documents that stick to condition needs.

Form popularity

FAQ

Insider trading refers to the practice of purchasing or selling a publicly-traded company's securities while in possession of material information that is not yet public information.

SEC Rule 10b-5 prohibits corporate officers and directors or other insider employees from using confidential corporate information to reap a profit (or avoid a loss) by trading in the Company's stock. This rule also prohibits ?tipping? of confidential corporate information to third parties.

If you have 'inside information' relating to the Company, it is illegal for you to: ? apply for, acquire, or dispose of, securities in the Company; or ? procure another person to apply for, acquire, or dispose of, securities in the Company; or ? directly or indirectly, communicate the information, or cause the ...

If any Designated Person contravenes any of the provisions of the Insider Trading Code / SEBI Regulations, such Designated Person will be liable for appropriate penal actions in ance with the provisions of the SEBI Act, 1992. The minimum penalty under the SEBI Act, 1992 is Rs. 10 Lakhs, which can go up to Rs.

On December 14, 2022, the Securities and Exchange Commission (the ?Commission?) adopted amendments to Rule 10b5-1 under the Securities Exchange Act of 1934 (the ?Exchange Act?), which provides affirmative defenses to trading on the basis of material nonpublic information in insider trading cases.

How to reduce the risk of insider trading Conduct due diligence. ... Take extra care outside of the office. ... Clearly define sensitive non-public information. ... Never disclose non-public information to outsiders. ... Don't recommend or induce based on inside information. ... Be cautious in informal or social settings.

Federal and state securities laws prohibit the purchase or sale of a company's securities by anyone who is aware of material information about that company that is not generally known or available to the public.

The government tries to prevent and detect insider trading by monitoring the trading activity in the market. The SEC monitors trading activity, especially around important events such as earnings announcements, acquisitions, and other events material to a company's value that may move their stock prices significantly.

Insider trading by a designated person or their close associates is forbidden at all times. ing to SEBI laws, a Designated Person who buys or sells any number of the company's stocks may not engage in a contrary transaction within 6 months of the date.