Indiana Disclaimer and Quitclaim of Leasehold Interest

Description

How to fill out Disclaimer And Quitclaim Of Leasehold Interest?

Choosing the best legal file web template might be a have difficulties. Needless to say, there are plenty of layouts accessible on the Internet, but how can you get the legal kind you want? Take advantage of the US Legal Forms website. The service offers a huge number of layouts, for example the Indiana Disclaimer and Quitclaim of Leasehold Interest, that can be used for enterprise and personal demands. All the forms are inspected by professionals and satisfy state and federal demands.

When you are previously registered, log in to the accounts and then click the Down load button to have the Indiana Disclaimer and Quitclaim of Leasehold Interest. Use your accounts to look throughout the legal forms you possess bought previously. Proceed to the My Forms tab of the accounts and have yet another backup from the file you want.

When you are a new end user of US Legal Forms, here are basic instructions for you to comply with:

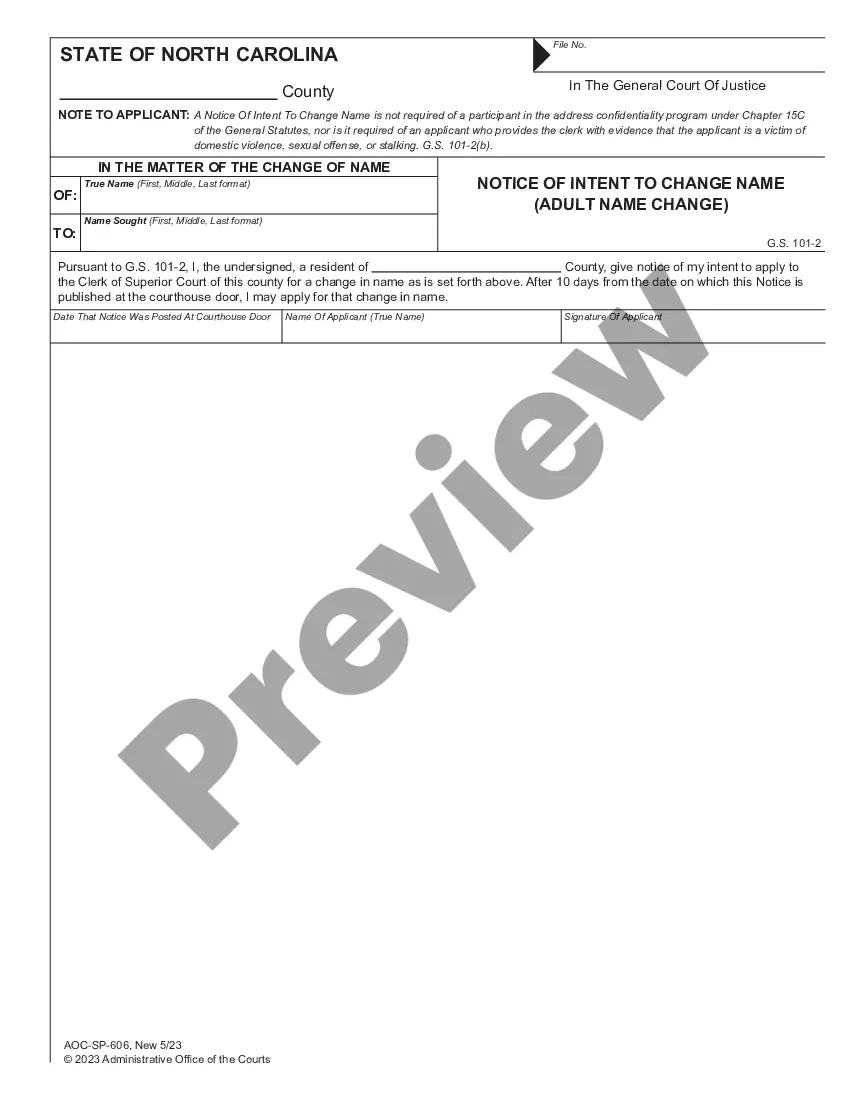

- Initially, be sure you have chosen the appropriate kind for your personal area/region. You may look through the shape using the Review button and read the shape explanation to make sure it is the best for you.

- In the event the kind fails to satisfy your needs, use the Seach industry to discover the appropriate kind.

- Once you are certain that the shape is suitable, click on the Get now button to have the kind.

- Opt for the pricing plan you would like and enter the essential details. Design your accounts and pay for your order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the submit formatting and obtain the legal file web template to the system.

- Complete, edit and print out and sign the obtained Indiana Disclaimer and Quitclaim of Leasehold Interest.

US Legal Forms is the greatest collection of legal forms for which you can find various file layouts. Take advantage of the service to obtain skillfully-made papers that comply with state demands.

Form popularity

FAQ

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, ing to your state's laws of intestacy.

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant in front of a notary (IC 32-17.5-3-3).

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

Also called a non-warranty deed, a quitclaim deed conveys whatever interest the grantor currently has in the property if any. The grantor only "remises, releases, and quitclaims" their interest in the property to the grantee.

If you decide to disclaim an inheritance, there are specific steps you must follow to ensure that the process is legally valid. First, the disclaimer must be in writing and signed by the potential heir. The disclaimer must also be delivered to the executor of the estate or the trustee in charge of the assets.

A quitclaim deed transfers the title of a property from one person to another, with little to no buyer protection. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The title is transferred without any amendments or additions.

A quitclaim deed releases a person's interest in a property without stating the nature of the person's interest or rights, and with no warranties of that person's interest or rights in the property.