Indiana Deed and Assignment from Trustee to Trust Beneficiaries

Description

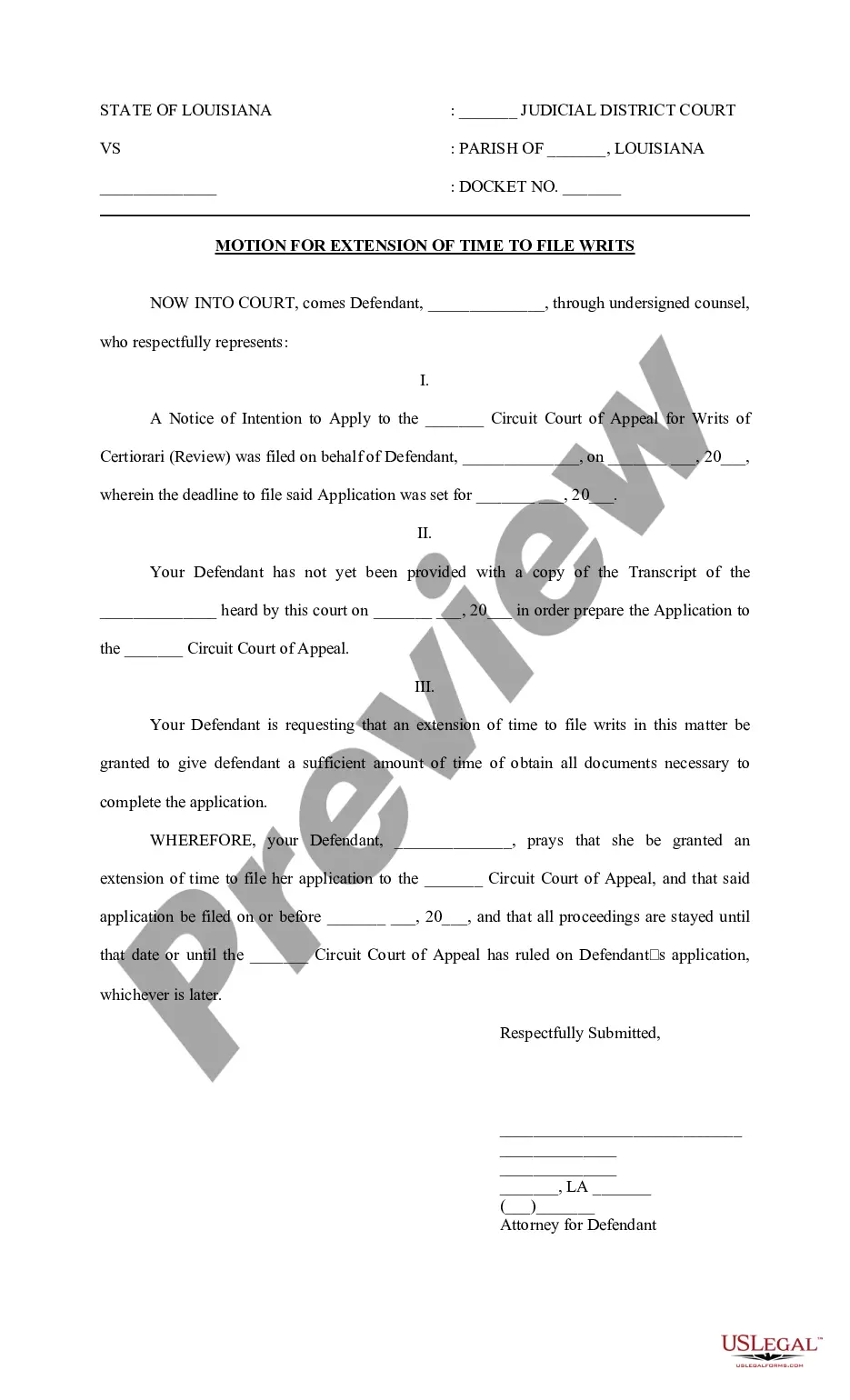

How to fill out Deed And Assignment From Trustee To Trust Beneficiaries?

Are you presently within a placement in which you will need documents for both business or person purposes just about every day time? There are plenty of authorized record layouts available on the net, but finding ones you can rely on is not simple. US Legal Forms gives a huge number of form layouts, just like the Indiana Deed and Assignment from Trustee to Trust Beneficiaries, which are published in order to meet state and federal requirements.

If you are presently informed about US Legal Forms web site and have your account, basically log in. Next, you may download the Indiana Deed and Assignment from Trustee to Trust Beneficiaries web template.

If you do not have an profile and wish to begin to use US Legal Forms, follow these steps:

- Obtain the form you will need and ensure it is for that proper area/county.

- Make use of the Preview option to check the shape.

- Read the information to actually have selected the correct form.

- In case the form is not what you are searching for, use the Lookup discipline to find the form that meets your needs and requirements.

- Whenever you obtain the proper form, click Acquire now.

- Choose the rates plan you would like, fill out the required details to create your account, and pay money for your order making use of your PayPal or bank card.

- Choose a practical file structure and download your copy.

Get all the record layouts you possess purchased in the My Forms menus. You can aquire a extra copy of Indiana Deed and Assignment from Trustee to Trust Beneficiaries whenever, if required. Just click on the needed form to download or print the record web template.

Use US Legal Forms, the most comprehensive variety of authorized forms, to save lots of some time and prevent blunders. The services gives skillfully produced authorized record layouts that you can use for a selection of purposes. Generate your account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

Create the trust document. You can get help from an attorney or use Willmaker & Trust (see below). Sign the document in front of a notary public. Change the title of any trust property that has a title document?such as your house or car?to reflect that you now own the property as trustee of the trust.

Estate planning in Indiana involves creating legal documents to manage assets, taxes, and burial arrangements, including wills, durable power of attorney, and healthcare power of attorney. The costs vary based on complexity, with wills typically around $500 and trusts approximately $2,000.

Creating a living trust in Indiana is simple. There is no specific form required and your trust document must simply be clear in its terms. You sign the document in front of a notary and then fund the trust by placing ownership of assets in its name.

Outright Trust Distributions They consist of the trustee releasing each beneficiary's inheritance without any restrictions. Outright distributions can either be made as a single lump sum, or periodically. Prior to making outright trust distributions, the trustee will need to pay the trust's debts and taxes.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

An irrevocable trust offers your assets the most protection from creditors and lawsuits. Assets in an irrevocable trust aren't considered personal property. This means they're not included when the IRS values your estate to determine if taxes are owed.

When property is ?held in trust,? there is a divided ownership of the property, ?generally with the trustee holding legal title and the beneficiary holding equitable title.? The trust itself owns nothing because it is not an entity capable of owning property.

You might choose to put just a few vital assets, such as your house, in a trust and have everything else be decided by your will. This can help ensure a speedy transfer for your most important assets while the rest of your estate goes through the normal probate process.