Indiana Correction Assignment of Overriding Royalty Interest Correcting Lease Description

Description

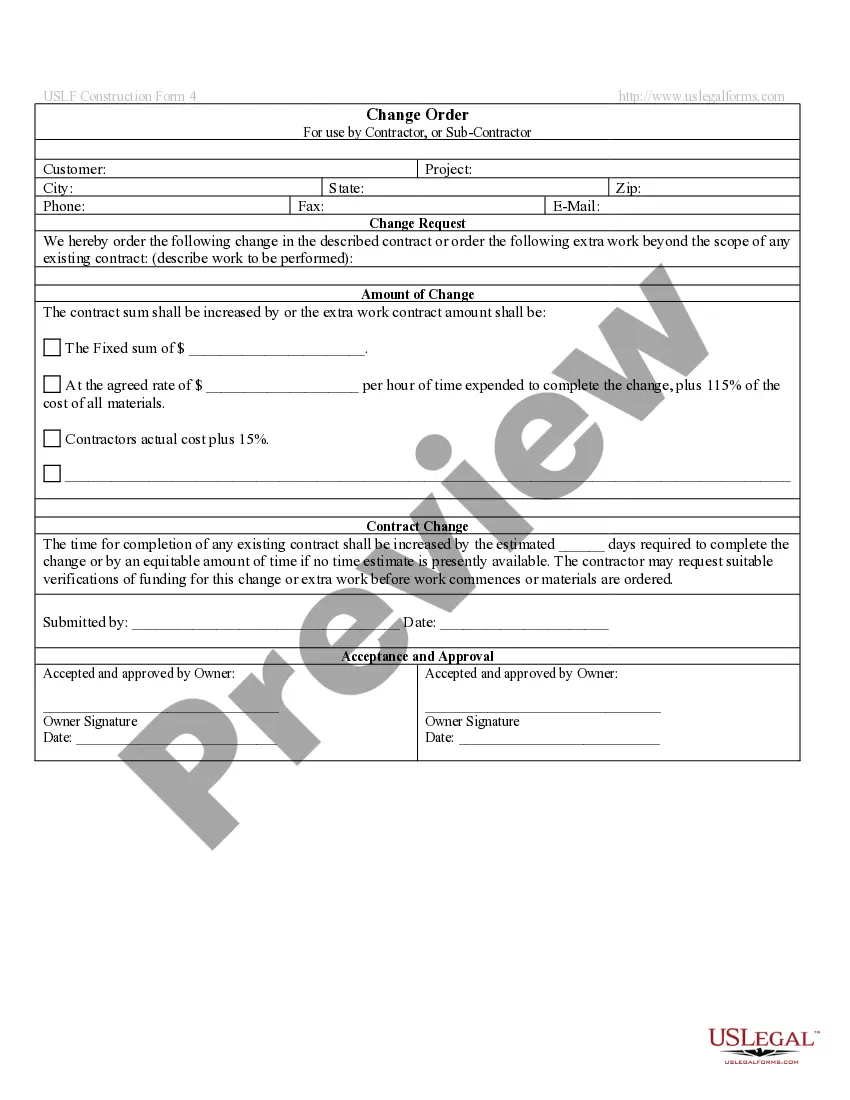

How to fill out Correction Assignment Of Overriding Royalty Interest Correcting Lease Description?

US Legal Forms - among the most significant libraries of legal varieties in America - gives an array of legal document layouts it is possible to acquire or printing. While using website, you can find thousands of varieties for enterprise and person uses, categorized by groups, suggests, or key phrases.You can get the latest types of varieties much like the Indiana Correction Assignment of Overriding Royalty Interest Correcting Lease Description within minutes.

If you have a subscription, log in and acquire Indiana Correction Assignment of Overriding Royalty Interest Correcting Lease Description from your US Legal Forms local library. The Download option can look on every type you perspective. You have access to all formerly downloaded varieties in the My Forms tab of your own account.

In order to use US Legal Forms for the first time, allow me to share easy directions to help you get started out:

- Be sure you have selected the correct type for your area/county. Go through the Review option to analyze the form`s information. Browse the type explanation to ensure that you have chosen the appropriate type.

- If the type does not match your demands, use the Research industry on top of the display screen to find the one who does.

- When you are happy with the form, confirm your decision by visiting the Purchase now option. Then, opt for the rates prepare you prefer and offer your credentials to register on an account.

- Procedure the deal. Make use of your charge card or PayPal account to accomplish the deal.

- Select the structure and acquire the form on your gadget.

- Make modifications. Fill out, change and printing and indicator the downloaded Indiana Correction Assignment of Overriding Royalty Interest Correcting Lease Description.

Each format you included with your account lacks an expiration day and is your own property for a long time. So, if you want to acquire or printing yet another duplicate, just check out the My Forms segment and click on in the type you will need.

Obtain access to the Indiana Correction Assignment of Overriding Royalty Interest Correcting Lease Description with US Legal Forms, the most comprehensive local library of legal document layouts. Use thousands of expert and status-particular layouts that meet up with your organization or person needs and demands.

Form popularity

FAQ

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

The value of non-producing minerals is usually determined by a price per net acre multiplier. This represents how much of the land is owned, and how much of that acreage is valuable.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Several things determine what the ORRI value is, including: Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

You may have noticed on your check stubs an ?owner interest? or ?net revenue interest? or a ?decimal interest?. The operator will then multiply your interest by the quantity of oil and gas produced and the current price to determine your oil and gas royalty payments.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.