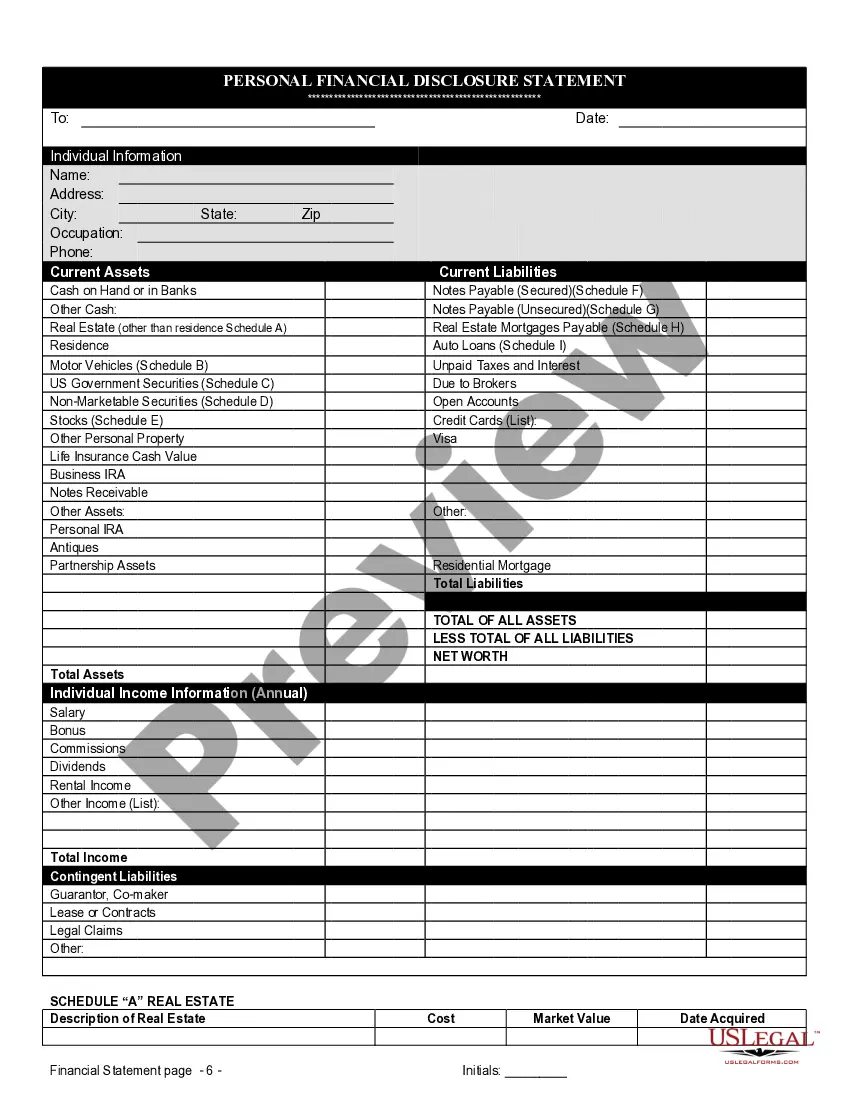

Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Massachusetts Financial Statements Only In Connection With Prenuptial Premarital Agreement?

You are invited to the most important collection of legal documents, US Legal Forms. Here you can obtain any template like Massachusetts Financial Statements solely associated with Prenuptial or Premarital Agreement templates and store them (as many as you desire or need). Create official documents in a few hours instead of days or even weeks, without having to spend a fortune on a lawyer or attorney. Access the state-specific form in just a few clicks and feel assured knowing that it was crafted by our experienced attorneys.

If you’re already a subscribed user, simply Log In to your account and then select Download next to the Massachusetts Financial Statements solely associated with Prenuptial or Premarital Agreement you need. Since US Legal Forms is web-based, you will always have access to your saved templates, regardless of the device you are using. Find them within the My documents section.

If you still do not have an account, what are you waiting for? Follow our instructions below to get started.

After you’ve completed the Massachusetts Financial Statements solely related to Prenuptial or Premarital Agreement, send it to your attorney for validation. It’s an additional step, but a crucial one to ensure you’re fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific form, verify its relevancy in the state you reside in.

- Check the description (if available) to ensure it’s the appropriate example.

- View more information with the Preview option.

- If the document suits all your needs, simply click Buy Now.

- To establish your account, choose a pricing plan.

- Utilize a card or PayPal account to register.

- Download the template in the format you desire (Word or PDF).

- Print the document and fill it out with your or your business’s information.

Form popularity

FAQ

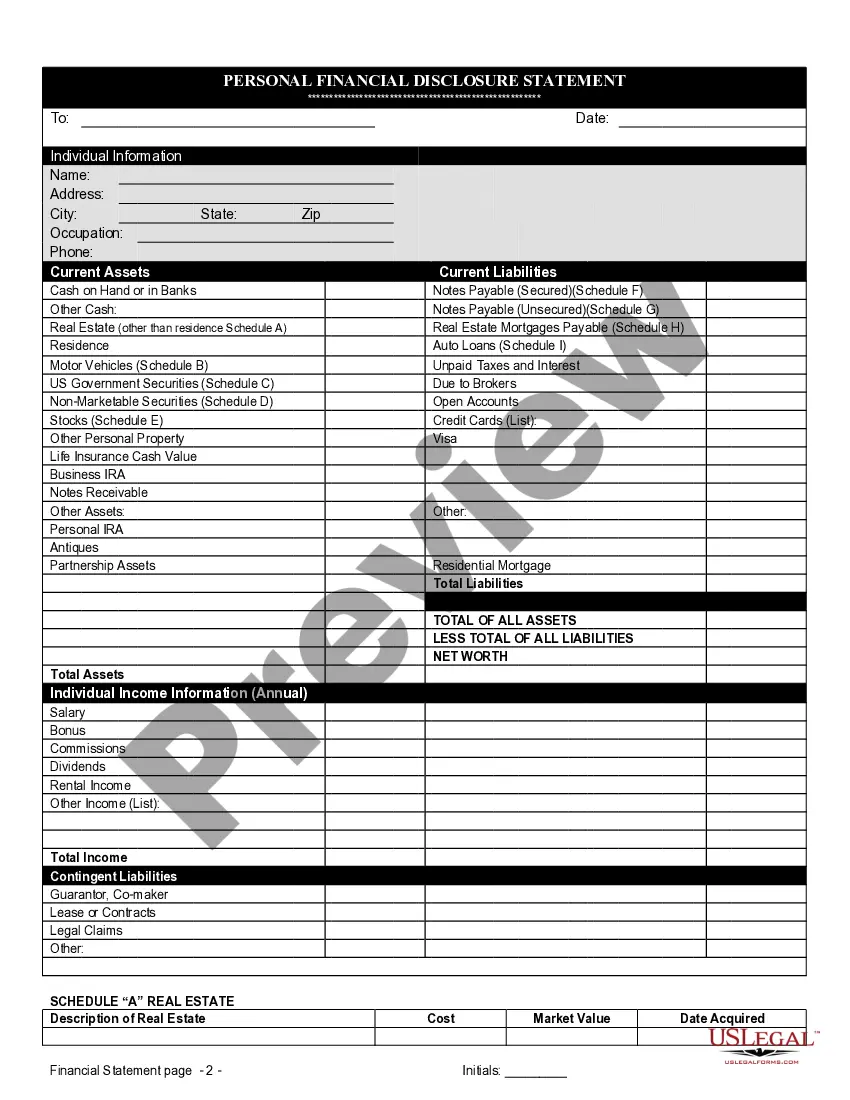

Rule 401 in Massachusetts establishes the requirements for financial disclosures in divorce cases. This rule is particularly relevant when discussing Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreements. It mandates that both parties provide accurate and complete financial information to ensure transparency. Understanding Rule 401 helps individuals navigate the process of financial disclosures effectively.

A prenup can't include personal preferences, such as who has what chores, where to spend the holidays, whose name to use, details about child rearing, or what relationship to have with certain relatives. Prenuptial agreements are designed to address financially based issues.

The courts will not enforce illegal terms in a prenuptial agreement. The courts also will not enforce verbal prenuptial agreements. If someone wishes to enforce the terms of a prenup in California in court, he or she must have a written, signed and notarized legal document.

A prenup can also be overturned if one or both parties change their mind after initially signing the agreement. They may decide at that time to sign a new agreement suspending the prenup.

Failure to Disclose All Assets and Fraud. Unfairness and/or Duress. Promote Divorce or Separation. Legal Requirements:

If a spouse is able to prove non-disclosure of all previous assets or property, then the prenuptial agreement can be considered void. Second, if a spouse is able to prove that he or she was compelled to sign the prenuptial agreement under stressful circumstances, then the prenup can be invalidated.

As long as you and your spouse agree, your prenuptial agreement can be changed. To create an amendment to a prenup, you can either add to the original contract or sign a separate contract that modifies the terms of the initial agreement.

The three most common grounds for nullifying a prenup are unconscionability, failure to disclose, or duress and coercion. Unconscionability may be present if the agreement is patently unfair to one party.

A prenuptial agreement does not have to be notarized to be valid. Often, they are notarized, so there is no question that it was actually signed by the parties. Assuming, that neither of you are contesting the validity of the agreement it should be legally viable.

Assets acquired after the ceremony are ordinarily considered jointly owned marital property, with disposition to be decided during the divorce process. However, a prenup can be used to address future assets if written correctly.