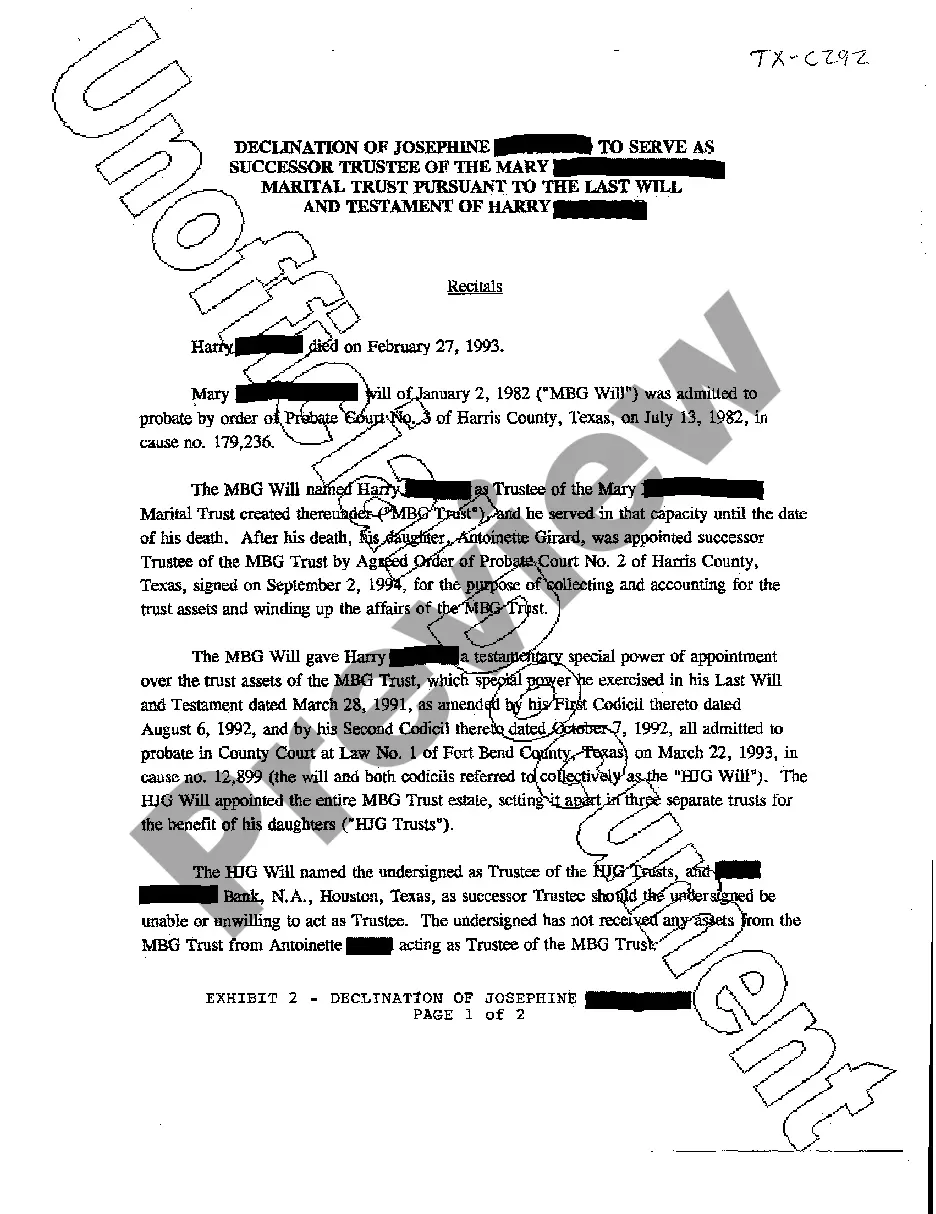

Texas Recitals regarding Declination to Serve as Successor Trustee

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

A02 Recitals Regarding Declination to Serve As is a legal expression used primarily in the context of jurisprudence in the United States. It refers to the documented reasons or formal statements made when an individual or entity declines to take up a designated role or responsibility, often in legal or corporate settings.

Step-by-Step Guide

- Identify the Role: Understand the nature of the role or duty you are being asked to serve as.

- Consult Legal or Professional Advice: Seek advice to understand any potential legal implications or requirements.

- Formulate Recitals: Draft your reasons for declination clearly and professionally.

- Document the Decision: Properly record the declination and the reasons in a formal document.

- Notify Relevant Parties: Communicate your decision and provide the documentation to the pertinent parties.

Risk Analysis

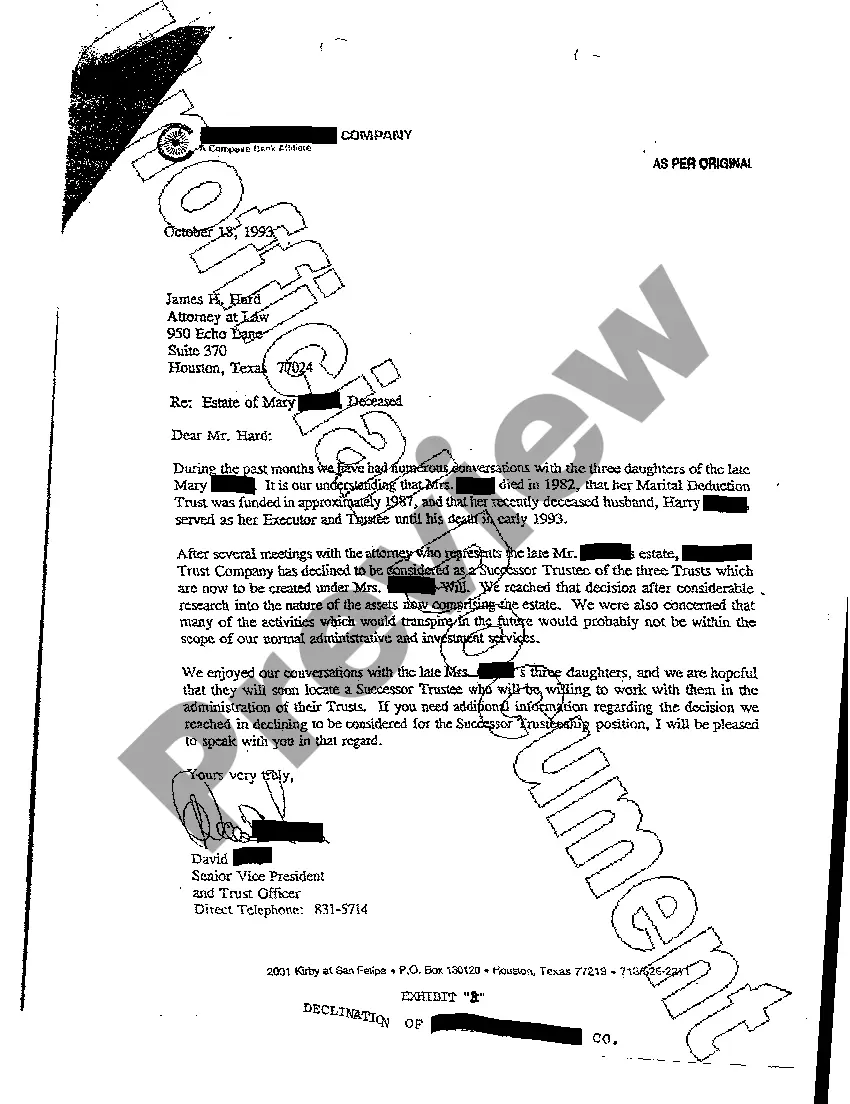

- Legal Risks: Inadequately documented declinations might lead to legal challenges or misunderstandings.

- Professional Risks: Declining certain roles without clear, documented reasons can affect professional relationships and reputation.

- Operational Risks: In organizations, failure to effectively communicate the declination might disrupt operational continuity.

Best Practices

- Clarity: Be as clear and detailed as possible in your declination to avoid ambiguity.

- Consultation: Always consult with a legal or professional expert when necessary.

- Timeliness: Address the declination as soon as possible to avoid operational delays.

How to fill out Texas Recitals Regarding Declination To Serve As Successor Trustee?

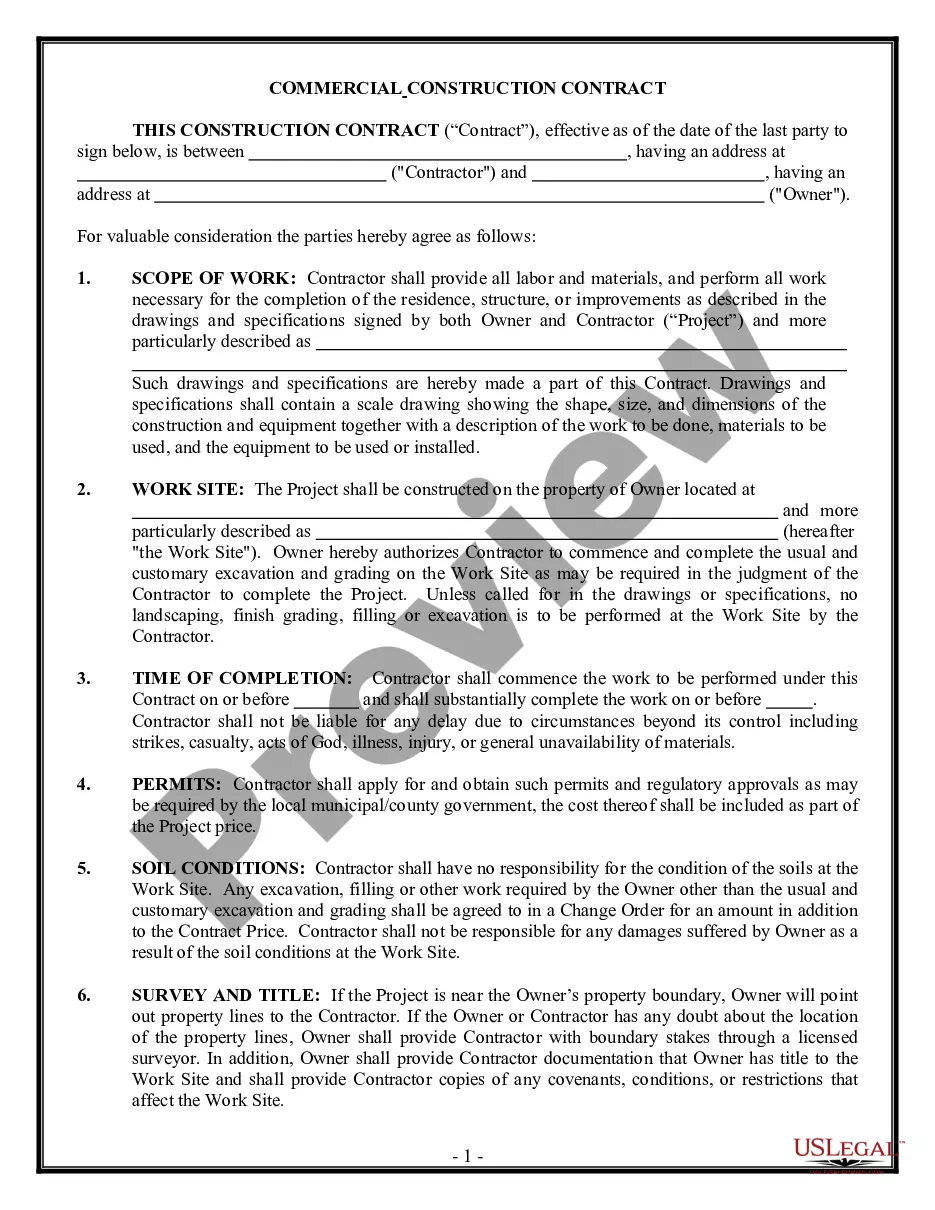

Get access to top quality Texas Recitals regarding Declination to Serve as Successor Trustee forms online with US Legal Forms. Steer clear of days of misused time searching the internet and lost money on documents that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Get above 85,000 state-specific legal and tax samples that you can save and complete in clicks within the Forms library.

To receive the example, log in to your account and click Download. The file will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Verify that the Texas Recitals regarding Declination to Serve as Successor Trustee you’re considering is appropriate for your state.

- Look at the form using the Preview function and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to keep on to register.

- Pay by card or PayPal to complete creating an account.

- Select a preferred file format to download the document (.pdf or .docx).

Now you can open the Texas Recitals regarding Declination to Serve as Successor Trustee template and fill it out online or print it and do it yourself. Think about mailing the document to your legal counsel to make sure everything is completed properly. If you make a error, print out and fill application again (once you’ve created an account all documents you save is reusable). Create your US Legal Forms account now and get access to far more samples.

Form popularity

FAQ

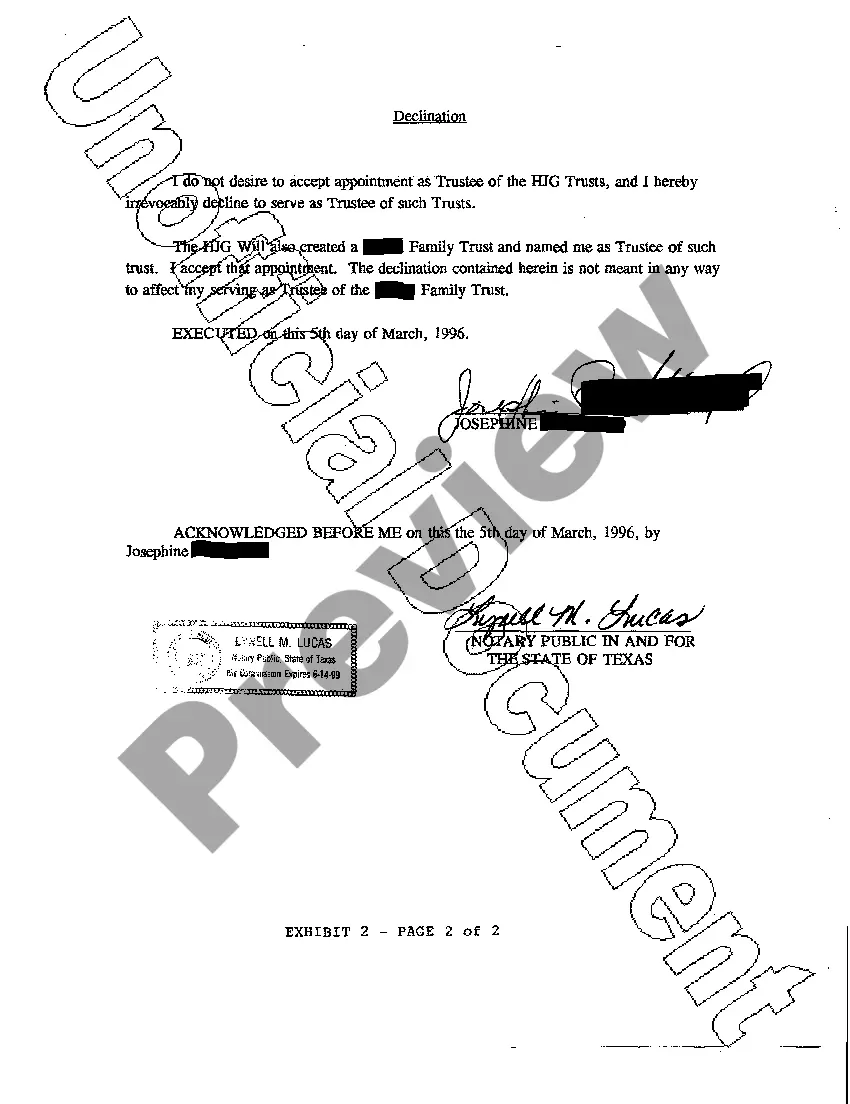

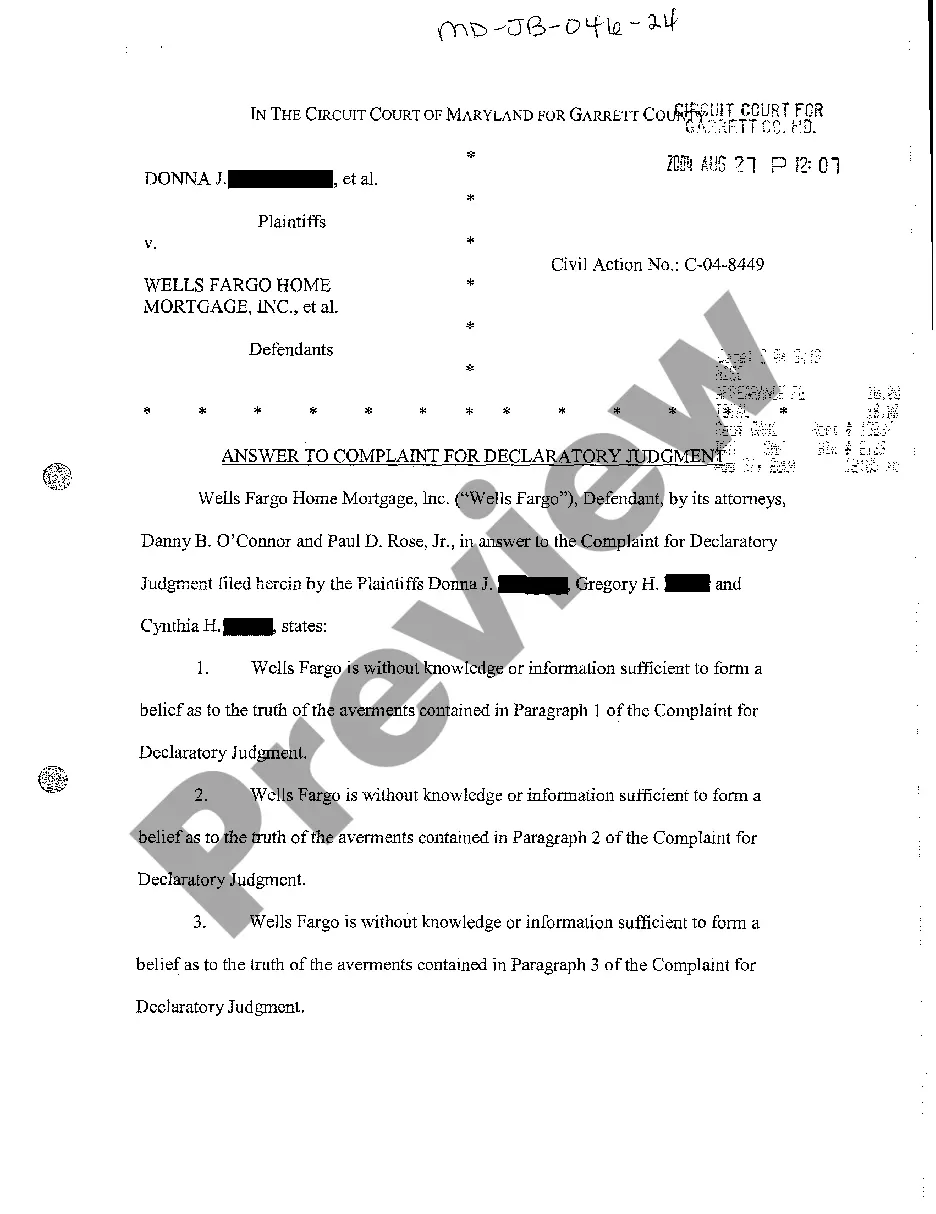

For a revocable living trust, that Trustee is usually the person that created the trust.The successor trustee usually takes power when the person that created the trust either becomes incapacitated or has died. The Trustee only manages the assets that are owned by the trust, not assets outside the trust.

Successor trustees have to willingly accept their role usually by signing a consent to serve or affidavit of appointment. If an existing trustee wishes to change their successor trustee, they must make an actual amendment to the trust. Most courts won't accept informal, self-made changes.

A Successor Trustee is the person responsible for administering the trust after its Grantor either passes away or becomes Incapacitated that is, unable to administer the trust for themselves.

Once you follow that directive, the Trustee must step down and a successor Trustee can be appointed.Once a Trustee resigns, then either the next person named would act, or maybe you can appoint someone new if the Trust terms allow you to do that. Either way, a new Trustee will be in office when a Trustee resigns.

It's perfectly legal to name a beneficiary of the trust (someone who will receive trust property after your death) as successor trustee. In fact, it's common. EXAMPLE: Mildred names her only child, Allison, as both sole beneficiary of her living trust and successor trustee of the living trust.

Do not sign the trust agreement. Do not exercise any powers given to you under the trust agreement. Notify the trust's beneficiaries that you decline. Notify the other successor trustee you have declined.

A release provides protection to the trustee in a scenario where the beneficiary later decides to sue the trustee. The trustee can use the release to show that the beneficiary released the trustee of any legal claims the beneficiary might later bring.

Write an amendment to the trust. The amendment prevents the need to write a whole new trust. At the top of the page, state the date and that this is an amendment to name a successor trustee.