Indiana Notice of Meeting of Members of LLC Limited Liability Company to consider dissolution of company

Description

How to fill out Notice Of Meeting Of Members Of LLC Limited Liability Company To Consider Dissolution Of Company?

It is possible to spend hrs on the web looking for the legal file template that suits the federal and state demands you need. US Legal Forms offers 1000s of legal varieties which are evaluated by specialists. You can easily down load or printing the Indiana Notice of Meeting of Members of LLC Limited Liability Company to consider dissolution of company from our support.

If you already have a US Legal Forms account, you are able to log in and then click the Down load option. Afterward, you are able to total, modify, printing, or signal the Indiana Notice of Meeting of Members of LLC Limited Liability Company to consider dissolution of company. Every legal file template you acquire is your own for a long time. To acquire one more copy of the obtained type, check out the My Forms tab and then click the related option.

Should you use the US Legal Forms web site for the first time, adhere to the simple directions beneath:

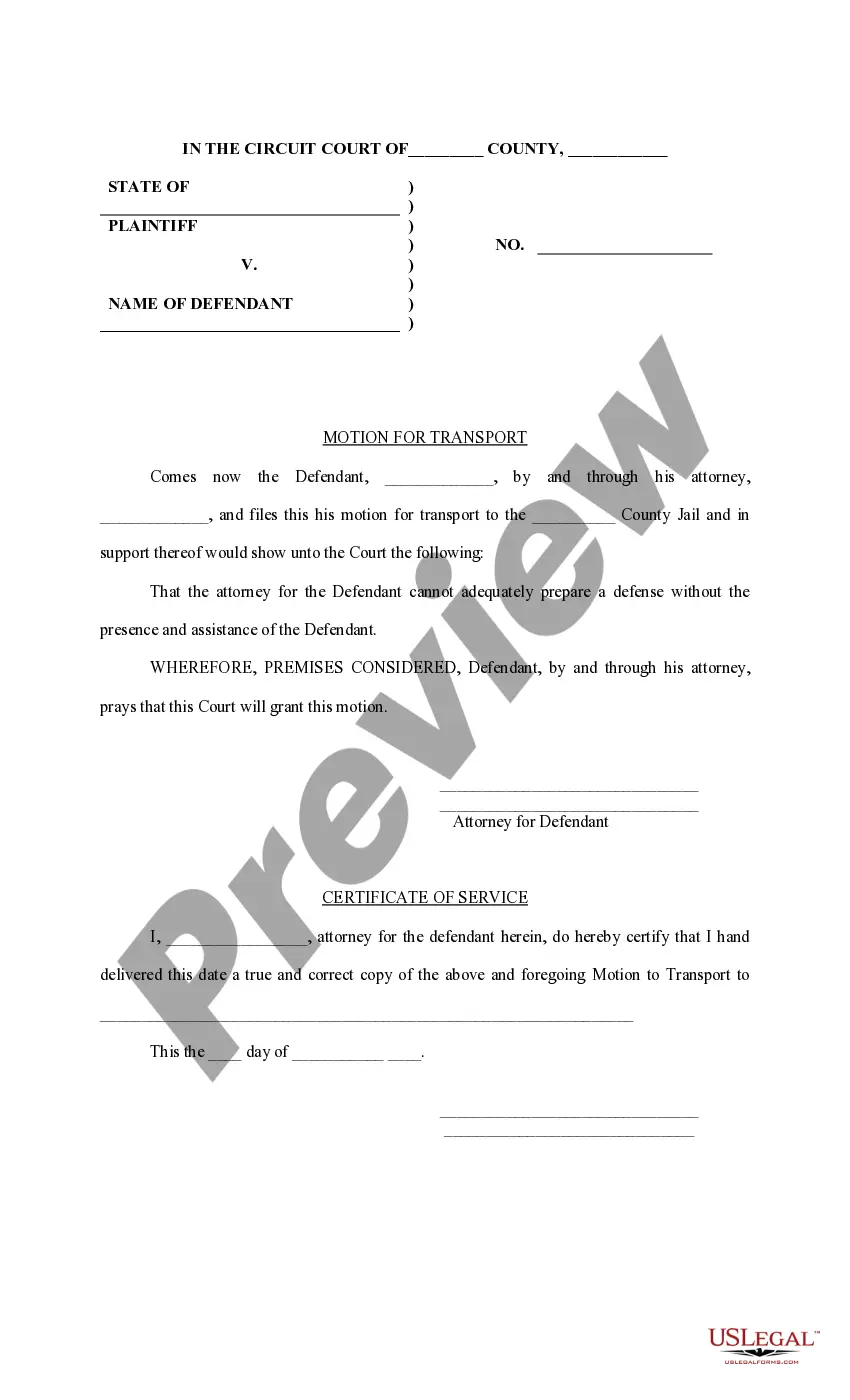

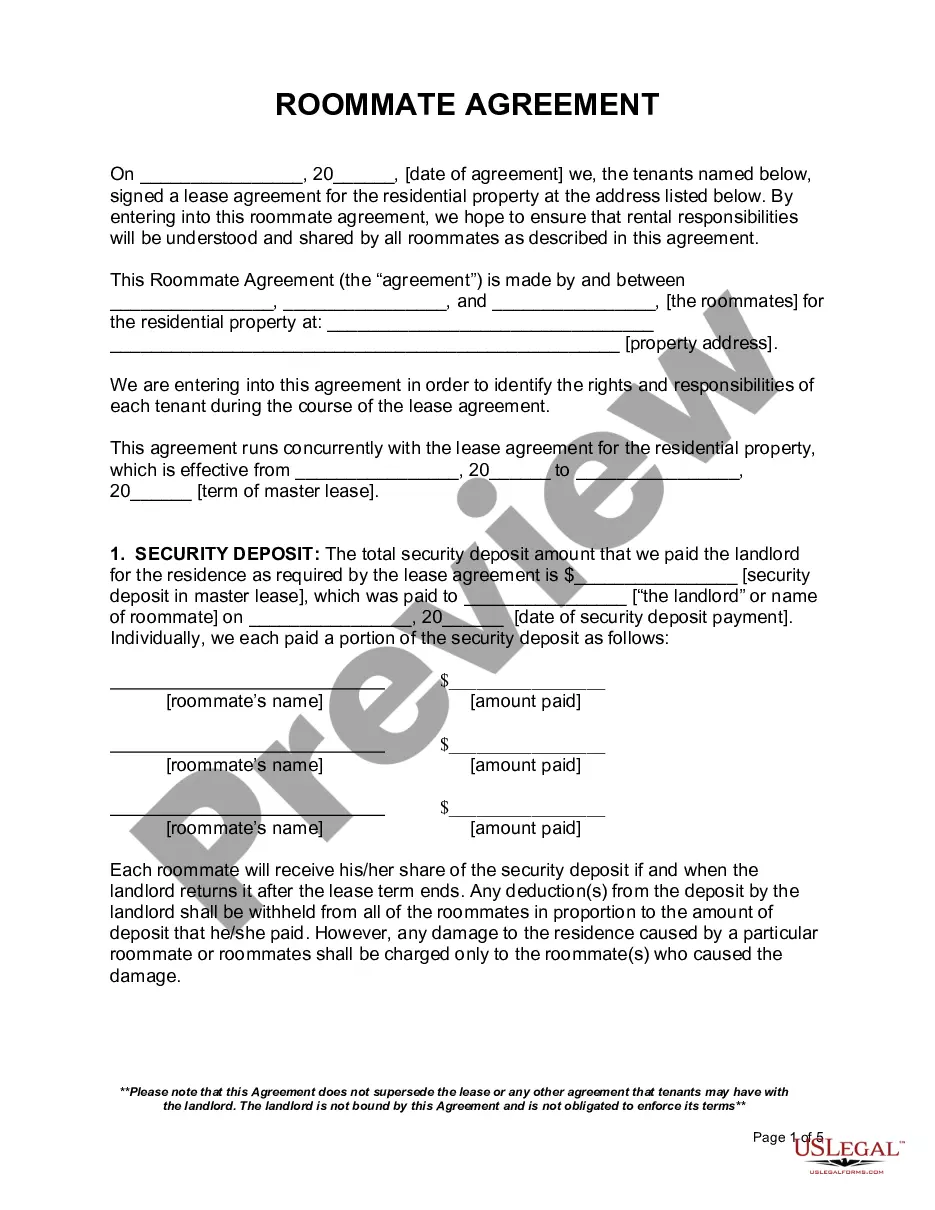

- Very first, be sure that you have selected the correct file template for that state/metropolis that you pick. See the type information to ensure you have picked out the proper type. If accessible, use the Preview option to appear throughout the file template at the same time.

- In order to get one more model of the type, use the Lookup discipline to get the template that meets your needs and demands.

- Upon having identified the template you want, click on Acquire now to move forward.

- Pick the rates strategy you want, type in your references, and register for a merchant account on US Legal Forms.

- Complete the deal. You should use your credit card or PayPal account to pay for the legal type.

- Pick the formatting of the file and down load it for your device.

- Make adjustments for your file if necessary. It is possible to total, modify and signal and printing Indiana Notice of Meeting of Members of LLC Limited Liability Company to consider dissolution of company.

Down load and printing 1000s of file layouts utilizing the US Legal Forms site, that offers the biggest assortment of legal varieties. Use skilled and express-particular layouts to take on your business or individual requires.

Form popularity

FAQ

To dissolve your Indiana Corporation, file Indiana Form 34471, Articles of Dissolution with the Secretary of State, Corporations Division. You can also file for dissolution online if you set up an IN.gov payment account or pay by MasterCard, Discover or Visa credit card.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.25-Mar-2022

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

What is the Dissolution of a Corporation? When a corporation dissolves, it means to officially close down or end the enterprise so it is no longer running.

How to Dissolve an LLCConfirm the Company Is in Good Standing.Hold a Vote to Dissolve the Business.File LLC Articles of Dissolution.Notify the Company's Stakeholders.Cancel Business Licenses and Permits.File the LLC's Final Payroll Taxes.Pay Final Sales Tax.File Final Income Tax Returns.More items...?

To dissolve your LLC in Indiana, submit one original and one copy of the Indiana Articles of Dissolution (Form 49465) to the Indiana Secretary of State (SOS) by mail or in person. Articles of Dissolution can be filed online if you pay using an IN.gov payment account or a MasterCard, Discover or Visa credit card.

Closing Correctly Is ImportantOfficially dissolving an LLC is important. If you don't, you can be held personally liable for the unpaid debts and taxes of the LLC. A few additional fees you should look for; Many states also levy a fee against LLCs each year.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

Basic Letter of Dissolution ElementsThe name of the recipient and the name of the person sending the letter.The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.More items...

A letter of dissolution is an official notification of the end of a business relationship with a partner, client, vendor, or another party.