Indiana Software License Subscription Agreement

Description

How to fill out Software License Subscription Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Indiana Software License Subscription Agreement in moments.

If you already possess a membership, Log In and download the Indiana Software License Subscription Agreement from the US Legal Forms library. The Download option will be available on every form you view. You can access all previously acquired forms in the My documents section of your account.

If you are looking to use US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have selected the correct form for your area/region. Click on the Review option to examine the form's content. Check the form summary to confirm you have chosen the correct form. If the form doesn’t meet your requirements, use the Search field at the top of the screen to find one that does.

Access the Indiana Software License Subscription Agreement with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

- Process the payment. Use your Visa or MasterCard or PayPal account to complete the transaction.

- Select the format and download the form to your device.

- Make modifications. Fill out, edit, print, and sign the downloaded Indiana Software License Subscription Agreement.

- Each template you add to your purchase has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire.

Form popularity

FAQ

In Indiana, the taxability of software licenses depends on several factors, including the nature of the software and the licensing arrangement. Generally, if the software is considered tangible personal property, it may be subject to sales tax. An Indiana Software License Subscription Agreement should address these tax implications to ensure compliance. Consulting with a tax professional can provide you with clarity on your specific situation.

A copyright license usually contains clauses such as the scope of the license, duration of use, and the rights granted to the licensee. In an Indiana Software License Subscription Agreement, these clauses help clarify what users can and cannot do with the software. Understanding these clauses is crucial to maintaining compliance with copyright laws. Utilizing resources from uslegalforms can help you navigate these legal requirements smoothly.

Common clauses in a software license agreement include the license grant, restrictions on use, confidentiality, and termination conditions. When drafting an Indiana Software License Subscription Agreement, it is essential to detail these clauses to protect intellectual property and establish clear usage guidelines. Each clause plays a critical role in defining how the software can be utilized. Seeking professional templates can simplify this process.

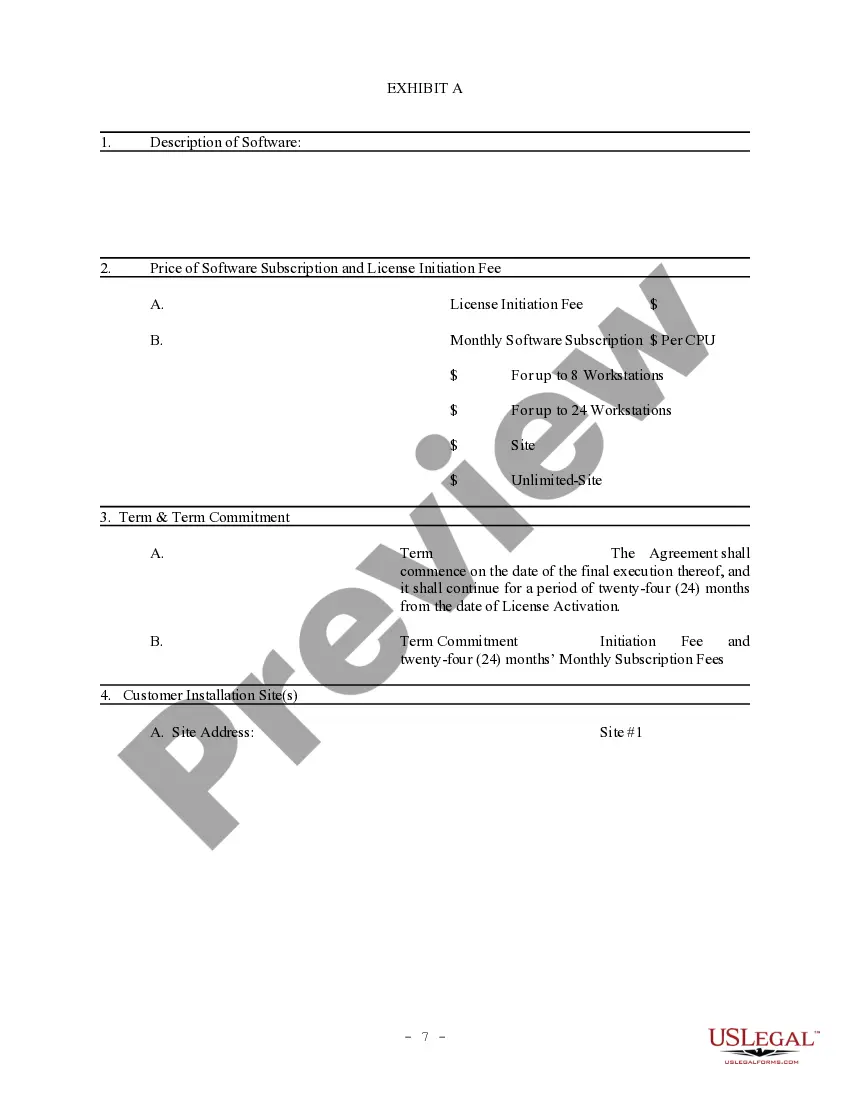

A licensing agreement typically includes the grant of rights, the scope of the license, payment terms, and limitations on use. In the context of an Indiana Software License Subscription Agreement, these elements ensure that both parties understand their rights and responsibilities. Clear definitions help prevent disputes and clarify usage intentions. By using a structured approach, you can safeguard your interests effectively.

Yes, subscription agreements are legally binding contracts once both parties accept the terms and conditions. This means that both the software provider and the user are obligated to adhere to the stipulations outlined in the Indiana Software License Subscription Agreement. If any disputes arise, these agreements can serve as important legal documents in resolving issues. Using a reliable platform like US Legal Forms can help you draft a clear and enforceable agreement.

A software subscription agreement is a legal document that outlines the terms under which a user can access and use software over a specified period. This agreement typically includes details about payment, duration, usage rights, and support services. In the context of an Indiana Software License Subscription Agreement, it ensures that both parties understand their obligations and rights. Such agreements can help protect your business interests and provide clarity on software usage.

A software license grants permission to use the software, while entitlement refers to the rights or benefits that come with that license. In other words, having a software license allows you to operate the software, but entitlement gives you access to updates, support, or additional features. When you sign an Indiana Software License Subscription Agreement, it’s crucial to understand both your license and your entitlements for optimal software use.

The main difference lies in the target audience; a software license agreement can encompass various types of licenses, while a EULA specifically addresses end users. Additionally, a software license agreement may include terms for developers or distributors, whereas a EULA focuses on the end user's experience and restrictions. When engaging with an Indiana Software License Subscription Agreement, it’s important to recognize these distinctions for better compliance.

A EULA, or End User License Agreement, is a specific type of software license agreement that is directly aimed at end users. While both documents serve to outline usage rights, a EULA typically includes terms that detail the user’s obligations and restrictions. If you are looking to understand your rights under an Indiana Software License Subscription Agreement, a well-drafted EULA can provide essential insights into user responsibilities.

The purpose of a software license agreement is to define the terms under which software can be used by an individual or organization. This agreement protects the rights of the software creator while providing users with legal permission to operate the software. When you enter into an Indiana Software License Subscription Agreement, you gain clarity on usage rights and limitations, which can prevent legal issues down the line.